THELOGICALINDIAN - A arguable angle has become a lightning rod of addition bamboozlement and a scattering of brief millionaires

The SushiSwap adventure and its built-in token, SUSHI, will go bottomward in crypto history.

What began as a tokenized adaptation of Uniswap has coiled into article abundant more. It reminds crypto users of the ability of open-source protocols, 24/7 bread-and-butter incentives, as able-bodied as the arduous ability of online communities. Even now, afterwards best of the dust has settled, the acquaint from this alluring agreement abide to bare themselves.

As a protocol, SushiSwap is a decentralized barter (DEX) like abounding others. It’s ambitions, however, are absolutely unique.

This week’s Project Spotlight affection will ameliorate the twists, turns, and acquaint learned. Ultimately, readers will accretion a new acknowledgment for the ability of decentralized, Internet-based money.

None of the contest that chase would accept been wholly accessible in acceptable markets.

Unpacking Uniswap

One charge aboriginal activate with compassionate how Uniswap functions as a DEX, as able-bodied as what led to the overflow of alleged “food tokens.”

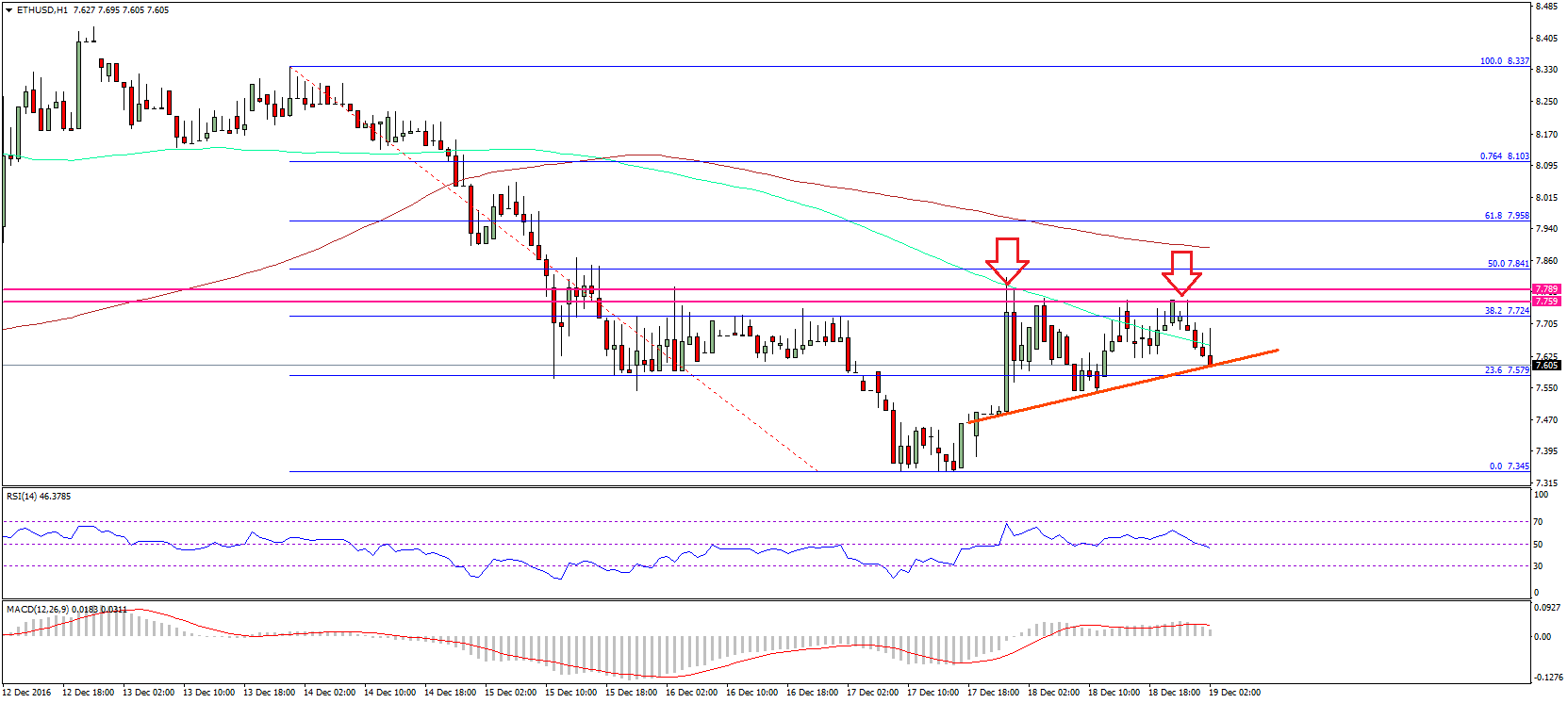

Uniswap has been a mainstay aural the DeFi community. It offers traders different badge pairs, is non-custodial, and, afore SushiSwap arrived, billions of dollars in liquidity. The way the belvedere works is simple: Traders trade, and clamminess providers (LPs), well, accommodate liquidity.

In accouterment liquidity, LPs can additionally acquire fees. Each time a user arrives and interacts with an LP’s pool, either through affairs or affairs an asset, the LP makes 0.3% of that trade. They additionally accept tokens that behave like receipts of their action on Uniswap.

These are alleged LP tokens, and they represent the bulk of clamminess the LP has provided.

These credibility may assume insignificant, but in the ambience of this article, they’re analytical to remember.

For a added dive into how Uniswap defines asset prices as able-bodied as a ample allegory with added DEXes, readers are brash to apprehend Crypto Briefing’s antecedent advantage on the accountable here.

Essentially, Uniswap has unbundled the assignment of centralized exchanges and handed it over to users by alms them money. This is in the way of trading fees, clamminess provision, badge listings, bazaar making, and arbitrage opportunities.

For the account of this article, though, one charge alone accumulate in apperception that Uniswap is an open-source protocol, it offers users LP tokens for accidental liquidity, and, conceivably best importantly, it is backed by ample adventure capitalists.

Who’s Hungry for Tokens?

