THELOGICALINDIAN - n-a

Bitcoin SV’s scalability agency it will one day be able of hosting billions of bodies on a circadian basis, claims the project’s advance engineer.

Daniel Connolly, a affiliate of the SV development team, told Crypto Briefing that billions of bodies should be able to use the payments protocol. As the block size gradually increases, hopefully to 2 GB by the end of abutting year, added bodies will be able to use Bitcoin SV after putting too abundant ache on the network.

“We aim to accept 5 billion people [using BSV] daily”, said Connolly, at a CoinGeek conference in London. “It’s still a continued way away, but it will become accessible so far as we scale.”

Bitcoin SV (‘Satoshi Vision’) was a proposed agreement accomplishing for the Bitcoin Cash (BCH) arrangement upgrade, which took abode beforehand this month. BSV added the block admeasurement from 64 MB to 128 MB. Supporters, including Calvin Ayre, the architect of CoinGeek, and Craig Wright from nChain, said it was the alone band-aid for creating scalable payments that abide on the arrangement – ‘on-chain’.

Originally a angle for Bitcoin Cash, not anybody agreed with SV. Most notably, Roger Ver, from Bitcoin.com, and Bitmain’s Jihan Wu, proposed their own battling implementation, accepted as Bitcoin ABC. When the hard fork happened, ABC, which had a beyond allotment of the hashing power, became the adopted implementation.

Within a week, best exchanges and abstracts aggregators had accustomed ABC as Bitcoin Cash. But followers of SV backward on their own network. Bitcoin SV became its own absolute blockchain network, currently admired at over $1.7bn.

Will there be Bitcoin SV users?

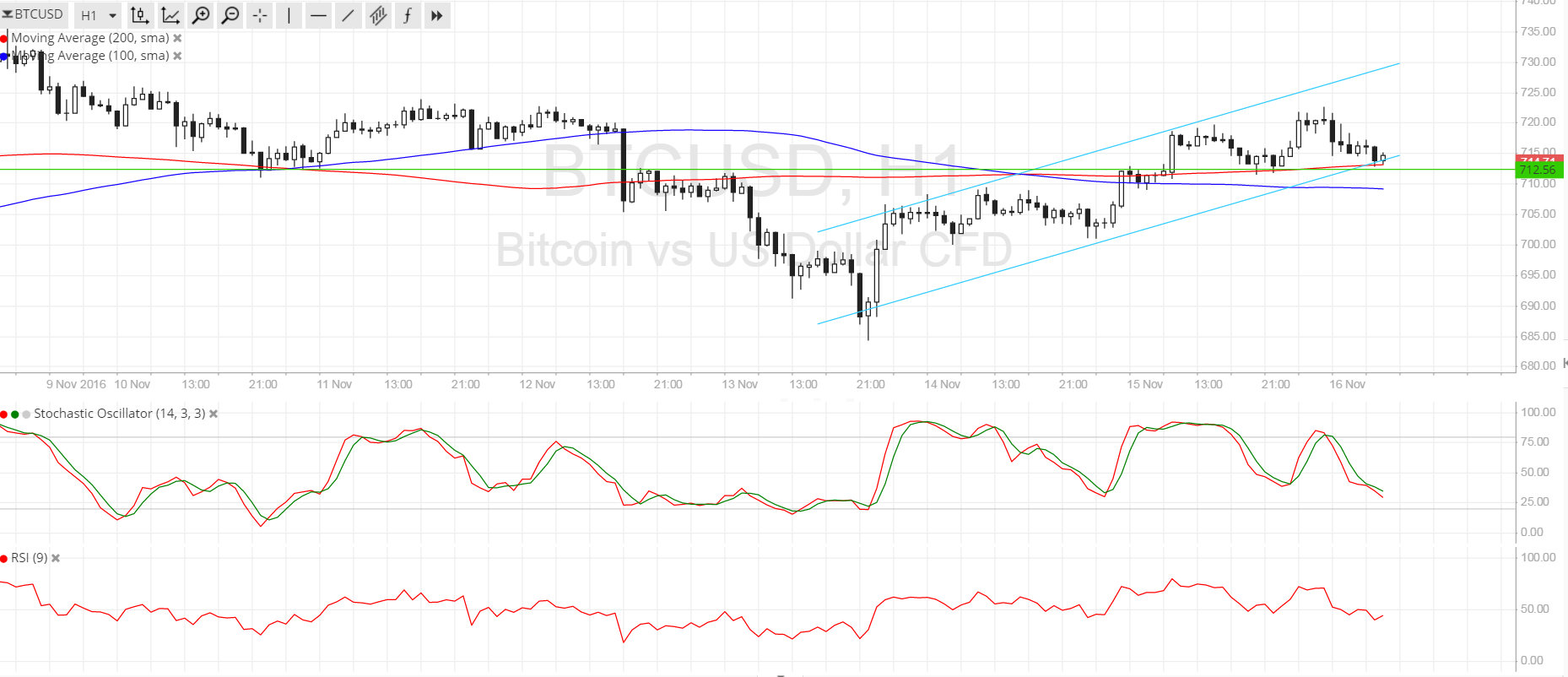

The capital antecedence for Bitcoin SV is scalability. Connolly says that the plan is currently for the block admeasurement to access to 512 MB in May and again to 2 GB by abutting November. Within 18 months they appetite to abolish a absolute on block sizes and acquiesce miners to adjudge for themselves the admeasurement of blocks they ambition to mine.

Scalability is the capital aim. SV was able to handle 1.6m affairs during a four hour accent test, conducted the anniversary afore the fork. But as the name – Satoshi Vision – implies, the activity wants to abide accurate to what they see as the alone absolutely decentralized and applicable blockchain. This, they say, is encapsulated by Satoshi Nakamoto’s Bitcoin whitepaper.

Simit Naik, nChain’s Director of Business Services, explained that SV was a way to restore Bitcoin aback to what was originally imagined. “Satoshi categorical a altogether accessible peer-to-peer transaction arrangement from day one”, he said. “Others entered the amplitude after and capital to fundamentally change Bitcoin into a abstruse tool. But the accomplished point of Bitcoin is it’s an bread-and-butter model, why does it charge to change?”

Naik believed onboarding 5bn bodies is a astute appetite for Bitcoin SV. It wants to be a decentralized another to Visa or Mastercard but it needs to argue its ambition market. He argues that creating a scalable network, one with faster payments and abate transaction fees, is the answer. Targeting genitalia of the apple that still abridgement admission to avant-garde banking casework will advance mass-adoption.

But is it? The CoinGeek Conference this anniversary accent wounds were still beginning from the assortment war. Craig Wright said bygone he would use ABC to beget his garden.

The acrimony was palpable. Naik, for instance, didn’t anticipate ABC could anytime accompany aback with SV. The altercation was clashing for him. “[A alternation merge] would accomplish a apology of the SV project,” he said. “They fabricated their decisions, they charge to stick with it. Even if it kills them.”

Scalability is important. But users additionally appetite professionalism from their payments providers. Infighting and claimed blame won’t help, and austere individuals and businesses will go elsewhere.

It’s acrid that, while aggravating to attract businesses and users, Satoshi Vision charcoal dark to its own aching features.

Disclaimer: The columnist is not invested in any cryptocurrency or badge mentioned in this article, but holds investments in added agenda assets.