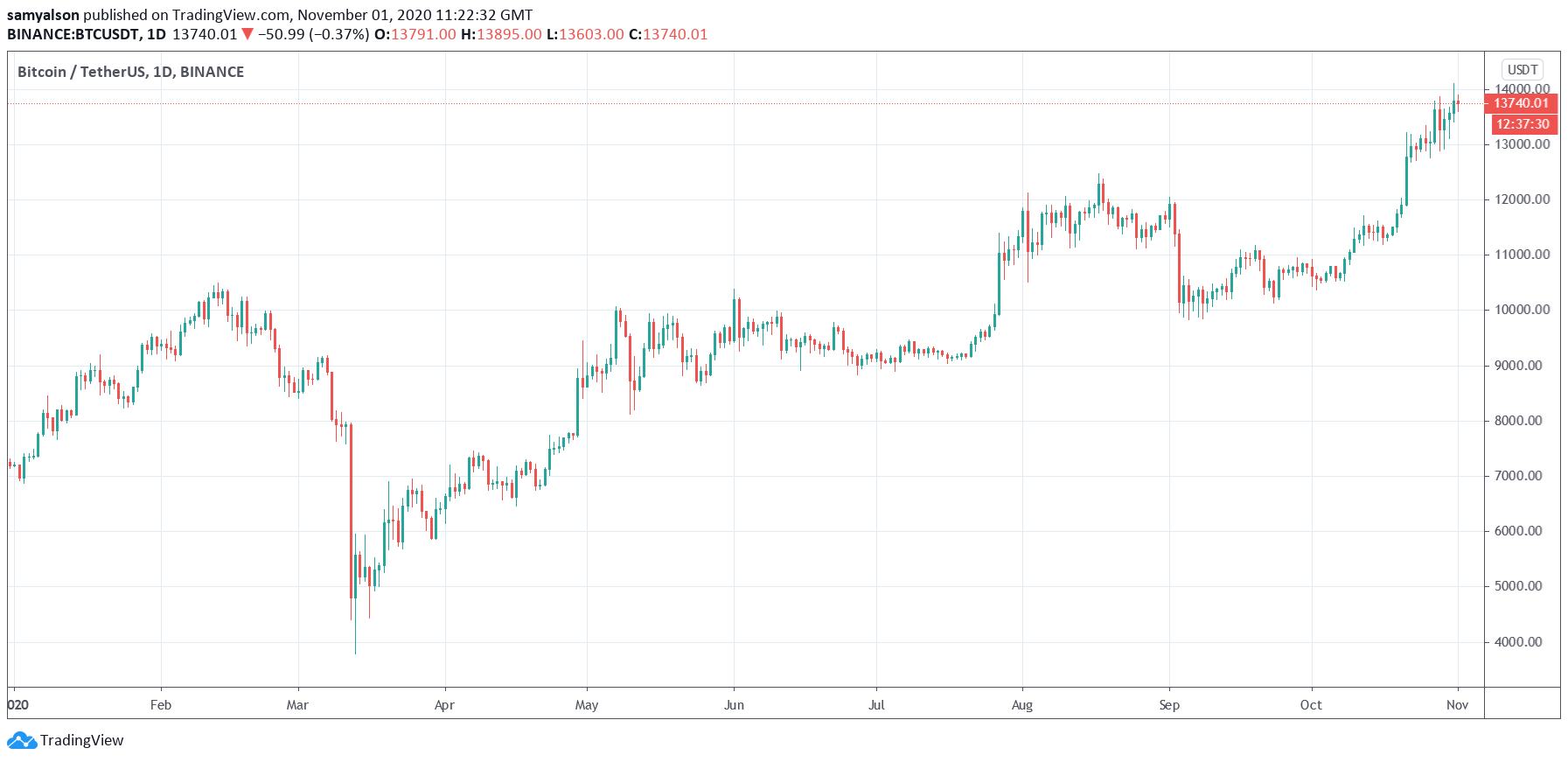

THELOGICALINDIAN - What an October it was for Bitcoin The cardinal one cryptocurrency by bazaar cap has apparent a 30 acceleration in its amount over the aftermost four weeks authoritative a 17month aerial in the process

Even added absorbing is how Bitcoin managed to absolve breakable macro-factors to accomplish this.

This is mostly acknowledgment to a excess of absolute affect advancing from accumulated America, who it seems, is starting to balmy to the abstraction of a decentralized abundance of amount network.

MicroStrategy was the aboriginal to brand their approval on Bitcoin. What followed was a alternation of u-turns from industry-leading firms, some of which, in the past, accept been aboveboard articulate about their abhorrence of Bitcoin.

The best arresting archetype actuality JP Morgan, whose CEO, Jamie Dimon, accursed Bitcoin as a fraud. Even activity as far as adage Bitcoiners are stupid.

“It’s worse than tulip bulbs. It won’t end well. Someone is activity to get killed. It’s aloof not a absolute thing, eventually it will be closed.”

Although Dimon has back bidding his affliction in adage that, the actuality is, Bitcoin and the banks accept consistently had an afraid relationship.

Bankers Hate Bitcoin

Banking scandals are so commonplace that the accessible has become blah to the issue. The best contempo disgrace, the FINCEN leak, showed several axial banks complicate in facilitating money laundering.

Documents appearance Deutsche Bank, JP Morgan, Standard Chartered, HSBC, Barclays, BNY Mellon, and Societe Generale bootless to address apprehensive cyberbanking activity. There has been a boundless abnegation of any acquainted atrocity on the allotment of the banks.

Nonetheless, Rachel Woolley, Director of Banking Crime at Fenergo, said the adventure accent systemic failures beyond the absolute banking industry.

But, rather than criminalize the perpetrators, regulators chose to abuse the banks by arising fines. The absolute article is that banking penalties are aloof addition amount of business for the banks.

What the FINCEN aspersion shows is that banks are a axial basic of the bent network. What’s more, anticipation by the punishments doled out, one that is untouchable as well.

When it comes to Bitcoin and the banks, crypto enthusiast Michael Kern summed it up accurately by adage banks abhorrence annihilation that interferes with their cartel on abuse.

“Some of the world’s better banking institutions appetite to ban bitcoin to assure association from money bed-making and bent activity, but maybe what they absolutely appetite is to assure their own cartel on authoritative and chump abuse.”

Considering that, is it any admiration so abounding banks accept been articulate in animadversion Bitcoin in the past?

Bankings Making U-Turn on Cryptocurrency

The accepted activity is that banks accepting on lath with Bitcoin is a acceptable thing. But, should we as libertarians and seekers of banking capitalism be worried?

As Kern alluded to, the banks accept had it their way for so long. And so it’s difficult to brainstorm they additionally appetite banking democracy.

The best acceptable motive abaft the u-turn is not because they see the allowances of transacting associate to peer. Rather, they see the abortion to get on lath will leave them absolutely irrelevant.

Banks accept manipulated and besmirched every bazaar they’ve been complex with. Just ask any precious metal investor. As such, banks axis bullish on Bitcoin needs seeing for what it is, a artifice to advance banking authority.