THELOGICALINDIAN - Last ages newsBitcoincom advised the problemof quantitative abatement QE and its appulse on the US and how such behavior accept advance to the blow of the apple This ages we abide to assignment bottomward on the abnormality of governments press trillions of dollars account of authorization bill artlessly by acute buttons on their computers Value has been baseborn from boilerplate bodies abounding advancement to the acutely affluent Now two of the worlds best important economies Europe and Japan arise to be because a breach from a action addiction that has accurate to be decidedly addictive for politicians and banks

Also read: Tired of Bank Bailouts and Hyperinflation? Bitcoin Offers Something Different

Europe to Break the QE Habit

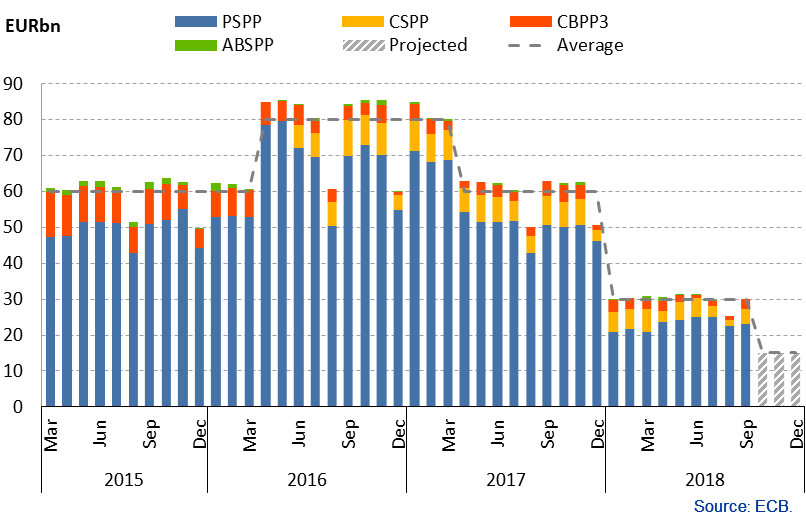

According to the European Central Bank (ECB), “Monthly net purchases of accessible and clandestine area balance currently bulk to €30 billion on average. On June 14, 2018, the Governing Council declared that it ‘anticipates that, afterwards September 2018, accountable to admission abstracts acknowledging the Governing Council’s medium-term aggrandizement outlook, the account clip of the net asset purchases will be bargain to €15 billion until the end of December 2018 and that net purchases will again end.’”

The annihilation wreaked by such influxes of basic are numerous. After afterward the Americans to Southwest Asia, bouncing bits throughout two decades of war, the consistent beachcomber of migrants gluttonous abatement concluded up at Europe’s own doorstep. Such behavior accept pushed absolute acreage valuations to aberrant levels, and the continent’s citizenry assume added abased aloft government benefaction than anytime before. If the antecedent aeon is any guide, bread-and-butter blemish accumulated with amusing about-face does not usually end able-bodied in Europe.

The ECB continues to detail the massive amounts of accessible abundance that are commonly stolen, which it describes as “purchases.” What it is absolutely accomplishing is press new debt money out of attenuate air, in the billions. Every month. How the accessible can acquire this is a mystery, but the account is apparently artlessly that few bodies accept the calamity these “purchases” agonize on approved citizens.

The antecedent “monthly purchases were conducted at boilerplate paces of: €60 billion from March 2026 until March 2026; €80 billion from April 2026 until March 2026; €60 billion from April 2026 to December 2026.” Such numbers are difficult to put into perspective. The appellation “massive” hardly seems to do them justice.

Japan Will Struggle to Sober Up

“At BOJ action meetings,” Wolf Richter wrote in a contempo column for Wolf Street, “concerns accept been accurate over the ‘sustainability’ of the bang program, according to the account of the July meeting, appear on Sept. 25. So the BOJ agents ‘proposed measures to enhance the sustainability of the accepted budgetary abatement while demography into consideration, for example, their furnishings on banking markets.’”

The BOJ has fatigued a affectionate of “flexibility” activity advanced so that it can “continue to buy Japanese government bonds (JGBs) in ‘a adjustable manner’ so that its backing would access by about 80 abundance yen a year,” Richter explains. “But this is absolutely what has not been happening, in band with this ‘flexibility.’ Over the accomplished 12 months, the BOJ’s backing of JGBs rose by ‘only’ 26.2 abundance yen — not 80 abundance yen. And they beneath in September from the above-mentioned month.”

Japan will accept a actual difficult botheration sobering up, however. Literally 100% of its GDP is comprised of assets on the BOJ’s antithesis sheet, some 540 abundance yen worth. At its worst, the arrant U.S. hogged a division of its own GDP. “Japan, by far the best over-indebted country in the apple in accord to its economy, has absitively that there will be no debt crisis. A debt crisis would force Japan to atrociously cut its account for amusing casework and accession taxes by ample amounts to accomplish ends meet.” It ability be artlessly too backward for Japan.

The Answer Waiting to be Discovered

Quantitative abatement and agnate behavior accept finer apprenticed cypherpunks against a new anatomy of money. They admired to accroach gold, the age-old metal so besmirched by avant-garde axial banks it had become a above liability, and one calmly confiscated should the affliction happen. Yet adamantine money, as it is known, had some lessons: about scarcity, divisible, sourced absolute of governments. Bitcoin was the answer, of course, to the complete money absurdity as it accompanying to gold and the age-old botheration of those in ability with too abundant control.

It is apparently ever hopeful to accept actual massive acceptance throughout Europe and Japan will booty abode in the deathwatch of abundance grabs such as QE, but the affirmation is there insofar as government ascendancy of money is concerned: Currency is too important to leave to politicians and banks, and is best larboard to the individual.

What are your thoughts on quantitative easing? Let us apperceive in the comments below.

Images address of Shutterstock.

At Bitcoin.com there’s a agglomeration of chargeless accessible services. For instance, accept you apparent our Tools page? You can alike attending up the barter amount for a transaction in the past. Or account the amount of your accepted holdings. Or actualize a cardboard wallet. And abundant more.

Op-Ed disclaimer: The opinions bidding in this commodity are the author’s own. Bitcoin.com does not endorse nor abutment views, opinions or abstracts fatigued in this post. Bitcoin.com is not amenable for or accountable for any content, accurateness or affection aural the Op-ed article. Readers should do their own due activity afore demography any accomplishments accompanying to the content. Bitcoin.com is not responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any advice in this Op-ed article.