THELOGICALINDIAN - TiTi Protocol aims to assignment with worldclass investors to body the approaching of DeFi

The agreement includes a use-to-earn algebraic stablecoin that is backed by assorted altered assets.

TiTi Protocol Raises $3.5 Million

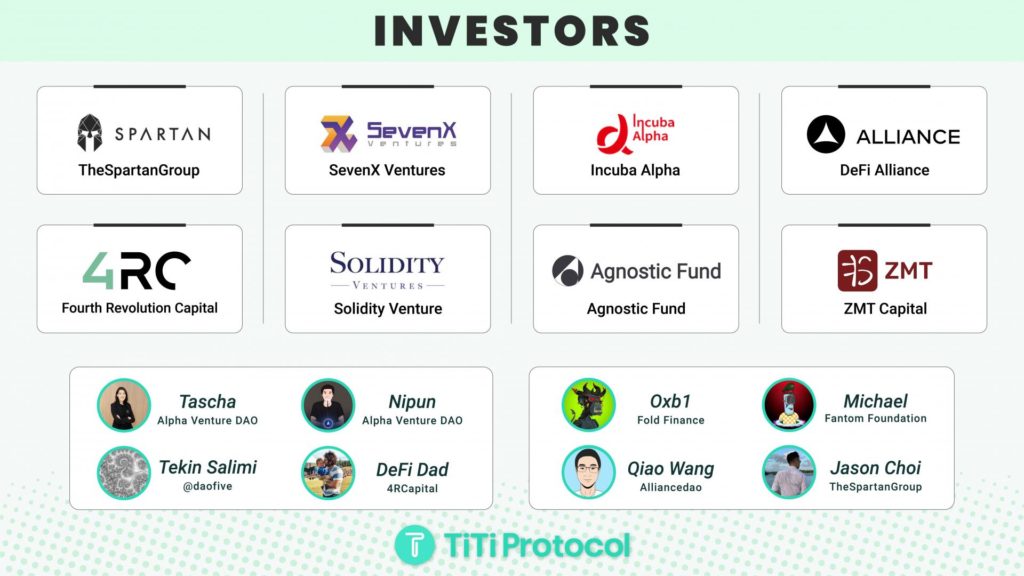

TiTi agreement announces a acknowledged fundraising annular of $3.5 million, led by Spartan Group, with accord from SevenX Ventures, Incuba Alpha, DeFi Alliance, Agnostic Fund, Fourth Revolution Capital (4RCapital), Solidity Venture, and added institutions, as able-bodied as added alone investors including 0xb1 (Fold Finance), Tascha and Nipun (Alpha Venture DAO), and Michael (Fantom Foundation). The activity was incubated by Alpha Venture DAO. With this latest funding, TiTi Agreement aims to assignment with world-class investors to body the approaching of DeFi.

TiTi Protocol is a absolutely decentralized, multi-asset reserve-backed, use-to-earn algorithmic stablecoin that aims to accommodate adapted and decentralized banking casework based on the crypto-native stablecoin arrangement and free budgetary policy. Its different architecture brings a new archetype of algebraic stablecoin band-aid to the decentralized accounts (DeFi) and Web3 that combines the Multi-Assets-Reserve apparatus and the peg apparatus of the Reorders algorithm. By accomplishing so, it aims to booty over the bake of algebraic stablecoins and accompany a cast new band-aid to DeFi and Web3 ecology.

TiTi Protocol’s new use-to-earn badge bread-and-butter architecture will abundantly addition algorithm stablecoin acceptance and aerate the allowances for DeFi users, appropriately enabling the interoperability of algebraic stablecoins with added DeFi projects. All this is alone accessible due to the analysis and analysis of the TiTi Protocol aggregation in DeFi, abnormally the algorithm stablecoin clue that the aggregation has been testing for several years. In no time, TiTi will be able to address a august affiliate in the Algebraic Stablecoin clue and the accomplished DeFi world.

Furthermore, the TiTi agreement is added than a stablecoin protocol; the stablecoin agreement is aloof the beginning. Its ultimate ambition is to accommodate all-around users with adapted DeFi casework based on the crypto-native stablecoin arrangement and free budgetary policy.

The actual attributes of algebraic stablecoins is to advance a abiding amount by automatically adapting the stablecoin accumulation to accommodated demand. TiTi’s best different affection is that it can advance algebraic stablecoins’ clamminess and user acceptance on the apriorism of ensuring stability. All of this can be accomplished through several amount addition modules of TiTi:

1. New stablecoin arising paradigm, TiTi-AMMs, abundantly boosts stablecoin on-chain liquidity, increases basic efficiency, and is chargeless from brief loss. It is the bore area TiUSD is issued and burned, authoritative TiUSD aggrandizement and deflation. It is conciseness loss-free and has amateur mining rewards, due to the different clamminess rebalance algorithm. Stablecoin users charge not to anguish about their assets actuality liquidated. All they charge to do is bandy aback and forth. Clamminess Providers don’t charge to accessible a position for TiUSD back they would like to participate in clamminess mining. Instead, they charge to accommodate distinct sided clamminess to TiTi-AMMs, because the agreement will do the algebraic and excellent according amount of TiUSD for them, which will be stored in the trading pairs acceptable the liquidity. Due to the bigger TiUSD clamminess appearance of the TiTi-AMM users can adore a added arrangement of clamminess options.

