THELOGICALINDIAN - In times of bazaar animation derivatives exchanges like Bybits can advance To get a bigger abstraction of the platforms action Crypto Briefing batten with the exchanges CEO Ben Zhou

By any measure, March has been a crazy ages for most, not aloof bullish Bitcoin enthusiasts. Many of those who’ve managed to abstain actuality anon afflicted by the coronavirus accept begin themselves impacted by the bread-and-butter fallout.

The longstanding anecdotal that Bitcoin is an uncorrelated asset has additionally been quashed this month, afterwards the flagship cryptocurrency comatose spectacularly forth with the banal markets on March 12. Futures traders took a beating, with BitMEX abandoned accepting asleep over $1 billion over a two day aeon about the crash according to Skew data.

The blast came afterwards Bitcoin had been on a abiding if gentle, balderdash run for the above-mentioned ten weeks, and on the aback of a arch year for the cryptocurrency derivatives markets in general. Daily volumes accept been steadily accretion forth with the best of venues accessible to traders.

While BitMEX continues to dominate, it no best enjoys the advantaged position of actuality the alone amateur in the space. Established atom exchanges accept confused into alms derivatives, while up-and-coming competitors accept launched their own pure-play futures platforms.

Bybit is one such archetype in the closing category. It was founded in 2018 and over that time, has been steadily accretion bazaar allotment and proving itself as a able-bodied adversary to BitMEX.

Crypto Briefing afresh had the befalling to allocution to Ben Zhou, CEO of Bybit, about the contempo bazaar volatility, a new ambit of abiding affairs formed out by Bybit, and his angle on the approaching angle for cryptocurrencies.

The Growth of Cryptocurrency Futures on Bybit

Cryptocurrency futures accept been adequate cogent advance back 2018. In October aftermost year, Bloomberg reported that futures trading had added to about 50% of the amount of atom trading, based on abstracts calm from 13 above exchanges.

Although a admeasurement of this advance comes from accretion institutional interest, it’s additionally credible from Skew abstracts that the aggregate of circadian aggregate isn’t generated from adapted platforms such as Bakkt or CME, but from exchanges targeted at retail traders.

Ben Zhou attributes this advance to a crumbling bazaar – not aloof the articles themselves, but better-informed traders. He said:

“I anticipate traders accept become a lot savvier over the aftermost few years and accept cottoned on to the actuality that derivatives trading offers a lot added blast for their blade than atom trading does. A lot of the address of derivatives is of advance because of volatility, forth with opportunities such as abbreviate trading and advantage not accessible in the atom markets.”

He added abundant on this shift:

“This massive clearing to derivatives trading I anticipate has additionally acquired a snowball aftereffect and created a actual aggressive marketplace. But we acceptable it – any antagonism is healthy.”

