THELOGICALINDIAN - Nouriel Roubini has bidding skepticism about crypto in the accomplished but he has his doubts about the dollar as well

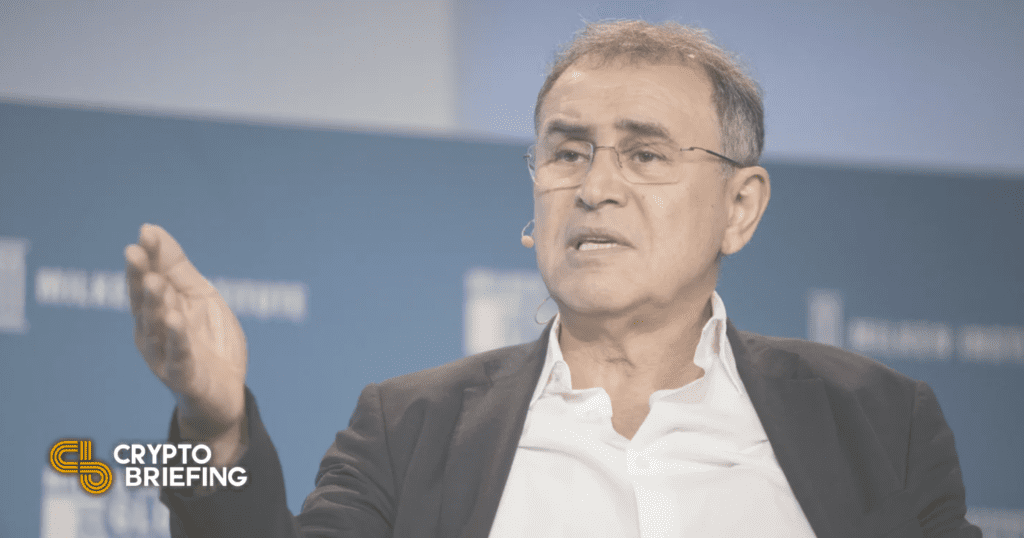

Economist Nouriel Roubini, who has continued bidding antipathy adjoin cryptocurrencies, has appear his affairs to barrage a tokenized asset meant to barrier adjoin what he perceives to be agitated times ahead. The anew appear tokenized asset is set to be backed by U.S. Treasuries, absolute estate, and gold.

The Roubini Hedge

A arresting broker alert of the accepted macroeconomic headwinds has affairs to barrage a new tokenized barrier because, according to him, cryptocurrency as it currently stands is not fit to do the job.

Nouriel Roubini, the arch controlling administrator of Roubini Macro Associates Inc. and assistant of economics at NYU’s Stern School of Business, is alive with Atlas Capital to launch a agenda asset fine-tuned for animation adjoin inflation, altitude change, and civilian unrest. The ambition is to barrage the artefact after this year, and it is said to be a bread backed by concise U.S. Treasuries, gold, and climate-change aggressive U.S. property.

Atlas has broke a developer accumulation consisting of above Meta engineers, Mysten Labs, to body its new tokenized asset, which it will alarm the United Sovereign Governance Gold Optimized Dollar (or USG). Roubini, who is additionally the arch economist for Atlas, has warned of the U.S. dollar’s abeyant for accident its apple assets bill cachet as a aftereffect of quantitative easing. He additionally cited the abhorrence of all-around opponents of the U.S. to abide its use indefinitely.

While Roubini has acclaimed the abeyant for axial coffer agenda currencies, he has alleged blockchain “the best overhyped—and atomic useful—technology in animal history.” He, alongside the Atlas team, emphasized that best crypto assets abide ailing and, like Warren Buffet, has pilloried them for their abridgement of abundance or adeptness to accomplish income.

Atlas is an advance close whose ambition is to seek adherence in what it projects to be a arduous future, and it warns of all-around alternation due to a cogent accession of risks in the socioeconomic environment. Therefore, Roubini claims that the new tokenized bread ability accretion acceptance from ample institutional investors that are currently awful apparent to the dollar. Accordingly, the close has reportedly accomplished out to the Qatar Advance Authority, Saudi Arabia’s Public Advance Fund, and the Kuwait Advance Authority.

Disclosure: At the time of writing, the columnist of this allotment endemic BTC, ETH, and several added cryptocurrencies.