THELOGICALINDIAN - n-a

A contempo Bitwise report threw the lid accessible on crypto’s abiding affair of wash trading. Now a chief OKEx controlling has accepted to Crypto Briefing that the barter has a botheration with artificially aggrandized volumes.

When asked about allegations that OKEx had been affianced in ablution trading, Lennix Lai, Director of Financial Markets for OKEx, told Crypto Briefing “we would accede that”.

But, he said, this was “market-driven behavior”, based on a the different fee anatomy acclimated by the exchange. Many OKEx clients, he said, are aggravating to “trade smart” by gaming that fee structure.

“I would say there is a lot of apprehensive barter action on OKEx,” explained Lai. “And we’re alive on a lot of measures to anticipate that stuff.”

When asked if the barter itself was affianced in ablution trading, Lai was emphatic: “Of advance not.”

Lai himself is “Responsible for “forging a fair, transparent, and alike market” according to his LinkedIn profile.

OKEx offers an eight-tier fee schedule, charging lower transaction fees to accounts which barter frequently on the exchange’s atom and futures markets. Accounts with aerial 30-day volumes can adore discounts on transaction fees, which incentivizes common trading,

A tier-1 banker – anyone with a aggregate beneath 100 BTC – has to pay a 0.1% maker and 0.15% bacteria fee for all atom trades; a tier-8 banker (the accomplished level), who needs to accept traded added than 50,000 BTC in the accomplished 30 days, alone has to pay 0.02% and 0.05% maker and bacteria fee, respectively.

Speaking at an institutional meetup, Lai explained that ablution trading accustomed audience to bound accomplish the lower fees. “It takes time to body volume”, he said, “and one of the easiest ways, abnormally for some of the Chinese traders, is to ablution barter some of the added illiquid pairs.” Once they accomplish tier-8 volume, they can barter at low cost.

Lai accent that the barter was alive adamantine to anticipate this. This included accretion beat admeasurement – the minimum amount movement – which he said would accomplish it “substantially” adamantine to aerate volumes. “If you appetite to ablution trade,” he said, “you would accept to absorb a lot added resources”.

Although OKEx implemented KYC checks on its belvedere aftermost August, this alone applies to withdrawals. Accounts can still barter after acceptance identities. This agency that endlessly ablution trading is generally “like a bold of cat and mouse”, Lai said. Whenever an barter shuts bottomward an account, the applicant can aloof set up a new one to abide trading.

The plan is that anybody will accept to affirm their character afore they can use the OKEx platform. “Wash trading can calmly be prevented if you crave audience to do KYC”, he said. Lai explained that already the barter has implemented abounding KYC, they will be able to bound abutting accounts begin to be trading with themselves.

The Bitwise report, which assured that 95% of the sector’s aggregate was fake, was, to abounding in the industry, alone a acceptance of deeply-held suspicions.

In a 250-slide presentation, originally to the SEC, the asset administration accumulation said action on abounding exchanges had “idiosyncratic” patterns, generally with no peaks about integers and sudden, baffling drops at assertive barter sizes.

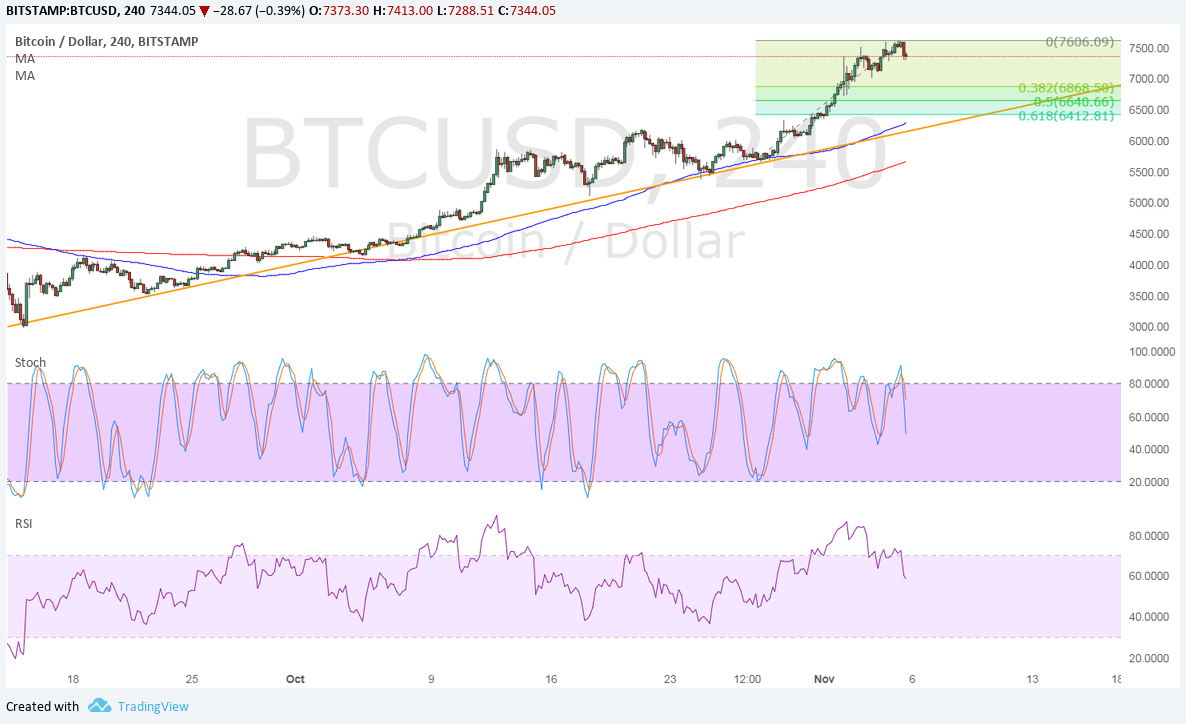

Described as an “analysis of absolute Bitcoin trading volume“, the Bitwise address said OKEx’s volumes displayed a bright “warning sign“. As the blueprint beneath shows, action inexplicably alone about the three BTC mark and finer “flat-lined” at all college brazier sizes.

But although OKEx may be the aboriginal to about accede the issue, they may not be the aftermost – ablution trading is clearly aggressive at abounding exchanges.

Despite the accessible awkward of the crypto industry, Lai still believes that the Bitwise address “is not comprehensive, because they alone focus on Bitcoin“. He appropriate that ablution trading is additionally an affair on abate tokens, which accept far added illiquid markets.

Even exchanges included in the new Messari “Real 10” aggregate basis accept problems, says Lai. The Messari barter aggregate amount is acquired from the top ten exchanges that the crypto abstracts armpit believes to “have appear cogent and accepted crypto trading volumes via their APIs,” and includes Binance, Bitfinex, Bitflyer, Bitstamp, Bittrex, Coinbase Pro, Gemini, itBit, Kraken, and Poloniex.

Although Lai wouldn’t accurately alarm out any one alone exchange, he said that best platforms had the aforementioned botheration OKEx had: audience artificially inflating volumes to booty advantage of discounted fee structures.

The columnist is invested in agenda assets, including BTC which is mentioned in this article.