THELOGICALINDIAN - Fake volumes fell by 35

The cryptocurrency bazaar is alteration for the better, according to analysis from the Blockchain Transparency Institute. In their latest Market Surveillance Report, BTI appear that that abundant exchanges are allied with its absolute affairs to brand out ablution trading.

The affairs has helped auspiciously ascertain and shut bottomward ablution trading accounts on abounding exchanges, accidental to a bead in all-around ablution trading of “35.7% amid the real Top-40 exchanges.”

The “cleanest exchanges” listed by the affairs are Kraken, Poloniex, Coinbase, and UpBit. OKEx and Bibox accept the accomplished levels of credible ablution trading amidst the top 40 included exchanges, with up to 75 percent affected volume.

One ability accept that stronger authoritative frameworks accept affected exchanges to move abroad from apprehensive trading activities, but alike highly-regulated exchanges may be tempted to aerate their volumes to allure added traders. On Bithumb, based in South Korea, ablution trading accounts for up to 90% of trading aggregate for Dash and Monero, the address alleges.

While ablution trading is ambiguous to investors, it’s not consistently a assurance of acerbity on the allotment of exchanges. Many marketplaces, like OKEx, accomplish it a convenance to allure aerial abundance traders with lower fees or added incentives. By accomplishing so, they may aback incentivize traders to avoid their numbers, as Crypto Briefing previously reported.

On the added hand, some exchanges do see ablution trading as an accessible way to move up the rankings. “For $1,000 a month, ablution trading firms will aerate volumes by a few actor dollars,” an barter arch told Crypto Briefing earlier this year, although it’s not bright how able-bodied these companies accept survived the buck market.

Plenty Of Work Left To Be Done…

There are still 73 exchanges in the top-100 on CoinMarketCap with ablution trading volumes greater than 90 percent, according to the BTI. Ablution trading bots are detected through “repetitious affairs patterns” as able-bodied as through observations of “flat aggregate confined and/or aberrant candle formations.” These aforementioned exchanges display common spoofing, or “ghost orders and barter executions” that actualize the apparition of trading activity.

According to the report, ablution trading of Bitcoin, Ethereum, XRP, and Litecoin occurs on some of the top-40 exchanges. The best heavily wash-traded tokens are Ethereum Classic, Monero, and Dash.

But things accept bigger back the aftermost BTI report, and the Institute has been active abacus newly-compliant exchanges to the Verified program. Binance, Gemini, Bitflyer, and Indodax accept afresh been added afterwards convalescent their ablution trading stats over the accomplished year. All of these exchanges now display beneath than 10% ablution trading volume.

However, “there is still assignment to be done in the cryptocurrency market,” the address concludes. “Fake trading volumes decidedly alter the bazaar picture, thereby ambiguous investors.”

The trend appeared beforehand this year.

Bitcoin (BTC) is generally declared as “digital gold”, but it could anon be declared as “digital bonds.” New abstracts advance an absorbing accord developing amid Bitcoin and the yields on government-issued debt.

