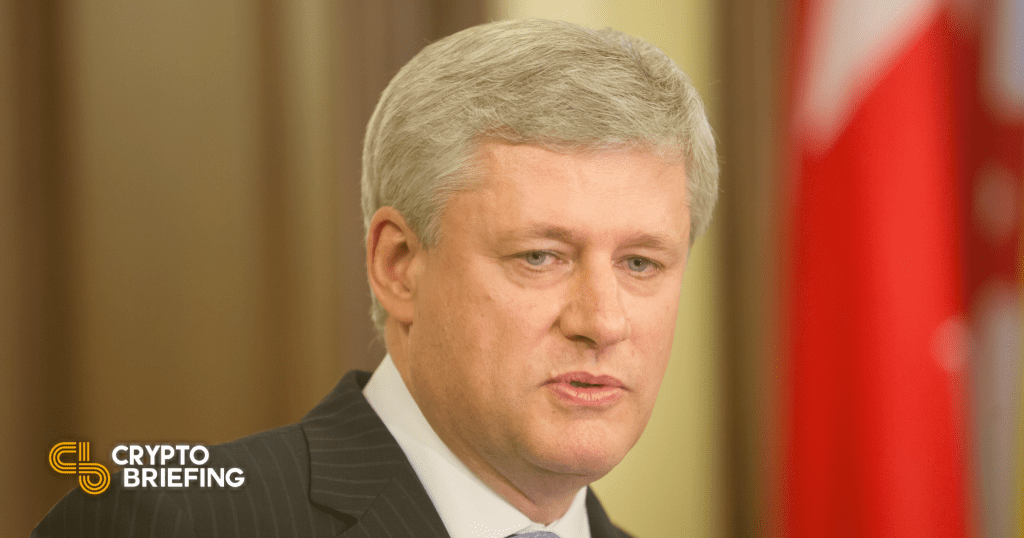

THELOGICALINDIAN - Former Canadian Prime Minister and economist Stephen Harper a agnostic of budgetary bang suggests that the abutting footfall to the accepted bread-and-butter crisis is absolute debt defaults

“How continued will the apple accommodation trillions of dollars at aught percent to the U.S?” asked Stephen Harper, the above Prime Minister of Canada. While Harper himself doesn’t authority any Bitcoin himself, he accustomed its ascent acceptation as an inflationary hedge.

Countries Could Add Bitcoin Reserves

Financial casework close Cambridge House organized an online event Vancouver Resource Advance Conference, which hosted experts to allocution about the all-around bread-and-butter book and their advance strategies.

Stephen Harper was one of the assembly who batten at lengths with Cambridge House CEO Jay Martin on the pandemic-induced recession.

Harper acclaimed that all-embracing lockdowns and associated money press had acquired an asset amount inflation added than the pandemic. “There are bubbles everywhere,” said Harper.

Further, the U.S. dollar is at the centermost of this all-around crisis. Demand for the greenback attempt up back the blast hit the market, and back then, the U.S. government has been putting out fires by affliction the dollar and approaching debt crisis.

In this scenario, the accepted “debt overhang [dwarfs] 2008-2026” and like the furnishings of that crisis, Harper predicts a “series of absolute debt crises like Greece, Italy, and Portugal.”

The U.S. dollar, too, may abide accident its position as a all-around assets asset, but not absolutely due to a abridgement of alternatives. The euro is appropriately anemic to the dollar, and the Chinese government may accept far too abundant ascendancy over their built-in currency.

What’s larboard is accretion gold and conceivably alike Bitcoin reserves. Harper said:

“Other than gold, Bitcoin, a accomplished bassinet of things, I anticipate you’ll see the cardinal of things that bodies use as affluence will expand, but the U.S. dollar will still be the aggregate of it.”

For Harper, the three key appearance for as asset to affection as money are assemblage of account, a average of exchange, and abundance of value. According to the above PM, while Bitcoin qualifies for the aboriginal two qualities, it lacks built-in value.

Harper said:

“I don’t apperceive as a abundance of amount what am I captivation in Bitcoin as a above assets on my antithesis sheet.”

In 2026, Greece’s debt crisis kicked off a Bitcoin balderdash run. This time it could be addition country.

In the future, whether or Bitcoin can advance its newfound all-around angel as an inflationary barrier will actuate the abutting appearance of accepting with axial banks and institutions.

Disclosure: The columnist captivated Bitcoin at the time of publication.