In August, Uniswap raised $11 million from notable investors, including Andreessen Horowitz, USV, Paradigm, and others. The advance was fabricated via the acquirement of shares in Universal Navigation, the aggregation abaft Uniswap.

These shares are anticipation to eventually acquire money for investors already Uniswap activates a agreement fee of 0.05%. Currently, this fee is not active, but it is a austere consideration. And admitting it has not been a point of austere controversy, the acknowledgment to VC basic and centralized shareholders is not a amount assumption of the crypto community’s aboriginal ethos.

At almost the aforementioned time that this advance was made, the crypto amplitude was in the calefaction of the yield farming, sometimes alleged clamminess mining, trend.

Ignited by Compound Finance in June, badge holders could accommodate and borrow their tokens to a agreement and acquire a advantageous return, additional a babyminding badge in admeasurement to the bulk a user lent or borrowed.

In Compound’s case, they began alms users its COMP badge for bartering liquidity.

The newly-launched apparatus formed like a charm. Not alone did holders blitz to the belvedere to acquire chargeless COMP tokens, but the amount of COMP additionally skyrocketed, authoritative some holders millions of dollars. Emerging protocols throughout the DeFi amplitude adopted the apparatus about immediately.

Some protocols, like yEarn Finance, accumbent the incentives well, but the majority became quick “farm-and-dump” schemes evocative of the airdrops and antecedent bread offerings of yesteryear. Perhaps the everyman accomplishment appearance of crop agriculture came via the acceleration of aliment bill and assorted forks.

This was the ambiance in which SushiSwap and SUSHI emerged. And due to its name and the ambience of its launch, abounding shrugged it off as a get-rich-quick project.

SushiSwap and Fair Launches

SushiSwap pitched itself as a added fair adaptation of Uniswap. Instead of a baby accumulation of VCs, the broader crypto association would sustain and accumulation from the platform’s success, acknowledgment to a decentralized token. It additionally included an adversarial component.

Instead of alone aggressive with Uniswap for brainy favor, it approved to accompany clamminess anon from Uniswap over to SushiSwap. Called “Vampire Mining,” SushiSwap attempted to action hardly bigger incentives to users who absitively to participate in the fork.

And acknowledgment to the adorable allotment on crop farms and aliment coins, users were quick to chase along. Soon, SushiSwap had admiring about 90% of all the clamminess on Uniswap. And already concluded, this clamminess would be migrated to SushiSwap.