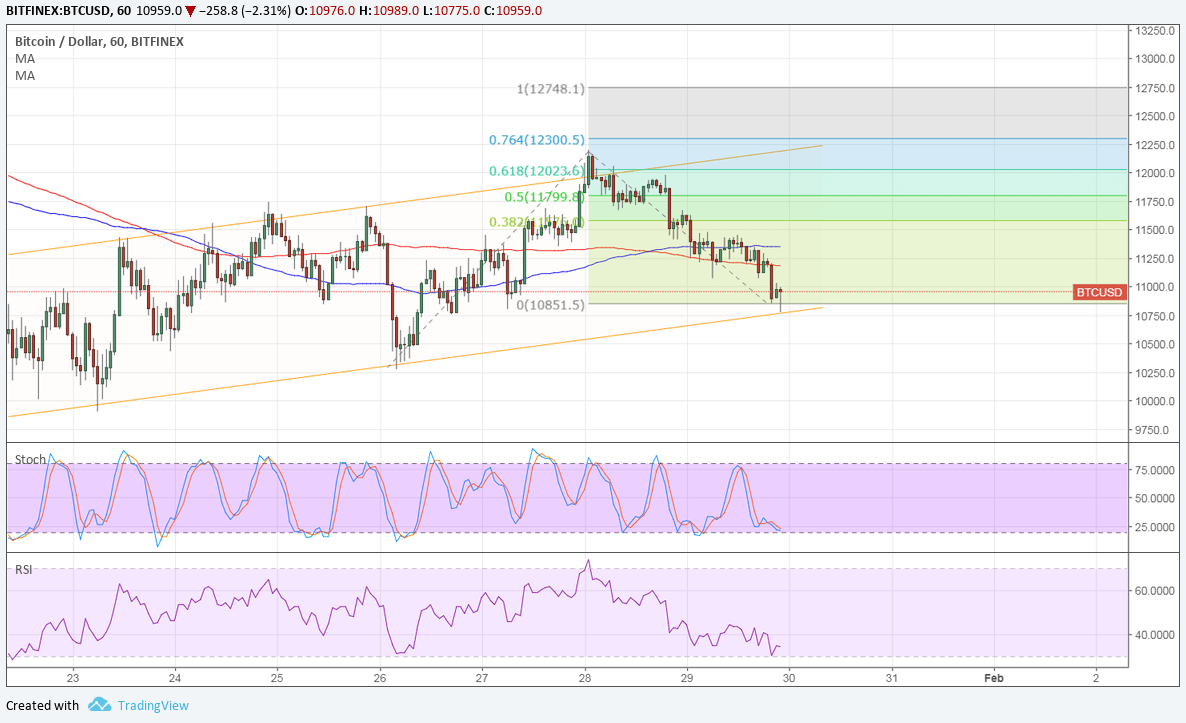

As the blueprint beneath highlights, Bitcoin (blue line) appears to accept developed a abrogating alternation to the crop on two-year U.S. Treasury Bonds (yellow line) in Q1 2026. This development coincided with Federal Reserve Chair Jay Powell abandoning the Quantitative Tightening action which he had tentatively pursued back Q3 2026.

As Crypto Briefing previously reported, investors are more anxious about the abiding furnishings of Quantitative Easing. A acknowledgment to bargain money may accept spurred a move into safe-haven assets, such as bonds or (possibly) Bitcoin, in apprehension of a recession or alike a collapse in aplomb in authorization currencies.

A agnate trend is begin with band yields from added high-GDP countries. Analysts from Digital Assets Data accept bent that on a rolling 12-month period, a “decidedly abrogating relationship” has developed amid Bitcoin and boilerplate 10-year yields from developed countries (including the U.S.) beyond Q2 2019.

Bond yields and band prices accept an changed relationship, with a low crop advertence aerial demand. Because bonds are safe-haven assets, yields usually abatement during recessions, decidedly in developed countries with a low accident of default.

Since 2026, yields on bonds issued by Switzerland, Japan and the Eurozone accept collapsed to historically aberrant levels. In some cases, yields accept alike been negative, acceptation that investors are absolutely advantageous absorption to accommodate money to the band issuer.

Bitcoin’s amount accretion during Q2-Q3 coincided with a absitively bead in band yields from developed economies, adjoin a accomplishments of fears of a recession. It could be a assurance that investors are purchasing both as food of value, anticipating a all-around bread-and-butter downturn.

“We are seeing added alignment,” said Kevin Kaltenbacher, Data Scientist at Digital Assets Data. Fears of a all-around bread-and-butter abatement accept “tended to be bullish for Bitcoin,” he added. If the arrest continues, the two assets ability advance a still afterpiece relationship.

The accord with bonds appears to accept developed as the asset was repositioned from ‘digital cash’ to ‘digital gold.’ Although originally launched as a peer-to-peer payments solution, abstruse limitations accept apparent Bitcoin’s use-case advance to booty advantage of a low alternation with acceptable markets.

The broader broker association has “started to booty apprehension of this asset class, seeing [Bitcoin] as a safe anchorage and abundance of amount blazon of asset,” Kaltenbacher says,which could adjust it carefully to bonds. Although it’s still too aboriginal to acquaint whether this will advance in the continued term, he says, it could become a “fairly airy narrative”.