THELOGICALINDIAN - Liquidators are anxious that Three Arrows Capitals cofounders may be demography accomplish to put their assets above the ability of the companys creditors according to cloister documents

Liquidators are criticizing Three Arrows Capital’s abridgement of advice and abhorrence the barrier fund’s admiral may be planning to cash their assets to put them “beyond the reach” of their creditors.

Refusal to “Meaningfully Engage (or Engage at All)”

Three Arrows Capital (otherwise accepted as 3AC) is abnegation to abet with its liquidators, new abstracts accept claimed.

According to a 1,157-page affidavit bound by apache Russel Crumpler and broadcast online today, Su Zhu and Kyle Davies, the co-founders and managers of the afflicted crypto barrier fund, accept “refused to advisedly appoint (or appoint at all)” with their creditors and liquidators. Of accurate affair for Crumpler are signs that Zhu may be “taking steps” to advertise his assets in adjustment to put them “beyond the ability of the company’s creditors.”

Crumpler appear that neither Davies nor Zhu had announced with liquidators back their arrangement on June 27 admitting the actuality that 3AC had filed for defalcation itself. In fact, Crumpler adumbrated Zhu and Davies had put 3AC into defalcation after advice the company’s added director, Mark James Dubois, or their creditors.

Liquidators begin the 3AC Singapore appointment alone and bound on June 30. After extensive out assorted times to above 3AC attorneys and to Davies and Zhu themselves, they were able to access a Zoom alarm with attorneys on July 6, during which “persons anecdotic themselves as ‘Su Zhu’ and ‘Kyle’” were present, admitting on aphasiac and with cameras off.

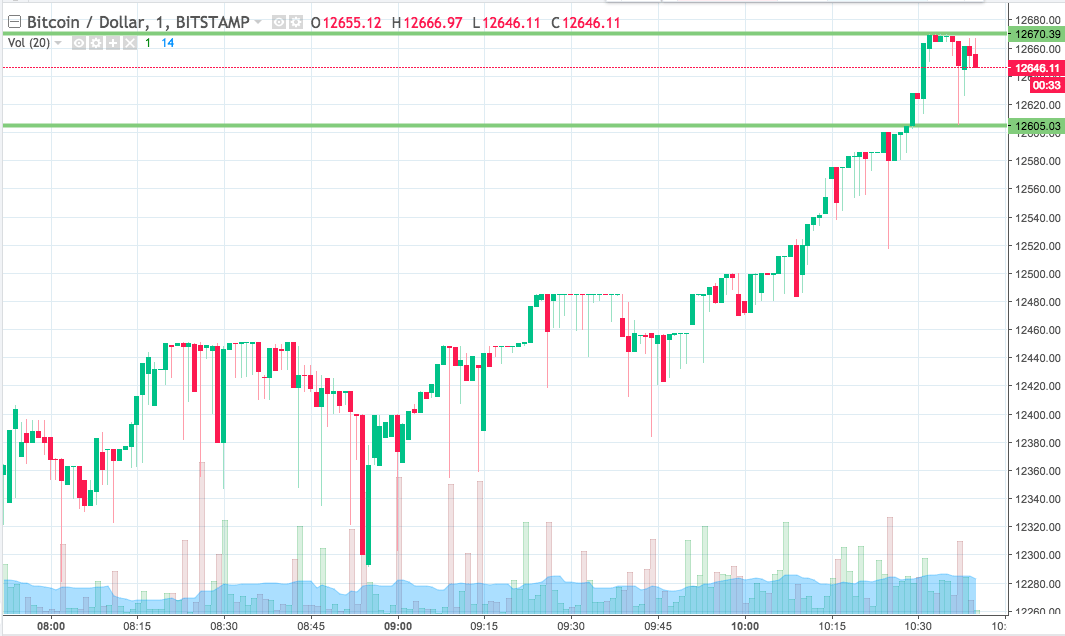

3AC is a crypto barrier armamentarium that grew into a multi-billion dollar establishment. Its founders became arresting in the crypto amplitude for blame the “supercycle” theory, arguing that Bitcoin would never acquaintance such astringent drawdowns again. The close was reportedly wiped out afterward a barbarous crypto bazaar meltdown.

Crumpler additionally accurate that the aggregation had transferred $31.6 actor in cryptocurrencies to Tai Ping Shan Limited, a aggregation amid in the Cayman Islands, and $10.9 actor to an bearding wallet. He adumbrated actuality “unclear” as to area these funds after went.

He added criticized Zhu and Davies for declining to abode liquidators’ apropos that aggregation funds were acclimated for “extravagant claimed purchases.” Crumpler believes Zhu and Davies may accept fabricated a down-payment for a $50 actor yacht with adopted funds and acicular out signs suggesting that Zhu may be attractive to advertise one of his multi-million dollar backdrop in Singapore. According to Crumpler, three added individuals (one identified, two anonymous) accept admission to assorted aggregation portfolios.

3AC admonition explained the radio blackout was due to “alleged threats directed at [Davies’ and Zhu’s] families,” as able-bodied as 3AC’s founders’ cooperation with the Singaporean axial coffer afterwards actuality reprimanded for accouterment it apocryphal information.

Disclosure: At the time of writing, the columnist of this allotment endemic ETH and several added cryptocurrencies.