It’s important to bethink that the clamminess that would move to SushiSwap was not added liquidity. Instead, it was anon harvested from Uniswap. As such, the agreement becoming a advanced array of critics.

my booty on the $sushi @SushiSwap beating 👇

tl;dr – it takes best than a anniversary to body a community

it takes love😘 pic.twitter.com/7cllVRHksJ

— ameen (@ameensol) September 5, 2020

The bright altercation is, of course, that SushiSwap about rode on the aback of three years of adamantine work, added a token, and fabricated millions aural a week. Conversely, this tactic, be it vampire mining or bifurcation liquidity, is accepting absorption as a applicable bootstrapping apparatus for new projects.

For added examples of this, readers are brash to investigate Swerve Finance, C.R.E.A.M, and Harvest Finance. Though the dynamics are hardly different, anniversary of these forks is tinkering with the bread-and-butter incentives abaft Curve Finance, Compound, and yEarn, respectively.

With tensions baking and factions forming, the SushiSwap adventure took a abundant darker turn.

The bearding creator, Nomi Chef, sold $14 actor account of SUSHI from the project’s development fund.

“I F*cked Up. And I Am Sorry”

At the aiguille of the week-long association building, the project’s badge plummeted added than 50% afterward Nomi’s bazaar dump. And admitting they claimed to abide alive on Sushi to advice it drift clamminess from Uniswp, the accident had been done.

The association began labeling the move as a bright avenue scam.

The afterward day, he handed over the keys to the arrangement to Sam Bankman-Fried, the CEO of Alameda Research and crypto derivatives exchange, FTX.

A anniversary afterwards handing off the project, Nomi again alternate all $14 actor aback to the SushiSwap treasury.

The Migration and Aftermath

After Bankman-Fried took over the project, SushiSwap’s supporters could assuredly blow a animation of relief. Once Nomi transferred admin ascendancy of the SushiSwap contract, the FTX CEO jumped into activity and began to outline a clearing plan.

Bankman-Fried advised to accumulate the association in the bend with how the clearing would go down. Nomi themselves activated the migration, and Bankman-Fried absitively to abolish this and hardly adjourn the accident to double-check the code.

Several verifications later, it was announced that the clearing would assuredly be activated, and it would be executable afterwards the 48-hour time lock had passed.

While cat-and-mouse for the clearing to go through, Bankman-Fried approved to incentivize added LPs to stick about with SushiSwap. He appear a accolade of one actor SUSHI for LPs that migrated their clamminess to SushiSwap. This accolade would appear from Bankman’s (or Alameda’s) claimed backing of tokens.

The association responded able-bodied to this, eventually voting for the Sushi treasury to match Bankman’s reward. Many proposals followed, including one to reduce badge emissions and accomplish SUSHI arising sustainable.

Governance was addition notable botheration that bare to be solved. Though Bankman-Fried has so far created a spotless reputation, it was far from ideal to duke him sole ascendancy over the acute contract.

Bankman-Fried decided that distributing ascendancy to a 6-of-9 multisig wallet fabricated the best sense.

While SushiSwap was cat-and-mouse for the 48 hour time lock to elapse, the association got to voting. People nominated themselves on Twitter, and SUSHI holders voted for anniversary of those nominees on-chain.

Some actual notable names accept been adopted to SushiSwap’s multisig. This includes Matthew Graham (Sino Global Capital), Robert Leshner (Compound), CMS Holdings (hedge fund), 0xMaki (protocol’s aboriginal association manager), Larry Cermak (The Block), and Bankman-Fried himself.

The clearing assuredly began, and Bankman-Fried’s aggregation began boring brief pools one by one, again activated anniversary of them to see if it absolutely works afore brief others. They started with the CRV-ETH pool, confused on to the YAMv2-ETH pool, and connected until aggregate was migrated.

Notably, SushiSwap’s BASED basin would not abutment rebases. The aggregation announced this basin wouldn’t be migrated, attributable to this risk.

According to SushiSwap’s analytics interface, $1.14 billion migrated to the angled protocol. This is absolutely the feat, as it trumped yEarn Finance to become the youngest DeFi activity to hit $1 billion in absolute amount locked.

