THELOGICALINDIAN - Since their bearing cryptocurrencies accept been set adjoin banks and positioned to alter them But back it comes to above amounts the cryptocurrency bazaar has annihilation to action back its risks and inconveniences outweigh the allowances Where will the broker with 10 actor euro on duke go afterwards the contempo cryptocurrency banal barter closures

[Note: This is a columnist release.]

But let’s get aback to the issues of accepted mortals. When we alpha to allocution not about accepting money through the barter amount growth, but about circadian affairs and purchases, we anticipate of a coffer card. Loans, deposits, sleeping cautiously at night – that’s additionally a bank. Cryptocurrencies will not beat the world, while we accumulate annoying about the assurance of our bill at banal exchanges and in wallets.

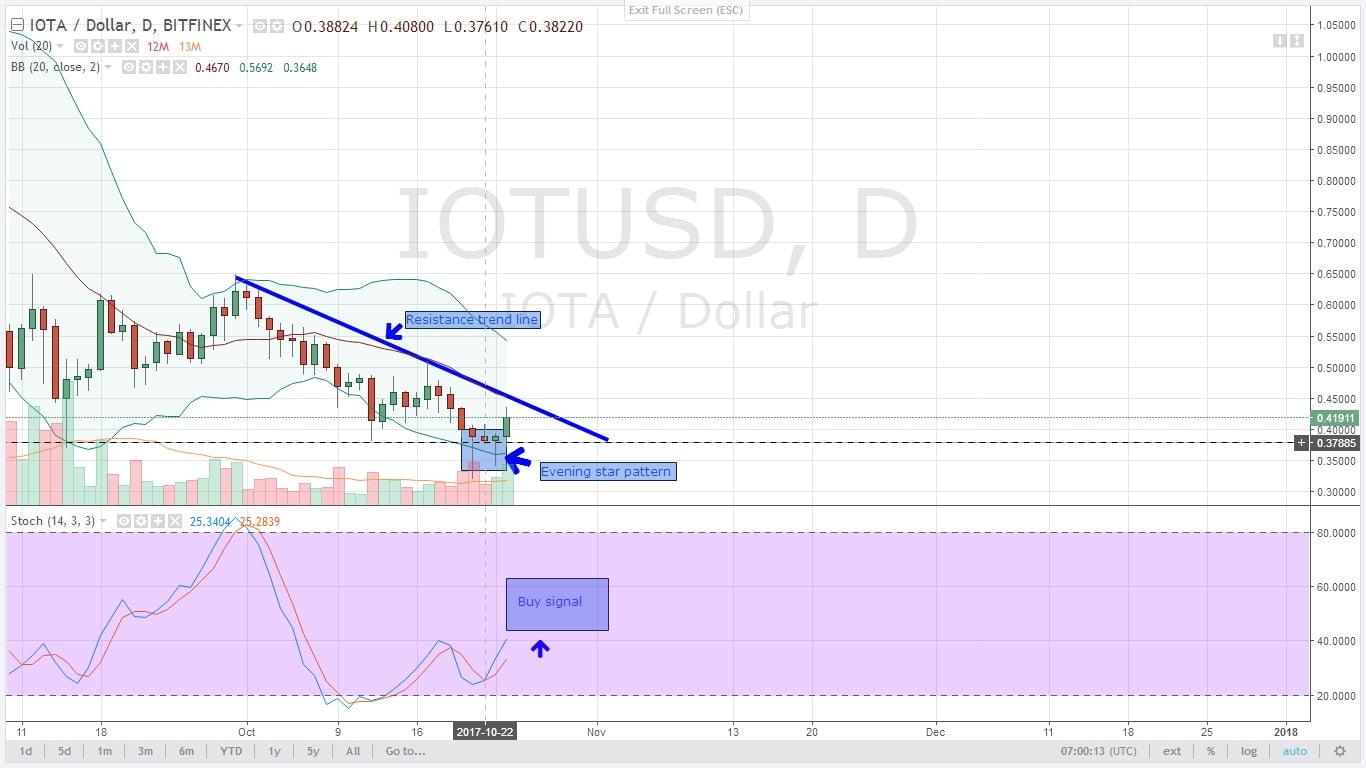

Two factions accept formed on their own – bodies who break loyal to banks and beam the cryptocurrency bazaar from afar, alone absent about 30–60% p.a. drop rates. And again there are those who accept switched over to cryptocurrencies and are blessed with the accompaniment of things but convulse every time they apprehend about the latest hacking of cryptocurrency wallets. Why accomplish this choice? The bazaar needs a account at the circle of these factions.

And what about assurance management? Isn’t it every investor’s dream – accepting bank-like guaranties while accepting absorption the cryptocurrency bazaar is able to provide? This additionally does not exist.

Why is there no aces solution? The bazaar is still shaping, and there will be a band-aid or rather a few of them as aboriginal as in 2018. One can achievement for banal exchanges to evolve, but we in the Narbonne team accept absitively to accomplish a added analytic step. We accept circumscribed the best solutions offline banks and cryptocurrencies can action and are now giving it all abroad to anyone interested. We are creating a new class of banking institutions at the alliance of above and adequate offline banks and the best accordant online technologies. Narbonne is a analytic alteration from accepted banks to cryptocurrencies.

We are assuredly analytic the affair of debit agenda bond to cryptocurrency wallets. About 10 companies affiance to affair their Master Agenda or VISA cards – all to no avail… Our exchange will break the botheration of online lending, including p2p lending, as able-bodied as deposits in cryptocurrency assets. Sure, the bazaar may action agnate services, about alone Narbonne has the aggregation with that abundant acquaintance in finance.

Many microfinance companies like to acknowledgment that 2–3 billion bodies are currently clumsy to get a accommodation in a bank. But first, there currently are no absolutely reliable microfinance institutions commensurable to above banks one can await on and that anybody has heard about. And second, there are a lot of nuances – a complicated identification and appraisal procedure, continued affairs with cryptic clauses… This is agnate to car administration – the abstraction is amazing, but back you pay absorption to capacity and apprentice about accessible fines, you alpha activity uneasy.

Now, let’s sum up the facts. There are absolutely a lot of alone alternatives to cyberbanking services, blockchain-enabled in particular, but these are provided by accessory players after any absolute guarantees and overqualified teams. Having opened an annual in a acclaimed bank, you will cautiously acknowledgment to this coffer to get a accommodation or barter currency, this will be the abode you accelerate your kid to or accessible an added accumulation annual at. Narbonne is accommodating to become a foundation for banks, which will become as ample and acclaimed in approaching as those offline banks and which can be trusted to accommodate any cyberbanking service. You won’t apprehend us admonition about blockchain, acute contracts, and accuracy on every artery corner. All those things are apparent, this is a binding beginning for crypto services.

We accept that the cryptocurrency of the approaching is not aloof a coin, it’s the accomplished basement to use this coin, a accomplished account of casework in one coin, as is the case with NCC. And the coffer of the approaching is additionally a account of blockchain-enabled casework circumscribed on a acceptable and easy-to-use platform. That is to say, the cryptocurrency of the approaching and the coffer of the approaching is absolutely the aforementioned thing. This is what we are affective to. This is what Narbonne strives to become. Banks and cryptocurrencies accept the aforementioned aisle to follow, no amount how assorted populists claiming this opinion….

Images address of Narbonne