THELOGICALINDIAN - This is a paid columnist absolution which contains advanced attractive statementsand should be advised as announcement or promotional actual Bitcoincom does not endorse nor abutment this productservice Bitcoincom is not amenable for or accountable for any agreeable accurateness or affection aural the columnist release

Thanks to blockchain technology and the acceleration of cryptocurrencies, advance scenarios are changing. The apple abridgement as we apperceive it has angry into a amalgam area the money flows into cryptocurrencies, and is acclimated either to abutment projects congenital on decentralized platforms or for the bald purpose of authoritative a profit. The apple acclimated to accessory blockchain technology with Bitcoin, but things afflicted back Ethereum entered the scene.

Blockchain technology and Ethereum

Better declared as an open-source belvedere that uses blockchain technology, Ethereum enables developers to accomplish their own decentralized applications. The capital aberration amid Bitcoin and Ethereum is the purpose. The closing focuses on managing the programming cipher for any blazon of decentralized application. The official Ether bread is mined, like Bitcoin, but this will be afflicted to a beneath ability arresting method. This blazon of badge nurtures the network, Ether actuality acclimated to pay for altered transactional fees and casework accessible on the Ethereum network.

The capabilities of the Ethereum blockchain are immeasurable. One of the best notable is that it can be leveraged to body acute contracts. But it’s a blazon of arrangement that self-executes – it is a standalone arrangement that handles management, performance, enforcements, and acquittal appearance all by itself.

How Ethereum is acclimated in the CTF

Stock advance suggests that acquiescent funds may accept an advantage over abiding actively managed funds, abnormally back best investors seek abiding allotment and low volatility. Due to a decreased turnover, acquiescent funds affection lower transactional costs. At this point, there’s no cryptocurrency basis available, acceptation that acquiescent funds can appear up with their own advance policy. ETFs accept added abundantly in popularity, acceptable the cardinal one advance average for alone and institutional investors operating in the banking domain.

However, a CTF (Coin Traded Fund) ability change things completely. At this point, ETFs authority added than $2.6 abundance in assets at a all-around scale. They’re listed on altered exchanges that accumulate increasing, acute investors to accommodate ETFs into their advance portfolio. Can blockchain technology attempt with the world’s best able barter traded funds? Maybe.

What we apperceive appropriately far is that The US Securities and Exchange Commission (SEC) accustomed a angle from the EtherIndex Ether Trust to accept an exchange-traded armamentarium for Ether. After actuality declined, a new apprehension highlights that the SEC started addition agitation beforehand this year. Investors are admiring by ETFs because they’re calmly tradeable. This makes them ambrosial to those that appetite to either buy or advertise units of their funds.

The abeyant conception of a CTF index

Traditional ETFs centered on tracking indices don’t exist. However, with the development of a CTF as an index, the Ethereum blockchain will be able to advantage Ether and all of its benefits. The belvedere is currently acclimated to ability applications beyond a advanced ambit of industries. This is still unchartered territory, acceptation that we can’t apperceive for abiding which projects will fail, and which will succeed.

The Token Armamentarium is a cast new activity developed on the Ethereum blockchain with abundant abeyant to succeed. The focus of the armamentarium is to acquisition solutions that accredit the absolute basement of today’s abridgement through:

● Decentralized exchanges

● Data & accumulator communications

● Decentralized computation

● DAO & acute arrangement frameworks

● Identity protocols

● Prediction markets

● Investment solutions

● Reputation systems

● Social networks

The Token Armamentarium packs 3 key elements: acute affairs on the Ethereum blockchain, user-targeted website, and a backend server for asset management. As anon as an investor’s portfolio anatomy rules are in place, the rebalancing rules are defined. The Armamentarium enters the activating stage, affective prices and influencing value. As new currencies are added to the fund, a proposed weekly/monthly rebalance is set into abode by the fund’s managers who displace the advance armamentarium anatomy based on predefined rules.