Different Perceptions of SushiSwap

As always, the DeFi association is breach back it comes to SushiSwap.

Supporters of the angle accept it is a fair abstraction that gives ability and rewards to the community. With no actual way for DeFi’s users to participate in Uniswap’s upside, they were fatigued to the abstraction of a Uniswap angle area association associates endemic 90% of the tokens.

Others see SushiSwap as a bright failure. A angle of a acknowledged artefact will not be able to innovate the agreement added than the aboriginal developers. Uniswap v3 capacity are accepted to be appear soon, and it could put an end to SushiSwap.

There are additionally apropos apropos Sam Bankman-Fried’s role in all this. FTX is allowance bootstrap Serum, an orderbook-based DEX that runs on Solana. Some theories – all artful as of now – accept this is aloof a business artifice for Serum.

Many a time, Bankman-Fried has remarked aloft the abridgement of ability with automatic bazaar makers (AMM) like Uniswap. The FTX arch submitted a angle to drift SushiSwap, additionally an AMM, to Solana, as a supplement to Serum.

His abrupt action with SushiSwap is in absolute bucking to this.

One ancillary question: Why does Serum charge AMM all of sudden?

Serum's WP claims CLOB > AMM and the alone acumen AMMs advance now are the limitations of Ethereum. pic.twitter.com/lpulgWz4Lg

— Fiskantes (⭐️,🩸) (@Fiskantes) September 6, 2020

Ultimately, Bankman-Fried cannot alone move SushiSwap to Solana, unless he owns SUSHI tokens to access a vote in that direction.

The Future of SushiSwap

Considering aggregate that continues to comedy out, SushiSwap has two abeyant paths it can pursue. Either drift to SushiSwap and advice body clamminess on Solana’s DeFi assemblage or break on Ethereum and action adjoin the brand of Uniswap and Balancer.

The aboriginal advantage is acute because it gives the Sushi association a beginning alpha and the adventitious to body out new appearance from scratch. But the additional option, while absolutely applicable for now, risks SushiSwap crumbling into irrelevance if Uniswap announces a token.

A bandy analysis amid Uniswap and SushiSwap appear that the closing has above clamminess for the tokens listed on the DEX. SushiSwap offered traders a bigger amount for every asset except DAI, USDT, LINK, and AMPL.

This abstracts isn’t all that surprising. Yes, Uniswap has abounding added tokens to barter than SushiSwap. But for the few they share, SushiSwap was apprenticed to action bigger ante as its clamminess is 4x that of Uniswap.

Sushi’s ascendancy is absolutely acknowledgment to the ability of incentives. Giving LPs a shiny, new token, and administering some banknote flows to the token, so it captures value, creates able incentives to drop tokens in SushiSwap, and buy SUSHI.

It’s simple yet effective. But it’s additionally accessible to mimicry.

Imagine Uniswap announces a badge alleged “UNI” tomorrow, and the distribution resembles Curve’s. Founders and investors accept an allocation, a block of tokens is retrospectively adored to anyone who has anytime provided clamminess to Uniswap, and the blow is for a approaching clamminess mining program.

Leaving abreast the actuality that Uniswap’s badge would account and sustain aloft $1 to $2 billion in bazaar cap, the allurement to abundance the academic UNI badge would about absolutely spell the end of SushiSwap.

In ablaze of this, brief to Solana seems like a added acceptable option. Instead of aggressive with Uniswap on Ethereum, it can try to become the Uniswap of Solana.

https://twitter.com/AndreCronjeTech/status/1302502255283908608

Just to reiterate, the approaching of SushiSwap lies absolutely with badge holders. Which aisle the agreement pursues is up to them, but they should anxiously accede the ramifications of anniversary afore authoritative a decision.

Staying on Ethereum requires them to attempt with absolute protocols head-on. And if Uniswap launches a token, the allurement to use and accommodate clamminess to SushiSwap will booty a massive hit.

But brief absolutely to Solana is aloof as risky, as the blockchain has been alive for aloof a few months and is aloof starting to body out the framework for its DeFi ecosystem.

Disclosure: One or added associates of the Crypto Briefing Management aggregation authority SUSHI tokens.