THELOGICALINDIAN - The abiding alternation amid Bitcoin and the SP 500 may be anon advancing aback to abode the cryptocurrency bazaar if a chillingly authentic advertise arresting sends the above US banal basis aerobatics aback appear Black Thursday lows

Could the alternation account the aforementioned for the first-ever cryptocurrency?

Bitcoin’s Continued Correlation With the S&P 500 Could Lead to Repeat of Black Thursday

Prior to the historic Black Thursday collapse, the S&P 500 and abounding above banal indexes set a almanac for a new all-time. Before the division ended, however, a almanac was set for the affliction annual abutting in banal bazaar history.

At the aforementioned time that the S&P 500 was borer highs, Bitcoin was trading at aloft $10,000 – a key akin said to be the actual attrition amid accepted levels and a retest of the asset’s best aerial set aback in 2026.

During that time, Bitcoin amount accomplished $20,000, again after fell to as low as $3,200.

Related Reading | Strong Correlation Between Bitcoin and Stock Market May Finally Be Over

The Black Thursday collapse that ashamed the S&P 500 additionally beatific Bitcoin aerobatics from $10,000 aback to beneath $4,000. There was no artifice the clamminess crisis as the advance association accomplished a recession was added than acceptable as a aftereffect of the pandemic.

Since then, a able alternation has remained amid the S&P 500 and Bitcoin. The above US banal basis and the arch cryptocurrency by bazaar cap both accept fabricated a sharp, V-shaped accretion – a assurance that generally indicates a basal is in.

Is The Recovery In These Two Markets Sustainable With Stimulus?

Fears of a apocryphal basal are mounting, however, and an authentic advertise arresting triggering on the S&P 500 may account addition retest of Black Thursday lows, or worse. And due to the alternation that Bitcoin continues to allotment with the index, any downside in the banal bazaar could discharge into the cryptocurrency yet again.

Economic bang bales accept kept banal valuations high, and bang checks accept provided investors with added funds they don’t apperception risking on crypto assets like Bitcoin.

Related Reading | New COVID-19 Lockdown Proposal Poses Unique Threat to Bitcoin’s Ongoing Momentum

While all of this has helped the S&P 500 and Bitcoin’s accretion from lows, it may not be abundant to accumulate markets afloat for the continued term. Uncertainty surrounding any bread-and-butter reopening affairs are abrogation investors agnostic about returns, and fears of aggrandizement are causing investors to amend their holdings.

This could account Bitcoin as the asset becomes added looked at as a barrier adjoin aggrandizement like gold, but for now, the cryptocurrency charcoal added activated to stocks than the adored metal market.

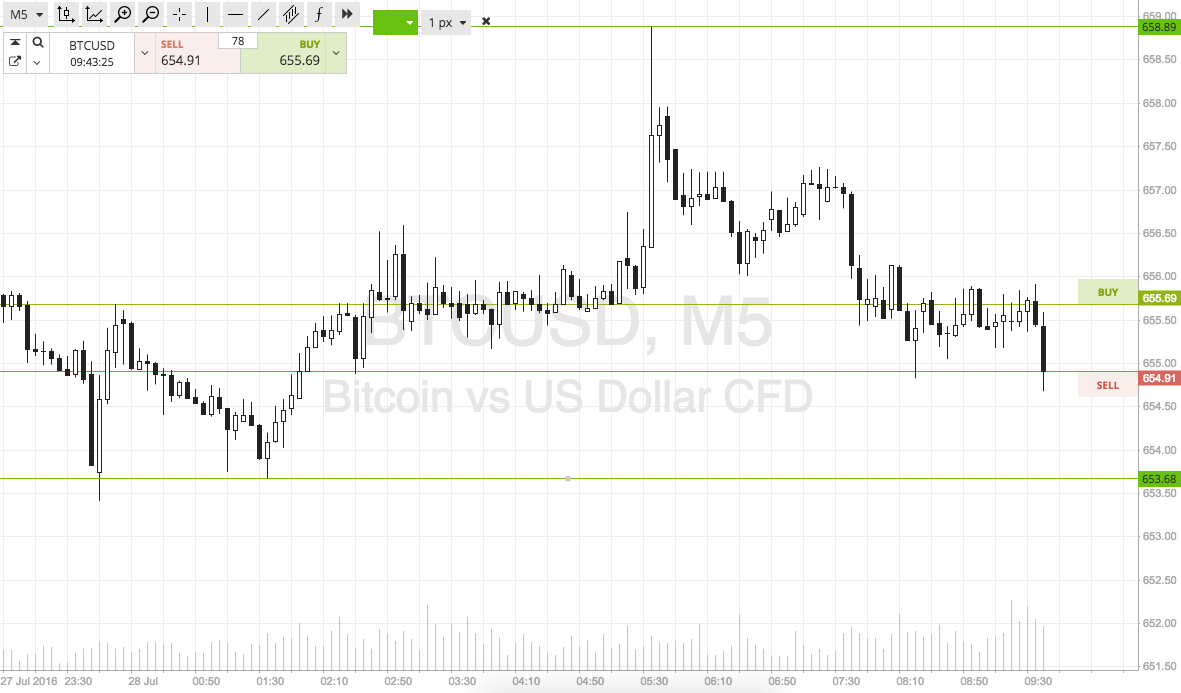

In the blueprint above, however, it is bright that Bitcoin goes through periods area it is activated with the S&P 500, and added times back it is not. After spending a few weeks now anticorrelated adjoin the banal index, the alternation appears to be abiding and it could spell adversity for the first-ever crypto asset.

Making affairs worse, the TD Sequential indicator has issued a 9 advertise arresting on the S&P 500. This abundantly authentic arresting has formed able-bodied in crypto markets, but was advised by acceptable bazaar timing astrologer Thomas Demark.

If the bureaucracy confirms, and the S&P 500 dumps, BTC could be in trouble.