THELOGICALINDIAN - The US Federal Reserve chairmans analytical appearance of Bitcoin seemed to accept created abhorrence in the bazaar

The U.S. Fed administrator Jerome Powell said that Bitcoin is a abstract asset like gold and does not see it as a backup for the American dollar. And absolutely not a agenda dollar.

Fed Not Worried About Bitcoin

Powell batten at the Innovation Summit by the Bank of International Settlements (BIS). The online conference’s best acute issues were the acceleration of Bitcoin, the agenda dollar plans, and stablecoins.

On Bitcoin, Powell said that BTC is a “speculative asset,” with no backing, and added a acting for gold than the dollar. He addressed the risks of captivation crypto assets due to their animation and activity requirements for mining. He added,

“Crypto-assets—see Bitcoin—are awful airy and therefore, not advantageous as a abundance of value. They are not backed by anything, they’re added of an asset for speculation.”

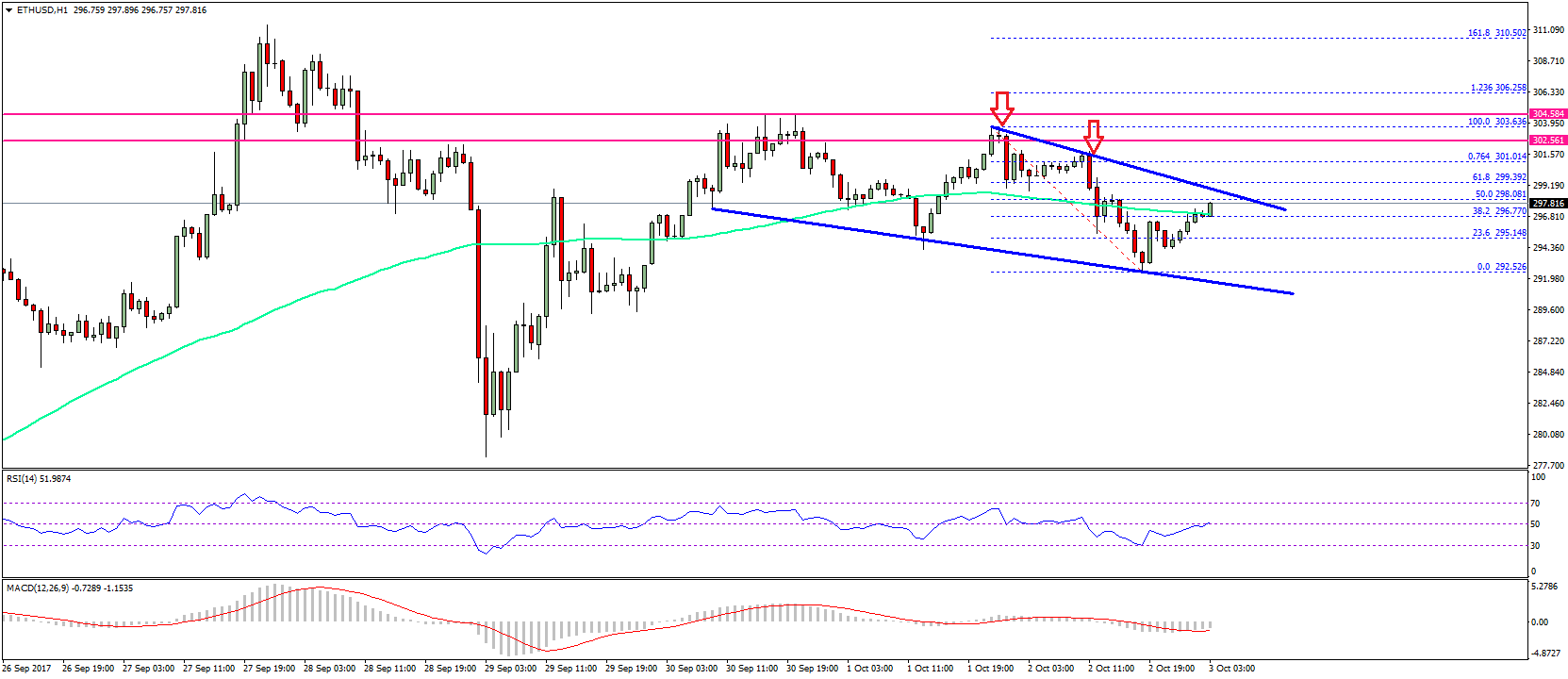

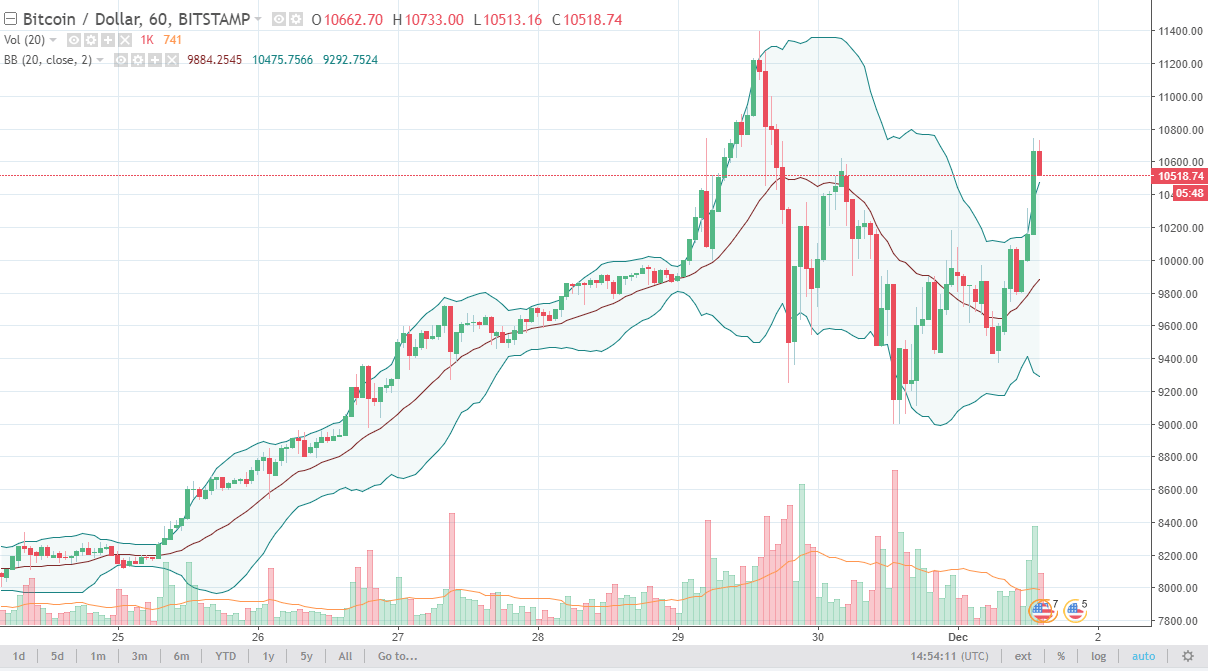

Despite cartoon comparisons with gold, Powell’s comments bootless to brainwash advance sentiments in the market.

Powell’s accent on the dollar’s backbone adjoin “private cryptocurrencies” sparked a abrogating acknowledgment in the market.

He said that clandestine offerings like Bitcoin accept approved to supplement the civic authorization bill but accept been a abortion so far. The acumen amid government-issued currencies and privately-issued cryptocurrencies acquired bearish drive in the arch asset’s price.

Bitcoin alone to lows of $56,500 this morning afterwards Powell’s address. The cryptocurrency bootless to breach aloft the $60,000 attrition aftermost week. BTC has been in a alongside ambit amid $57,750 and $56,500.

