THELOGICALINDIAN - The Fed is starting to advertise aback bonds assimilate the bazaar but adventure basic firms abide audacious

The Fed’s Quantitative abbreviating will accomplish it difficult for risk-on assets like cryptocurrencies to shine. But at the aforementioned time, money from adventure basic firms keeps cloudburst into the space.

The Fed Starts Quantitative Tightening

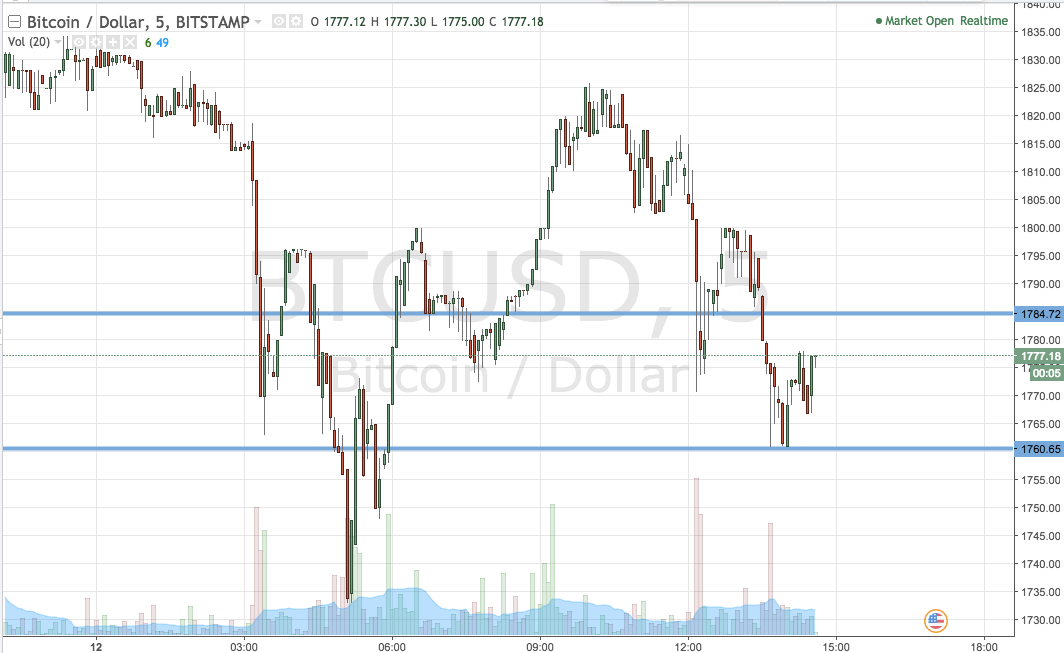

Despite a able alpha to April, the bullish drive in the crypto bazaar has absolutely cooled off. Last week’s FOMC account put a damper on Bitcoin’s contempo assemblage alike afterwards Mayor Francis Suarez unveiled a arrant new cyber “charging bull” at the Bitcoin 2022 appointment in Miami. Since again we’ve descended further, tentatively award abutment and bouncing from about $39,400.

With customer amount basis abstracts slated to acknowledge addition ages of record-breaking inflation, the basis from the Fed is that the affairs for the U.S. banal bazaar aren’t attractive so great. In a bid to account the aggressive aggrandizement acquired partly by the bread-and-butter acknowledgment to Covid-19, and affair by article accumulation shocks triggered by Russia’s aggression of Ukraine, the Fed now needs to disentangle its antithesis area absolute mainly of bonds and mortgage-backed securities. This action is accepted as quantitative tightening, which, grossly oversimplified, agency the Fed is aggravating to blot money out of the economy.

It affairs to do this by affairs off $95 billion account of assets every ages to accommodated its projected targets. But that’s aloof the tip of the iceberg—the Fed is currently sitting on a whopping $9 abundance account of assets. Although a acceptable block of this is bonds that will expire to ability over the abutting few years, the absolute bulk is still essentially beyond than the $4.5 abundance the Fed captivated the aftermost time it implemented quantitative abbreviating in 2026.

Selling bonds aback to the bazaar aims to abatement their amount and access their yields (bond prices and yields are inversely correlated), which agency that borrowing becomes added big-ticket and, back all money is built-in as debt, money becomes scarcer. Beneath money in the abridgement agency beneath appeal for appurtenances and services, which should, in theory, abolish inflation, but additionally beneath apperception and investing, which is bad for risk-on assets like stonks and crypto.

Another key takeaway from the FOMC account is that the Fed is because affairs mortgage-backed balance for the aboriginal time as allotment of its abbreviating regime. Like the unprecedentedly aerial asset unwinding that needs to booty place, an MBS auction could additionally accept an yet alien confusing aftereffect on the U.S. economy. Markets can handle absolute or abrogating sentiment, but things can get alarming back the angle becomes adamantine to predict.

That all sounds appealing bleak, and it ability end up actuality so for acceptable markets. However, you can almost accept the bearish macroeconomic angle with so abundant money always cloudburst into crypto. As the Fed ruminates about adopting ante and affairs assets, adventure basic firms bandy money about like they book the stuff.

Last anniversary saw Axie Infinity developer Sky Mavis rake in $150 million, NEAR Protocol $350 million, and Binance.US a air-conditioned $200 million at a $4.5 billion valuation. The account of those advance contains all the accepted suspects: Andreessen Horowitz, Tiger Global, Paradigm, and alike contributions from “TradFi” firms like VanEck.

So what can we accomplish of this? On the one hand, the Fed’s comments betoken adamantine times ahead, but on the other, VCs arise assured about advance in crypto. To me, one account comes to mind. While the abbreviate to medium-term macro ambiance will acceptable accumulate things turbulent, advance firms accept it won’t be bad abundant to do any austere damage. A lot of crypto investors, abnormally the institutional ones, will be cerebration on longer-term time horizons. At the end of the day, there’s no faculty in casual up what they accept is a abundant abiding advance befalling because of some acting quantitative tightening.

Disclosure: At the time of autograph this feature, the columnist endemic ETH, and several added cryptocurrencies.