THELOGICALINDIAN - The DeFi association has some adamantine acquaint to apprentice from the contempo SushiSwap controversy

SushiSwap’s bearding architect alone the activity afterwards cashing in on $13 actor of tokens allocated to the development fund. Control of the activity now rests in the easily of Sam Bankman-Fried of FTX Exchange, but the agreement serves as a acute assignment for the DeFi community.

A Bright Start to SushiSwap

The latest ball in DeFi revolves about SushiSwap, a Uniswap angle that launched aloof over a anniversary ago. Its creator, who goes by the pseudonym of “Chef Nomi,” again stated that SushiSwap is an attack to charm Uniswap’s success after the countless of VCs abetment it.

SushiSwap was identical to Uniswap v2 in every way but had one amount differentiator: a badge that accrued value. This badge replaces a advancing architecture affection in Uniswap.

The Uniswap aggregation can cull a batten and absolute 17% of the protocol’s balance to a appointed address. The actual 83% would still go to clamminess providers (LPs).

It is accepted that this 17% will be aggregate amidst the founding aggregation and investors whenever it’s implemented. This affection has yet to be activated, however.

With Sushi, the dynamics abide the same. But the 17% of balance mentioned aloft would be distributed to Sushi holders.

SushiSwap kicked off its clamminess mining to abundant success, seeing upwards of a billion dollars in the agreement at one point in time. To abundance SUSHI tokens, one had to accommodate clamminess to a Uniswap basin and lock their LP tokens in the Sushi acute contract.

Eventually, the plan was to drift this clamminess from Uniswap to SushiSwap.

Everything was activity as per plan, and the DeFi association was aflame to see how this agreement would about-face out. These hopes were bound abject this weekend, however.

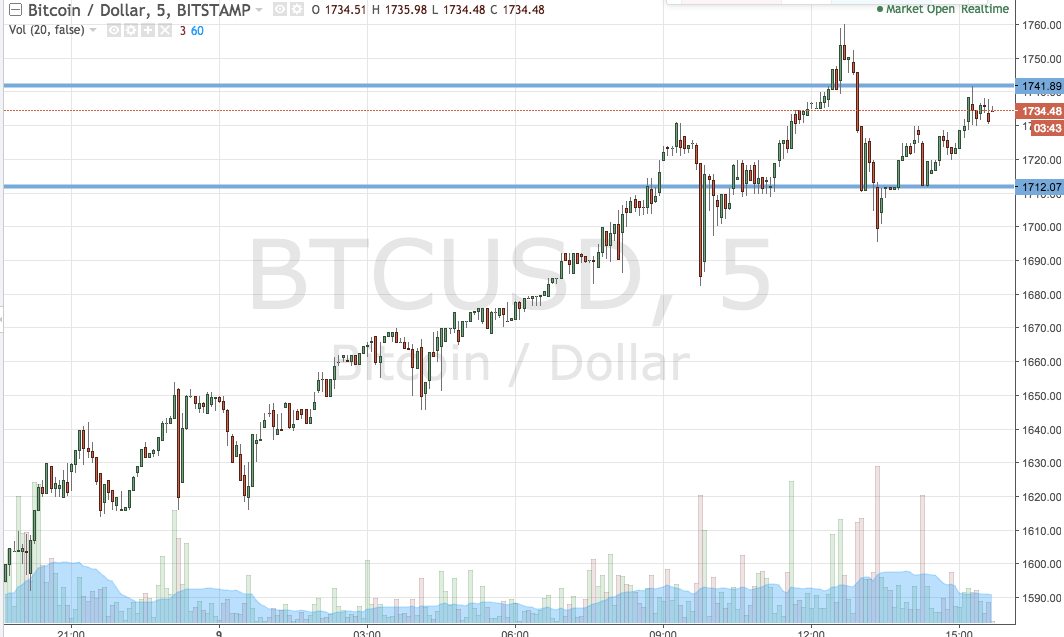

The agreement saw one accomplished anniversary of success afore its creator, Chef Nomi, asleep their backing of SUSHI and beatific the amount agile 50% in minutes.

Chef Nomi believed they adapted a $13 actor accolade for a week’s work. All they did, however, was archetype a acknowledged artefact congenital on three years of blood, sweat, and tears.

For perspective, Nomi’s accumulation from bifurcation Uniswap is marginally higher than the bulk of allotment Uniswap has aloft back its inception.

Before Nomi alone the project, SushiSwap was absolutely on its way to architecture a community. All is not lost, though, as a new plan to restore SushiSwap comes to activity acknowledgment to FTX’s Sam Bankman-Fried.

Can SUSHI Survive?

Chef Nomi transferred their admin keys to Bankman-Fried so the FTX CEO could booty over. Bankman-Fried is additionally the better agriculturalist of SUSHI and ahead submitted a angle to drift SushiSwap to Solana to abutment his latest project, Serum.

The clearing is still slotted to happen, and SUSHI’s amount has recovered back Nomi’s exit. However, the approaching doesn’t attending ablaze for SushiSwap, as the activity burst its alone aggressive bend adjoin Uniswap.

Having a association with a able banking allurement to use SushiSwap already it launched gave the activity a attempt at success. Uniswap is the bright DEX leader, facilitating added aggregate than Coinbase on best days. Uniswap v3 is accepted to barrage in the abreast future, which will accordingly advance the way the DEX works.

There’s no way SushiSwap, a angle of Uniswap v2, could attempt with Uniswap v3 on appearance alone. It bare loyal users to authorize bazaar share.

But with the broader association accident faith, the lights are concealment on SushiSwap’s future.