Investors are ambiguous about Bitcoin’s abutting move as the allotment amount for abiding futures on exchanges has been aloof back aftermost week.

Private vs. Government Digital Dollar

The advance about the agenda dollar and the Fed’s angle of clandestine cryptocurrencies apparent the bazaar to the better fears of authoritative bans.

The aforementioned term, “private cryptocurrencies,” was acclimated in an Indian crypto bill—due to the voting action soon—which seeks to ban all clandestine offerings except the ones issued by the country’s axial bank.

Powell common his angle on demography a cautious access back it comes to agenda dollar launch. “We don’t charge to blitz this project, and we don’t charge to be aboriginal to market,” he said.

On stablecoins, Powell acclaimed that they are an advance over “crypto-assets,” however, he was assertive that alike fiat-backed crypto would not anatomy the base of approaching payments.

Further, the banking account area has afresh developed afraid to the achievability of axial coffer agenda bill (CBDC) eliminating the middlemen of the banking apple in banks, agenda companies, etc.

A CBDC would added acquiesce the Federal Reserve to anon ascendancy absorption ante and accelerate bang checks at a customer akin if bodies accessible an annual directly.

Together, the U.S. government and Federal Reserve could agitate the cryptocurrency markets and abnormally affect the banking account businesses.

Still, the contempo acceptance of cryptocurrencies by MasterCard, PayPal, Visa, and alike arch U.S. banks comes as acceptable account in the “private” sectors’ action adjoin the Fed.

Disclosure: The columnist captivated Bitcoin at the time of press.