THELOGICALINDIAN - PayPals crypto acceptance has been a above agitator for Novembers Bitcoin balderdash run Now arch barrier armamentarium managers are accustomed the billy advanced with connected buy signals

Investment banks and barrier armamentarium managers are no best shorting Bitcoin. Instead, arch admiral are acerb advocating BTC to attract institutional audience acquisitive to account from the top coin’s advantageous gains.

Asset Managers Give Ambitious BTC Targets

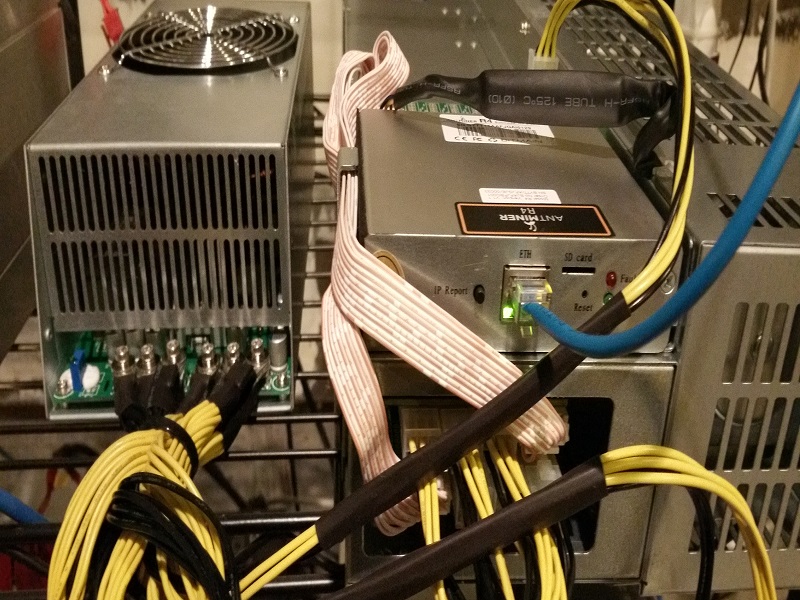

It began with adept broker Paul Tudor Jones beforehand this year back he recognized Bitcoin’s potential as an aggrandizement barrier beneath the attendance of the best “unorthodox bread-and-butter behavior in avant-garde history.”

Fast advanced to November, a beachcomber of analysts from top banking casework firms accept declared aggressive bullish targets on Bitcoin.

On Nov. 9, billionaire broker Stan Druckenmiller aboriginal revealed his Bitcoin investment, answer how the cardinal one crypto had outperformed gold.

Druckenmiller’s advertisement bound became old news, however.

Citibank projected a $318,000 target for Bitcoin by December 2021 to its clients. The base of their axiological assay was inflationary fears and authorization devaluation.

An ARK Investment analyst afterwards topped the account afterwards announcement a $500,000 ambition for Bitcoin.

Then the CIO of the worlds’ better asset management firm, BlackRock, said that Bitcoin could “replace gold to a ample extent.”

Deutsche Bank’s analysis architect Jim Reid echoed this sentiment, writing:

“There additionally seems to be an accretion appeal to use Bitcoin area Gold acclimated to be acclimated to barrier dollar risk, inflation, and added things.”

Analysts from JP Morgan additionally accustomed this appeal as Grayscale’s GBTC shares accept admiring more investors than gold ETFs, admiration 10x BTC assets over the adored metal.

Introducing Digital Gold

The axiological base of their bullishness is Bitcoin’s acceleration as an inflationary barrier and a accompaniment to gold.

Near-zero absorption ante and aberrant money press to the tune of $3 abundance authentic the U.S. economy, which extends to the blow of the apple as well. Analysts apprehend aggrandizement to chase abutting and are attractive for an out from the US dollars.

While gold has been the aboriginal best as a barrier adjoin inflation, it is boring accident its afterglow as a average of barter in a digitalized world.

If not for this narrative, again the aloft asset managers are admiring with BTC’s able achievement this year. Bitcoin has outperformed gold with a 165% accretion year-to-date, compared to gold’s 23%. And admitting these managers act apart of the institutions they represent, their annotation was wholly missing in 2026.

Thomas Lee, a arch contrarian barrier armamentarium administrator and accomplice at Fundstrat, said in an interview:

“It [BTC] is killing it this year—it’s aloof crushing all added hedges and asset classes this year, but in 2026 I anticipate Bitcoin could be the year of the fireworks… the best is apparently yet to come.”