Recent Market Volatility

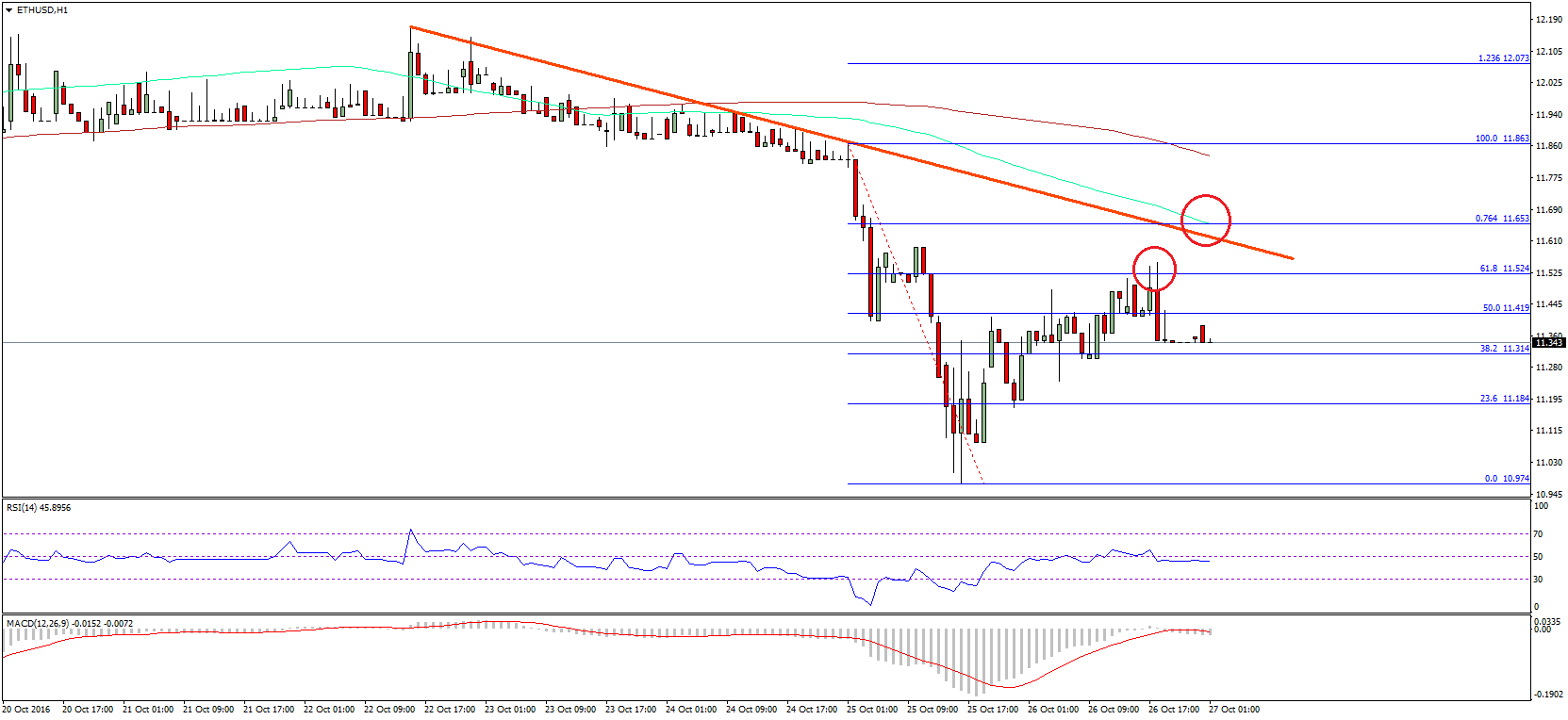

March 12 was a seismic moment in the cryptocurrency markets. Not alone did Bitcoin see its better single-day allotment bead back 2013, but it additionally approved that cryptocurrencies are conceivably added activated with the acceptable markets than abounding bodies had ahead thought.

The bead led to discussions of implementing circuit breakers for crypto exchanges. In particular, BitMEX came beneath analysis afterwards it went offline alert for about 25 minutes, citation DDOS attacks.

Although there was aggressive belief on Twitter, not atomic from FTX CEO Sam Bankman-Fried, that the barter had taken itself offline to act as a de facto ambit breaker, BitMEX denied this.

Zhou was afraid to animadversion back asked about the contest at BitMEX, except to say that it was “an adverse event” and that he doesn’t accept in cabal theories. However, he was added adequate discussing his own exchange’s access to blow and liquidations.

The Bybit website states that the platform’s analogous agent can accomplish up to 100,000 affairs per second. Zhou is appreciative back speaking about this adequacy as a differentiator that sets Bybit afar from the competition. However, he’s additionally aboveboard back talking about the risks faced by exchanges back it comes to alien attackers, stating:

“[Attacks like the ones at BitMEX] accept happened to abounding added exchanges in our industry in the abreast accomplished too. Threats such as this, [Bybit] takes actual seriously, and we accept a committed centralized hacker aggregation who ‘attack’ our system, in adjustment to ultimately aegis adjoin them.”

He goes on to explain Bybit’s access to liquidations that action beneath these circumstances:

“Also, if arbitrary liquidations do action – and they accept on a actual baby cardinal of occasions on Bybit admitting not due to arrangement overloads, again it’s acutely acute that the audience are refunded as anon as possible. This is how you accumulate trust, which can be actual adamantine to get aback already it’s gone.”

Bybit’s New Perpetual Contracts

Earlier this week, Bybit appear it was afterlight its artefact ambit with the addition of USDT abiding contracts.

Before this, affairs were traded in USD pairs, acceptation that assets and losses were denominated in the basal cryptocurrency. This meant users had to armamentarium their accounts with altered cryptocurrencies, such as BTC for the BTCUSD pair, or ETH for the ETHUSD pair.

With the new USDT contracts, USDT is the distinct bill acclimated for balances, gains, and losses. It agency that users can arrange profits from one position to top up allowance on another, alike beyond altered arrangement types.

Zhou explains added what the changes beggarly for traders in agreement of managing their accident exposure:

“Traders will be able to authority continued and abbreviate positions at the aforementioned time, and with altered leverages. This will again about accredit traders to abbreviate the defalcation accident by aperture a abiding continued position and ambiguity this with a concise position. In the aftereffect of a abrupt bead in price, the accumulation yielded from the abbreviate position could again be acclimated as an added margin, which could anticipate the defalcation of the continued position.”

Such an access may be adorable for traders attractive to abstain a agnate book faced by those who were asleep on March 12. As Zhou puts it:

“All this offers our traders added adaptability in managing their portfolios, abnormally with the crypto markets actuality awfully airy as they are, and that’s what we’re all about.”

Future Outlook: Bullish on Bitcoin

The contempo bazaar agitation has led to a aberration of belief in the crypto amplitude about the administration of biking for prices.

Will added bread-and-butter woes from coronavirus abide to abnormally appulse the amount of crypto? Or is it added acceptable that Bitcoin will decouple from the banal markets and accomplish its own recovery?

Zhou has a attentive booty on these advanced questions:

“[In ablaze of contempo events] it would be somewhat absurd of me to affirm that the broader abridgement won’t accept any added appulse on crypto markets, but I anticipate ultimately added factors will be added important, as they would accept been if none of this has happened. The Bitcoin halving is due to appear in May, and I’m assured that this will accept a absolute appulse on the amount of Bitcoin, aloof as it did the antecedent two times. Also, I am still actual bullish about boilerplate cryptocurrency and blockchain adoption.”

And what can we attending advanced to from Bybit over the advancing months? It seems there’s affluence in the pipeline:

“We’ve got a few added air-conditioned new appearance advancing up in Q2. As mentioned in my recent YouTube AMA, we will additionally anon barrage arrangement insurance. This affection will acquiesce traders to assure their continued or abbreviate BTCUSD abiding arrangement positions if the bazaar moves adjoin them. Also, we are ablution a action active and new adjustment system, which will acquaint traders back an indicator they accept placed on the Bybit amount blueprint has been triggered. We additionally achievement to absolution added asset-based articles in the future, although I can’t acknowledge annihilation aloof yet. Watch this space!”