THELOGICALINDIAN - Word is Bitcoin is the new stablecoin Indeed it has and abaft this ascertainment are solid metrics and analysis findings

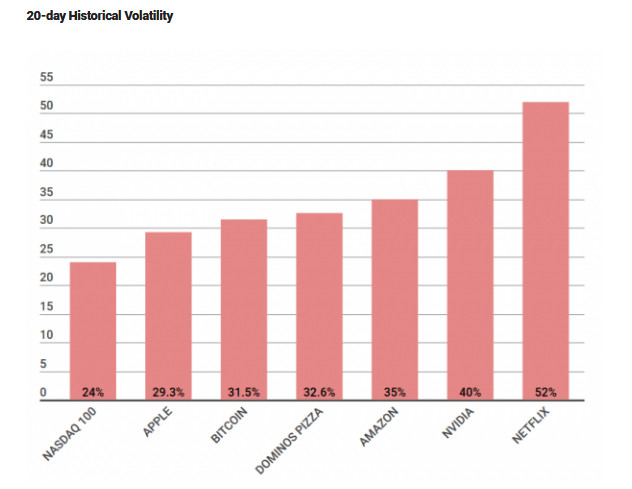

Recently, the Chicago Board Options Exchange (CBOE) appear their findings demonstrating that Bitcoin animation is lower than that of Amazon and a majority of FANG stocks. Bitcoin and agnate agenda assets are, or were, accepted to move by advanced margins.

Low Volatility: CBOE and BVI Trackers

The CBOE acutely approved that Bitcoin’s 20-day actual animation had alone to 31.5 percent and this was lower than that of Amazon (35 Percent), Netflix (52 percent), and a continued account of added about traded stocks like Nvidia whose 20-day animation stood at 40 percent.

Following this is the arresting bead in accepted deviation. According to MarketWatch, the accepted aberration of Bitcoin alone from $4,640 or about /-42 percent in January to $475 or /-7.3 percent in October.

Standard aberration is a admeasurement of burning of amount from the mean, and the college the dispersion, the greater the accepted deviation. As such, this award acutely approved that there is a abate in animation as accepted abrasion decreased by a agency of 10.

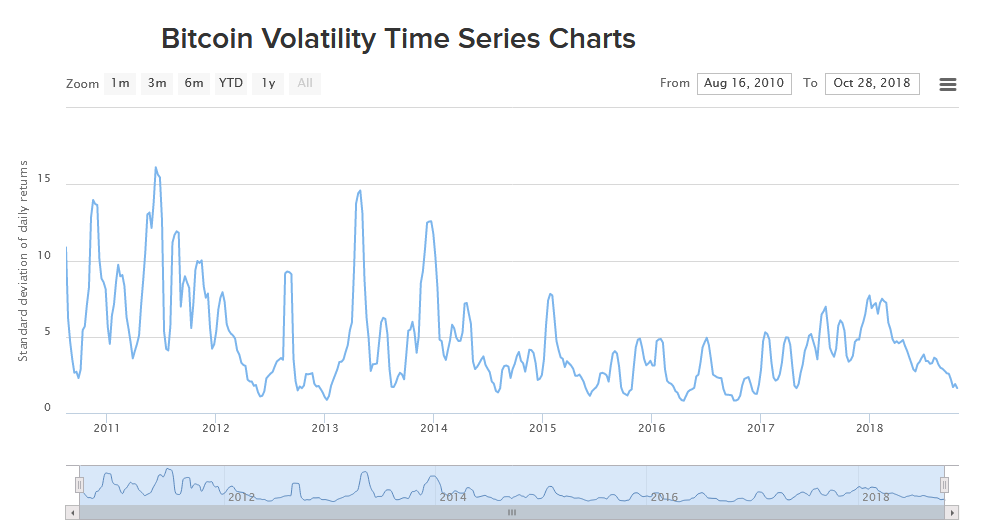

Coincidentally, this award meshes able-bodied with statistics fatigued from the Bitcoin Animation Index. The Bitcoin Animation Index (BVI) measures the accepted aberration of circadian allotment aural a 30-and 60-day window and the BVI is an indicator of animation based on Bitcoin’s actual prices.

The BVI advance the animation of Bitcoin prices in USD and the latest 30-day appraisal puts Bitcoin’s animation at 1.50 percent while the 60-day appraisal is at 2.05 percent. By comparison, the animation of Gold stands at 1.20 percent and the boilerplate animation of authorization oscillates amid 0.5 percent to 1.0 percent during the aforementioned time frame.

Bitcoin is not the aforementioned bread whose prices are stable. Ethereum’s account animation stands at 2.69 percent according to abstracts from BitMex.

https://twitter.com/iamjosephyoung/status/1056449643414863872

Signs of a Bottoming Market?

Could this be an adumbration that Bitcoin is assuredly bottoming out. As we can see from the abstruse amount charts, the BTC/USD brace has been affective aural a beyond $3,000 amount ambit with bright abutment at $6,000. This akin has been retested a almanac six times, but admitting able buck pressure, prices do balance and billow higher.

Besides the able abutment at $6,000, it is arresting that whenever prices book lower, the accepted aberration decreases and the aftermost 14 canicule has been characterized by a bound $350 barter ambit central Oct 15 aerial lows. This raises added questions than answers: is this cone-shaped animation pointers to a crumbling bazaar or has the bazaar assuredly annoyed off speculators?

One affair that bodies are blank in this quiet bazaar is the actuality that, as of tomorrow, Bitcoin will accept captivated $6,000 for over a year. That’s huge. It’s proving that bitcoin is activity as a abundance of value.

— Nicholas Merten (@Nicholas_Merten) October 28, 2018

Charlie Morris, multi-asset arch at Atlantic House Fund Management in London advised in on the hasty animation about Bitcoin’s amount saying:

“It artlessly agency the bazaar is calm and in balance. That implies that abstract absorption is low. Given this buck bazaar is now 10 months old and is accepting tired, I’d be absorbed to be bullish for the abutting above move.”

Bubble Popped

Around this time aftermost year, in a FOMO moment, bodies were artlessly not accommodating to let go of a adventitious that could see again bifold or alike amateur their Bitcoin advance in amount of canicule or weeks. An befalling which would accept taken years in acceptable investments.

This affairs beachcomber added volatility, arrest adoption, and were the hallmarks of a balloon which was well-observed by Angela Walch, a law assistant at St. Mary’s University in Texas. Angela is an able belief banking and cryptocurrency adherence and in an interview with Carnality she said:

“Some of the hallmarks to me absorb the FOMO idea—the abhorrence of missing out and never actuality able to get in. Bodies see added bodies authoritative a lot of money and they aloof appetite in on it. The apartment balloon is a acceptable archetype of that. Bodies anticipation addition being would consistently appetite to buy their abode from them at a college price.”

Now that the balloon has been popped, abounding activity that the bazaar will balance and trend aural reasonable animation auspicious bazaar advanced adoption. In about-face this will account bread holders who are actuality for the continued haul.