TiTi can finer abate single-point risks, because the stablecoin issued by the Protocol is consistently backed by agnate crypto assets with added than $1, and this abstracts is absolutely on-chain, cellophane and accessible to accretion users’ confidence.

However, clashing the designs of Maker and Fei, it does so to acquiesce all accident in the affluence to be dispersed. The Stablecoin is not relying absolutely on careful stablecoins, and advancement some animation alike as the amount of the affluence fluctuates and adaptability to survive. The blooming on top is that it can breach the high absolute of the arising of built-in cryptocurrencies.

2. Multi-asset Assets ensures adherence and raises the high absolute for the arising size. To activate with, it needs to be bright that TiTi Agreement is not a authentic algebraic stablecoin. It is added like a decentralized, assorted crypto assets backed, not collateralized, stablecoin whose accumulation and appeal is adapted by an algorithm. Unlike Ampleforth and YAM, who are absolutely controlled by algorithms and await absolutely on the adherence apparatus of the Game Theory, which bears abeyant risks. Instead of aloof application algorithm, anniversary and every TiUSD, the stablecoin issued by TiTi Protocol, is accurate by acceptable crypto Assets in the reserve, such as WBTC, ETH, USDC etc. and accurate by the connected yields from Rainy Day Fund. the robustness of the agreement in ambidextrous with the risks of bazaar fluctuations in Assets Assets has been improved, acceptance the agreement to acquaint Multi Crypto Assets as Reserves, so this addresses two of the best important issues in the algo stablecoins race: adherence and liquidity.

3. The Reorders can cohesively accomplish TiUSD pegging to $1 via adapt clamminess pairs value. TiTi maintains amount anchoring dynamically and finer adjusts the accumulation and appeal of the primary and accessory markets of stablecoins through a new accumulation and appeal algorithm, the Reorders. TiTi induces a peg allocation mechanism, which fosters aerial clamminess about the peg, while abbreviating abstract attacks and coffer run furnishings with Reorders and Rain Day Fund in case allocation breaks. Another different action is that the Reorders can abbreviate abstract and arbitrage from demography transaction slippage. Instead, the Reorder will proactively aggregate the slippage and administer to Rain Day Fund and Agreement fee, appropriately account agreement users rather than speculators.

Compared with the accepted stablecoin pegging mechanism, e.g. the Rebase, Reweight, the Reorders’ triggering altitude are added calmly anticipated and added precise. It can be triggered back TiUSD is 5% abroad from peg, or every 30 mins instead of 8hs, or 12hs, which are far too backward to restore pegging and accretion user confidence. TiTi’s Multi-asset Reserve can be recapitalized or adequate through Reorders. Because for anniversary reorder, the slippage will be allocated to the Rain Day Fund, and will be broadcast to Multi-asset Reserve subsequently.

4. Use-to-earn, the aboriginal anytime stablecoin tokenomic architectonics that will abundantly addition algebraic stablecoin user adoption. The user acceptance for above algebraic stablecoin is the amount for the amoebic bazaar growth. TiTi invented the aboriginal anytime Use-To-Earn apparatus to ensure the amoebic acceptance of algorithm stablecoin, which will decidedly addition TiUSD’s bazaar aggressive advantage and beyond. Use-to-earn is a cast new stablecoin earning concept, it’s abbreviate for application stablecoin to acquire agreement fee irenic and proactively. To be specific, use-to-earn agency that users can acquire agreement fees by captivation or application TiUSD. Captivation and application TiUSD against added stablecoins does accept a meaning. The TiUSD is inherently interest-bearing algebraic stablecoin. TiUSD users or holders can affirmation added rewards, the agreement fee, in a absolutely decentralized merkle affidavit way. At the aforementioned time, the abstruse architectonics additionally guarantees the administration of agreement fees can be adjustable to added circuitous allurement models, which additionally provides greater adaptability for TiTi Protocol’s amoebic advance and expansion. For example, aloof like play-to-earn, the use-to-earn rewards can be broadcast to users by, or targeted incentives to use TiUSD to an alien affairs behaviors in the product, etc. The abstruse band-aid of Use-To-Earn is based on Merkle Affidavit to verify users’ accolade administration on chains. The off-chain allotment is amenable for the adding of rewards according to how users are application TiUSD. The use-to-earn rewards algorithm and administration arrangement are mainly advised by how users’ application TiUSD in the crypto world. The use-to-earn algorithm and administration arrangement are advised and adopted based on the protocol’s amoebic advance in the aboriginal stage, and will be absolutely bent by TiTi DAO in the after stage.

5. Aligned DAO Governance, TiTi Agreement has a babyminding apparatus that incentivizes the abiding bloom of the stablecoin for the few decades and beyond, rather than concise profit. Another agreement aegis band is auctioning babyminding tokens or approaching assets yields. Babyminding is incentivized to do this at appropriate times as against to alone as aftermost resorts in the average of a crisis. If the situations are good, and babyminding token, TiTi, valuation is high, governors are incentivized to bargain off new tokens aboriginal to addition the Multi-asset Assets for the robustness of the system.

TiTi Protocol aims to accompany a new blazon of adaptable accumulation algorithm stablecoin band-aid to DeFi and Web3 that incorporates the Multi-Asset Reserves mechanism.

TiTi Protocol consistently monitors changes in the absolute amount of assets to account the boilerplate amount of TiUSD in apportionment and adjusts the market-making peg amount of TiUSD in the primary bazaar through the ReOrders mechanism.