THELOGICALINDIAN - The banknote administration aggregation has appear a roadmap to body cuttingedge multichain treasury basement for Web3

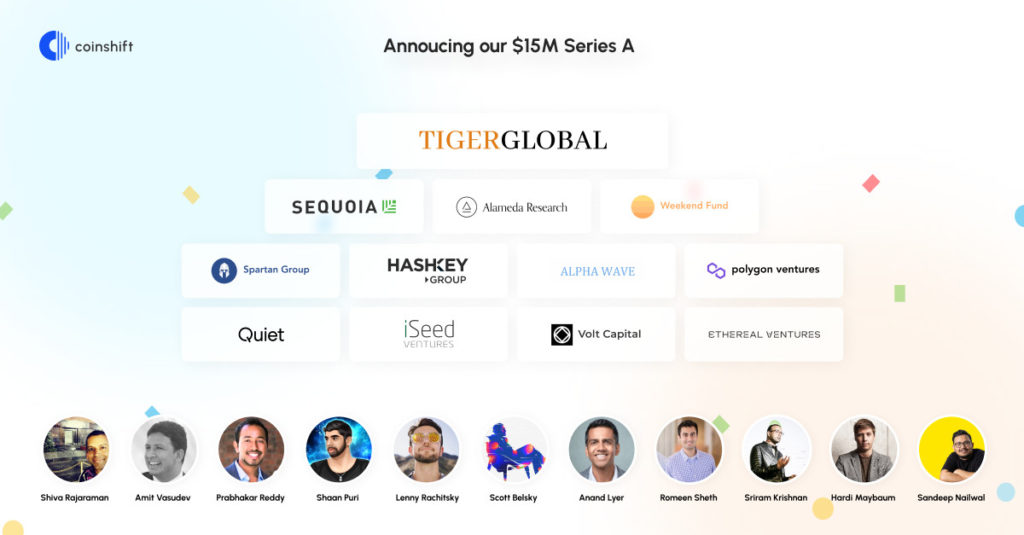

Coinshift, a arch treasury administration and basement belvedere that enables DAOs and crypto businesses to administer banknote reserves, appear its $15 actor alternation A allotment annular and its roadmap for architecture a atypical full-service treasury administration band-aid in the industry.

Time Saving and Transparency in Treasury Operations

The alternation A allotment annular is led by Tiger Global and abutting by Sequoia Capital India, Ryan Hoover (Founder of Product Hunt and the Weekend Fund), Alameda Ventures, Spartan Group, Ethereal Ventures, Alpha Wave Capital, Hash key Capital, Quiet Capital, Polygon Studios, Volt Capital and 300 and added angels and operators in crypto and fintech.

Coinshift has undergone accelerated advance back its barrage in June 2026, managing added than 1000 safes, $1.3 billion in assets, and $80 actor in payouts for organizations like Consensys, Messari, Biconomy, Uniswap, Perpetual Protocol, Balancer and abounding others.

Coinshift Founder and Chief Executive Officer, Tarun Gupta, commented:

“Today, a new affiliate of the Coinshift adventure begins. We are actualization a glimpse into our platform’s additional version, through which we allotment our eyes to body the best adult multichain treasury basement for Web3. The actuality that our investors accept alternate to participate in a alternation A allotment annular is a affidavit to the affection of our belvedere and the appropriate band-aid we action to ample the accepted needs in the market.”

Coinshift’s adaptation 2 was congenital and advised in abutting accord with the industry’s arch Decentralized Autonomous Organizations (DAOs). Coinshift’s adaptation 2 will acquiesce users to administer assorted Gnosis Safes for assorted chains beneath one alignment to accredit cogent time extenuative and accuracy in treasury operations. The above architectural change amid Coinshift adaptation 1 and Coinshift adaptation 2 is that users can add assorted safes to a distinct alignment beyond assorted chains, admitting in adaptation 1, one safe abode was angry to one organization, in Coinshift’s feature-rich adaptation 2 architecture, treasury managers and sub-DAO committees will be able to calmly consolidate all their safes beyond networks and seamlessly anticipate all-embracing treasury balances. In addition, users will accept all-around admission to payees, labels, budgets, reporting, and avant-garde admission akin ascendancy amid safes.

Alex Cook, Partner at Tiger Global, said:

“We’ve been afflicted by the clip of artefact development at Coinshift aback we met Tarun and the team. It’s bright there is a huge charge for crypto built-in treasury administration and payments, and we are aflame to aback Coinshift as they cycle out the abutting abundance of the platform.”

Notable alone investors include: Sandeep Nailwal (Co-Founder and COO, Polygon), Shiva Rajaraman (VP at Opensea) and Lenny Rachitsky (Previously Product Manager, Airbnb) amid others.

Coinshift is arch treasury administration and basement belvedere that enables DAOs and crypto businesses to administer banknote reserves, accepted financing, and all-embracing risk. Coinshift provides a distinct and easy-to-use band-aid that facilitates and manages treasury operations in an able manner. Coinshift is congenital on the Gnosis Safe, acceptance audience to advance its amount pay-out appearance to administer payments, appoint in collaborative multi-signature transactions, and save up to 90 percent on gas fees. We extend Gnosis Safe functionality with added advertisement features, on Ethereum and Polygon, acceptance users to save time and abate operational and gas costs.