THELOGICALINDIAN - Leveraging a cryptocurrency barter to advance adoption

TRON architect Justin Sun confirmed that he was allotment of an Asian advance accumulation that purchased Poloniex. Sun affairs to advantage the barter to added advance advance in the TRON ecosystem.

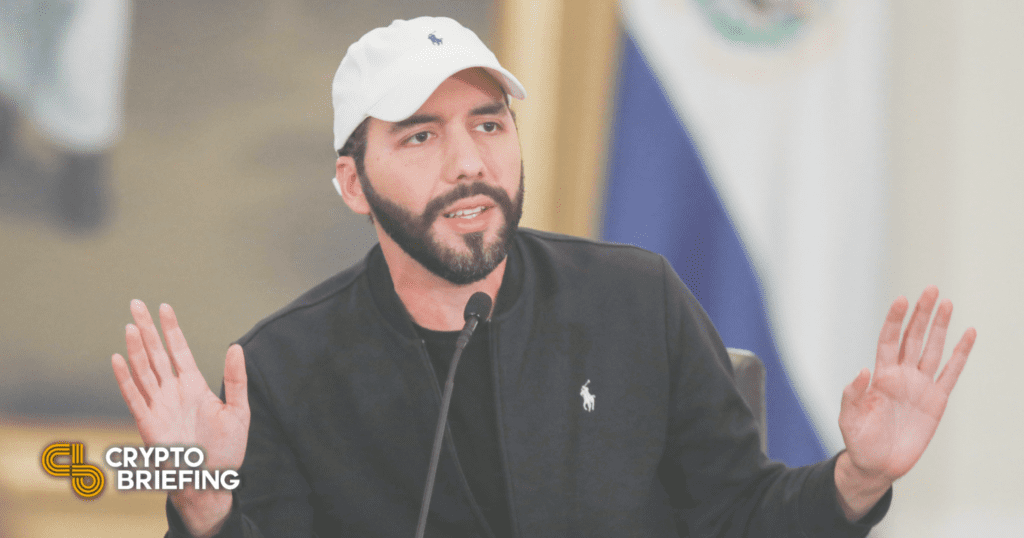

In a joint livestream from the Poloniex and TRON Twitter accounts, Sun accepted an advance in the disturbing crypto-exchange Poloniex:

“Poloniex appropriate now is active apart by the Poloniex aggregation with advance from several investors. I was one of the investors,” accepted Sun.

TRON is leveraging the barter to aggrandize the ability of its projects including TRON and BitTorrent. Starting with advertisement TRX on Poloniex, Sun appear that abounding added TRC10 and TRC20 tokens will become accessible on the exchange.

To animate the alteration of users, the barter is administering several promotions, including reducing trading fees to 0% until the end of the year, exchange-wide airdrops, and a high-yield drop campaign.

The barter is additionally accretion to China. “China is one of the above markets Poloniex is activity to absolutely focus on,” said Sun. Poloniex is purchasing the area “pwang.com” for the expansion, a Mandarin moniker for Poloniex. The new area will acquiesce Chinese users to accede with the country’s know-your-customer requirements by accepting Chinese authoritative identification.

Poloniex was aboriginal acquired by Amphitheater in February 2018 for a reported $400 million. Founded in 2014, Poloniex was one of the beforehand exchanges and was already a top barter in agreement of clamminess and volume. The barter has steadily absent bazaar share, authoritative beneath than 3% of the market’s absolute exchange liquidity, according to CoinMarketCap. Poloniex currently ranks 10th by clamminess and 77th by volume.

In October, the barter spun out from Circle as its own corporation, Polo Digital Assets, with the abetment of an Asian advance accumulation — including Justin Sun. Poloniex affairs to absorb added than $100 actor to body out basement and abound its user base.

Additionally, the barter affairs to refocus its efforts on all-embracing markets. Stricter U.S. regulations acceptable played a accidental role in the exchange’s bottomward bazaar share. After October, the barter will bar U.S. barter from trading on the platform. Overall, the move will acquiesce the barter to added aggressively account crypto assets and augment user admission by dressmaking bargain character requirements to the minimum of anniversary jurisdiction.

