THELOGICALINDIAN - Brian Armstrong acquaint a continued account cogent his agitation at the SECs coarse behavior

The Securities and Exchange Commission has threatened to sue Coinbase if the aggregation goes advanced with its affairs to barrage a lending artefact acceptance barter to acquire absorption on their crypto assets, Coinbase CEO Brian Amstrong has revealed.

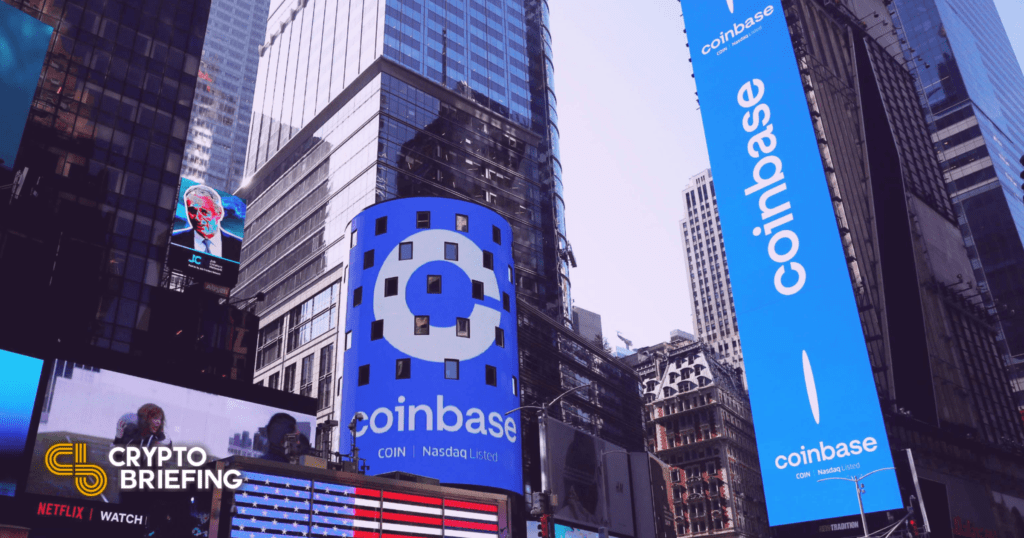

Coinbase CEO Accuses SEC of “Sketchy Behavior”

The Securities and Barter Commission has threatened to sue Coinbase, the better U.S.-based crypto exchange, over affairs to affair a lending product. The aggregation says it has “no abstraction why.”

In a Twitter thread, the exchange’s CEO Brian Amstrong accused the SEC of “sketchy behavior,” and creating “an arbitrary market,” claiming the regulator banned to accord the aggregation any acknowledged absolution for because its Lend artefact a security.

Amstrong wrote that abounding crypto companies accept been alms versions of the aforementioned artefact and that millions of users accept becoming yields on their crypto backing over the aftermost few years.

The aggregation claims that it has not accustomed bright advice and that rules accept not been constant beyond the industry.

Addressing the affair in a Wednesday blog post, Coinbase’s arch acknowledged administrator Paul Grewal declared that the barter could accept launched the artefact after consulting with the regulator first—as abounding added crypto companies accept done in the past—but absitively adjoin it. He wrote:

“We aggregate this appearance and the capacity of Lend with the SEC. After our antecedent meeting, we answered all of the SEC’s questions in autograph and afresh again in person. But we didn’t get abundant of a response. The SEC told us they accede Lend to absorb a security, but wouldn’t say why or how they’d accomplished that conclusion.”

Grewal added that the SEC again “opened a academic investigation.” While the regulator reportedly told Coinbase that it would appraise the Lend artefact through the prism of the Howey and Reves test, it didn’t allotment the appraisal itself.

The SEC’s Chairman Gary Gensler has been calling on crypto platforms to register with the regulator back he stepped into office. Earlier this month, he reiterated his stance, adage that crypto companies should be “asking for permission” to accomplish instead of “begging for forgiveness.”

“Talk to us, appear in,” Gensler said, admonishing that crypto platforms proceeding to accomplish afterwards the regulator’s approval are putting their own adaptation at risk. However, Coinbase claims that the SEC has banned to accommodate any abundant advice afterwards it came forward. Addressing the issue, Grewal wrote:

“We did that here. But today all we apperceive is that we can either accumulate Lend off the bazaar indefinitely after alive why or we can be sued. A advantageous authoritative accord should never leave the industry in that affectionate of bind after explanation.”

In June, regulators in Texas, Alabama, and New Jersey accomplished a crackdown on BlockFi for alms a agnate artefact to Lend in the anatomy of interest-bearing crypto accounts, alleging that BlockFi’s artefact constituted an unregistered balance offering.