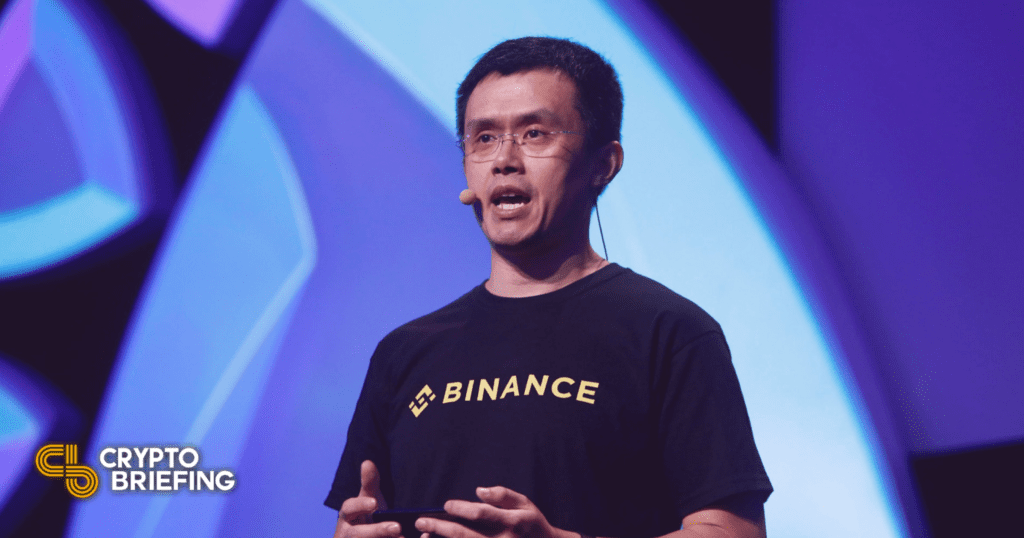

THELOGICALINDIAN - Binance CEO Changpeng Zhao has aggregate his reflections on aftermost weeks Terra abortion

Zhao didn’t authority aback in criticizing the aggregation abaft Terra as he advised on aftermost week’s events.

CZ Talks Terra Again

Changpeng Zhao has aggregate added thoughts on Terra’s implosion.

The Binance CEO, who’s fiercely criticized Terraform Labs over the accomplished few days, appear a new note Friday absorption on the contest that played out aftermost anniversary as Terra’s UST stablecoin absent its peg to the dollar, consistent in a $40 billion wipeout that afflicted the absolute crypto industry.

In it, Zhao discussed the “lessons to be learned” from the disaster, alms some of his claimed takeaways and recommendations for cryptocurrency investors. He discussed Terra’s bifold badge mechanism, which was advised to acquiesce LUNA to be minted whenever UST was trading beneath peg. “When you peg to one asset application a altered asset as collateral, there will consistently be a adventitious for beneath collateralization or depegging,” he wrote. He again took absolute aim at Terraform Labs over Terra’s tokenomics model. “Printing money does not actualize value; it aloof dilutes absolute holders,” he wrote. “Exponentially minting LUNA fabricated the botheration a lot worse. Whoever advised this should accept their arch checked.”

Zhao additionally declared “over-aggressive incentives” in advertence to Anchor Protocol, the lending belvedere that promised UST depositors 20% APY. Terraform Labs fabricated up the acquirement arrears to pay Anchor’s users, a archetypal Zhao said was unsustainable. “Eventually, you charge to accomplish “income” to sustain it… Otherwise, you will run out of money and crash,” he wrote.

Zhao issued a admonishing adjoin aerial yields, adage they “don’t necessarily beggarly advantageous projects.” He went on to call Terra’s architecture as “a self-perpetuating, bank concept,” and added that investors should consistently “look at fundamentals.”

Terraform Labs Slammed

Zhao criticized Terraform Labs already afresh for its acknowledgment to the crisis, arguing that its accommodation to use LFG’s Bitcoin affluence to balance UST afterwards it had absent its peg was “stupid.” He added that teams should “always be operationally acutely responsive.”

He additionally questioned Terraform Labs’ advice action afterwards it acquaint alone a scattering of updates during the meltdown. “Always acquaint frequently with your users, abnormally in times of crisis.”

Although Zhao was analytical in his takeaways, he additionally aggregate abounding absolute thoughts. He antiseptic that Binance would abutment the Terra association and acclaimed that crypto had apparent about animation admitting a bead in prices and abrupt USDT depeg event. “The accumulated admeasurement of UST and LUNA was bigger than Lehman Brothers back it failed,” he acicular out, acquainted that Bitcoin afford alone 20% of its bazaar cap in the fallout.

He additionally accustomed the charge for stablecoin regulation, afore rounding out with a attending to the approaching of the space. “While instances like the one with LUNA and UST are regrettable, we are committed to arena a acute allotment in architecture a sustainable, adorning blockchain ecosystem for all,” he wrote.

Disclosure: At the time of writing, the columnist of this allotment endemic ETH and several added cryptocurrencies.