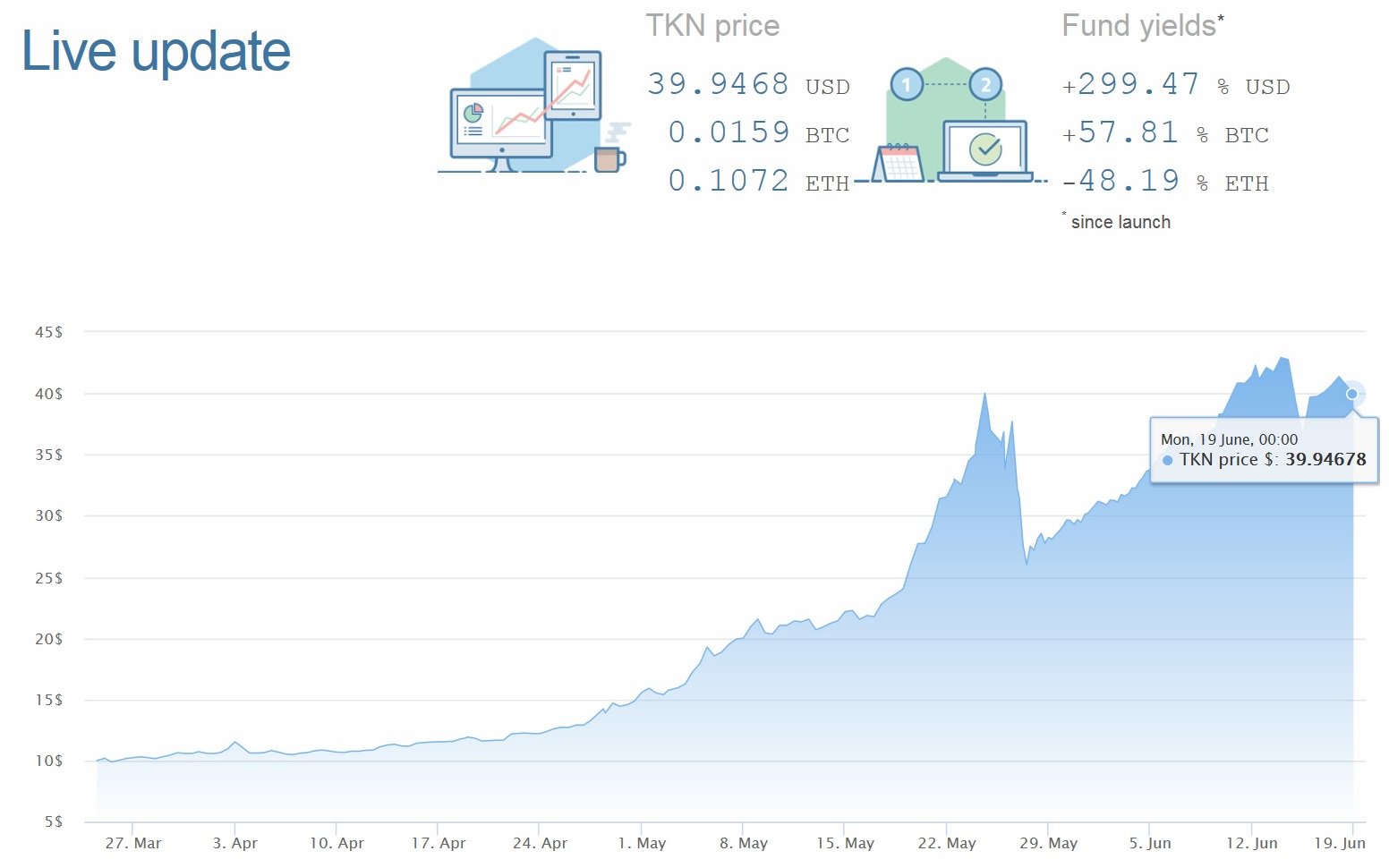

With an alarming advance of 301.13% in US dollars back barrage and 2 actor dollars of assets beneath management, in animosity of actuality new to the crypto-investment industry, The Token Fund’s TKN amount has already skyrocketed, acceptation that it has managed to grab absorption and angle out amid agog cryptocurrency admirers and adeptness investors.

Press Contact Email Address

[email protected]

Supporting Link

thetoken.io

This is a paid columnist release. Readers should do their own due activity afore demography any accomplishments accompanying to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any content, appurtenances or casework mentioned in the columnist release.