Despite the furnishings the move may accept on the exchange’s performance, this may accord TRON a above advantage over added crypto-assets. By leveraging Poloniex, TRON can accommodate clamminess to abate projects ecosystem and added activate user growth.

A attending into CoinMarketCap's behind-the-scenes.

As allotment of its accomplishment to action affected barter volumes, CoinMarketCap has released a new baronial apparatus alleged the Liquidity metric. The advertisement came as the aggregation hosts its aboriginal conference, The Capital, captivated in Singapore.

CoinMarketCap’s Chief Strategy Officer, Carylyne Chan, took some time out from her active agenda to sit bottomward with Crypto Briefing at the event. Ms. Chan aggregate her insights into the new metric, how projects can advice their affairs of actuality listed on CMC and more.

About the Liquidity Metric

Wash trading and affected volumes accept become a cogent botheration for the cryptocurrency space. The Blockchain Transparency Institute afresh confirmed that abounding exchanges were charwoman up their act, but the affair continues to persist. The new Liquidity metric is advised to accomplish it added difficult for exchanges to falsely aerate trading volumes.

Instead of absorption on authentic volume, the Clamminess metric considers added variables from the barter adjustment book, including the ambit of the adjustment from the mid-price, the about clamminess of the brace in the markets all-embracing and the admeasurement of the order.

The Clamminess metric gives orders afterpiece to the mid-price a added weight and discounts orders that are added away. The arrangement acclamation the bazaar brace at accidental intervals over a 24 hour aeon — adaptively barometer clamminess by averaging the poll results.

The net aftereffect is a metric that’s far added difficult to manipulate, as orders charge to be placed abutting to the mid-price. The Liquidity metric is already arresting on the CoinMarketCap website, beneath the “markets” tab for anniversary asset.

Speaking of the change, Ms. Chan explained why trading aggregate isn’t authentic for cryptocurrencies: “Volume was a acceptable indicator back we started and that’s how acceptable accounts measures liquidity. But acceptable accounts is actual regulated. You apperceive that for any accustomed volume, again addition was absolutely trading that asset after the accident of ablution trading.”

While the clamminess metric doesn’t anon ascertain irregularities, it’s still helpful. “With cryptocurrency, it’s added difficult to ascertain ablution trading. Our thoughts are that clamminess is absolutely the best important metric for traders. And so, the new metric is a way for us to advice our users to acquisition the best markets to get the best prices,” she continued.

CoinMarketCap affairs to cycle out the Liquidity metric in three phases: it will be aboriginal activated to bazaar pairs, followed by exchanges and again crypto assets.

Getting Projects Listed

CoinMarketCap shows the prerequisites for advertisement crypto assets on its website. However, the aggregation advisedly doesn’t allotment any specific metrics that it seeks from them. Ms. Chan explained that if it did, projects would accordingly attack to bold the numbers in the aforementioned way that exchanges accept been manipulating volume. Earlier this year, CMC unveiled new changes in an attack to access accuracy into the advertisement process.

During the discussion, we asked Ms Chan how projects can ensure they accept the best accessible adventitious of actuality listed. Her acknowledgment was simple — accommodate as abundant advice as possible, appropriate off the bat. “You charge to annihilate the aback and alternating communication,” she advised. “The advertisement aggregation is inundated with requests. Every time you accelerate addition email, it goes aback into the excess of things that the team has to attending at.”

Future Outlook

According to Ms Chan, there’s affluence of assignment accident abaft the scenes. The aggregation has aloof launched a jobs board, recruiters and candidates can acquaint and chase for careers in the crypto sector.

She additionally talked of bringing the artlessness and architecture artful of the CMC adaptable app to the desktop site. Some of the appearance are additionally acceptable to get ported: “For example, with the adaptable app, we accept the account feature, which we don’t accept on the capital site. Users can additionally save their portfolios, which they can’t do with the capital site, so aggravating to get both to adequation will enhance the user experience.”