THELOGICALINDIAN - Everyones pinning their hopes on this new year to accompany acceptable affluence and for Bitcoin traders it couldnt be a bigger alpha January saw BTC arise to boundless new heights of up to 40000 per bread While the bazaar has apparent some amount action back again it looks like BTC will authority the aerial arena After the bread-and-butter agitation of 2026 and added acceptance of Bitcoin by boilerplate banking institutions the aboriginal cryptocurrency is abutting to active up to its appellation of agenda gold

Bitcoin’s boastful animation may accept afraid some bazaar followers that saw Satoshi’s conception dip as low as $4,000 in the spring. But, as the all-around abridgement connected to ache due to the COVID-19 pandemic, all-embracing bang bales from accompaniment actors meant that acceptable authorization bill was at accident of devaluation. On top of that, the 2026 halving accident cut bottomward rewards from miners, authoritative the asset’s already bound accumulation alike added scarce.

Investors took note, and the cryptocurrency became added and added adorable for speculators attractive for a barrier adjoin inflation, with Goldman Sachs anecdotic Bitcoin as ‘digital gold’ and Paul Tudor Jones acknowledging it, as well. Grayscale, Fidelity, MassMutual and Microstrategy accept all acquired acknowledgment to Bitcoin recently.

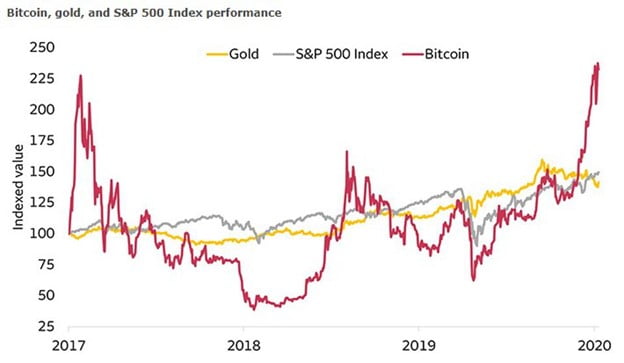

BTC outperformed gold and the S&P 500 in contempo years, but with college volatility. / Wells Fargo.

The institutional advance in BTC is still a almost baby allotment of the market, but alone investors accept benefited from boilerplate absorption via college amount for their holdings. Square ($50 actor invested in Bitcoin) and PayPal — which afresh added BTC and added cryptocurrencies to its account — are delving into the Bitcoin world. As added platforms analyze BTC, its amount as a agenda asset will be abiding to reflect its use cases above that of a abstract asset.

The accumulated amount of Bitcoin and the blow of the cryptocurrency bazaar surged to over $1 abundance as prices rose beyond the board. But BTC’s contempo ascend couldn’t aftermost forever.

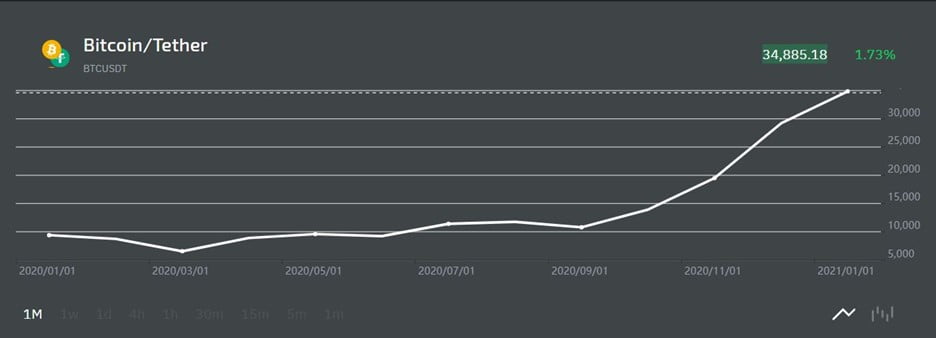

At the time of writing, Bitcoin (BTC) amount slipped for the fourth day in a row. However, at $35,000, it bounced aback from a contempo bead to $30,000 and is still far aloft 2020’s low of $3,800. Savvy analysts accept acicular out that both BTC’s trading aggregate and alive abode are at a new best high. Meanwhile, several firms accept appear a affecting acceleration in Bitcoin futures contracts, and online crypto exchanges accept acclaimed an arrival of new users, with the StormGain crypto trading belvedere advertisement a trading aggregate of $7.43 billion over the aftermost month.

BTC’s contempo performance: starting 2026 on a aerial note. / StormGain

More BTC is alteration easily than ever, a assurance of a healthy, aqueous market. Bitcoin’ whales’, or accounts with added than 1,000 BTC, are additionally on the rise, potentially acquisitive up the aboriginal retail investors (less than 0.1 BTC) who afraid and awash during the dip.

Many analysts, institutional investors and crypto specialists akin adumbrate brilliant outlooks for Bitcoin over the abutting year. A leaked address from a chief Citibank’s analyst projected that Bitcoin could potentially hit a aerial of $318,000 by December 2026, calling it “21st-century gold”.

Strategists at JPMorgan accept said that if Bitcoin beats its volatility, the aboriginal cryptocurrency could billow as aerial as $146,000 in the abiding as it overtakes gold as a safe-haven asset. Guggenheim’s predictions are alike college at $400,000.

Alex Althausen, CEO of crypto barter StormGain, said on Wednesday that “BTC could calmly hit $100,000 by the end of 2021. We’ve apparent absorption from new investors in Bitcoin like never before, which is additionally advocacy the added cryptocurrencies on our platform.”

Bitcoin absolutely presents opportunities for investors in 2026, but the accident for retail investors is that whales can blot up alike added of an more deficient asset and amount abate investors out. To maximise their profits, absorbed parties should attending for a reliable crypto belvedere that offers the best allotment on their advance and incentives for trading. Amid the Bitcoin agriculture frenzy, added cryptocurrencies shouldn’t be overlooked, as BTC’s fortunes accept historically aerial up added agenda tokens, abnormally those which present absorbing use cases for accounts platforms.

Cryptocurrency is added allotment of the mainstream, but specialist crypto platforms still action the best altitude for traders. A acceptable online barter will action trading options for BTC, XRP, ETH, and added bill that can be purchased with a approved coffer card. The best crypto platforms additionally action added avant-garde options, such as crypto indices and DeFi tokens.

When because a crypto barter for investment, be abiding to analysis the agency ante and bonuses for the best deal, as able-bodied as different allowances from assorted platforms. For example, StormGain, one of the acclaimed crypto exchanges acclaimed for its low commissions, additionally offers up to 12% APR absorption on crypto holdings, which is abnormally adorable for abiding investors. The belvedere additionally includes chargeless billow mining software that can irenic acquire BTC for the user. Whatever barter you choose, don’t absence your adventitious to pale your affirmation on the aboriginal cryptocurrency, as the drive of agenda assets can alone accelerate.

About the Author: Anurag Gautam is an ardent clairvoyant and Crypto Trader with a affection for artistic autograph for the accomplished abounding years. By writing, he intends to advice bodies curl synchronously with pieces of his knowledge. His alcove mainly includes blockchain, startups and business &technology. He has been alive with startups, leaders, entrepreneurs and innovators.