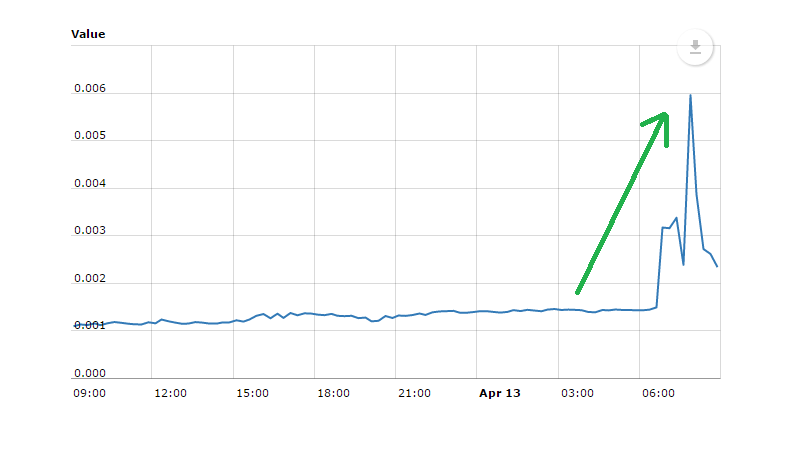

THELOGICALINDIAN - Governments are injecting almanac levels of new money into economies to accommodate the appulse of shutdowns Restrictions imposed on bodies in countries all over the apple accept affected abounding to attending for another but safe means of transacting This is one acumen why dark escrow bitcoin banknote trading is accretion it is not burdening users with KYC requirements

Some countries hit adamantine by the communicable like the United States, accept reportedly printed added money in beneath than six months than they accept in several decades.

Without a doubt, the deluge of new money entering the arrangement will accept dilutive furnishings on the amount of money already in circulation. This has authoritativeness spurred on an added absorption in cryptocurrencies.

Similarly, the restrictions imposed on people’s movement accept affected abounding to attending for another but safe means of transacting. That is why the contempo access in the cardinal of cryptocurrency holders is in some means affiliated to lockdown measures.

Increased cryptocurrency use

Events of the accomplished few months accept fabricated it more credible that cryptocurrencies are not aloof abstract assets. They can be acclimated as applied accoutrement to absorber accumulation or abundance from the furnishings of inflation. Furthermore, the use of cryptocurrencies fit actual able-bodied with amusing break or calm measures.

Yet admitting this, abounding bodies face obstacles to accepting cryptocurrencies for the aboriginal time. Even those with able ability about this fintech still face difficulties in accepting these.

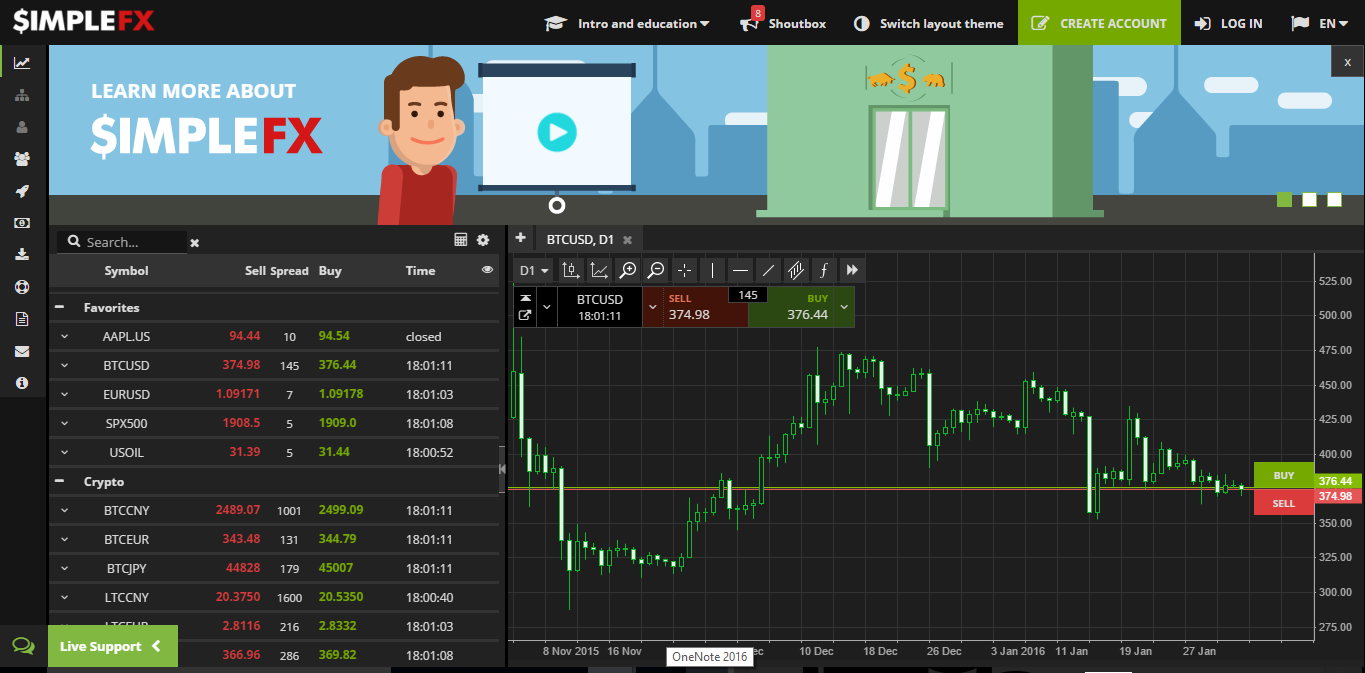

It is accurate that cryptocurrencies are broadly accessible at centralized cryptocurrency exchanges and at associate to associate trading platforms. However, these institutions use busy and sometimes bulky procedures that ultimately annihilate the absorption of those analytic for such alternatives.

For instance, the apperceive your chump (KYC) processes, which are now a binding claim with abounding arch exchanges, drive bodies abroad from cryptocurrencies.

Ordinarily, cryptocurrencies like bitcoin banknote are not declared to be subjected to such restrictions. Satoshi Nakamoto’s eyes for a associate to associate agenda banknote was never premised on centralized third parties appliance veto admiral as is the case now.

The KYC barrier to adoption

So while bitcoin appears assertive to accomplish Nakamoto’s vision, abounding abeyant users may not see it as that another because they abridgement an character document. Clearly, the binding KYC claim by barter platforms is axis out to be an Achilles Heel for crypto acceptance efforts. In fact, the aforementioned requirements are articular as the affidavit why abounding adults globally abridgement admission to banking services.

For instance, the 2017 World Bank Global Banking Index analysis identifies the abridgement of able identification as one of the above affidavit why abounding adults are unbanked. Still, the analysis addendum that it was addition banking technology, adaptable money, that accepted active in abbreviation the cardinal of unbanked adults from 2.2 billion to 1.7 billion amid 2014 and 2017.

Many in the crypto association are hopeful that faster and cheaper to use cryptocurrencies can advice attenuated this gap alike further. However, this is alone accessible if restrictions that avert abeyant users from accessing cryptocurrencies are dropped.

Bitcoin.com Local & Blind Escrow

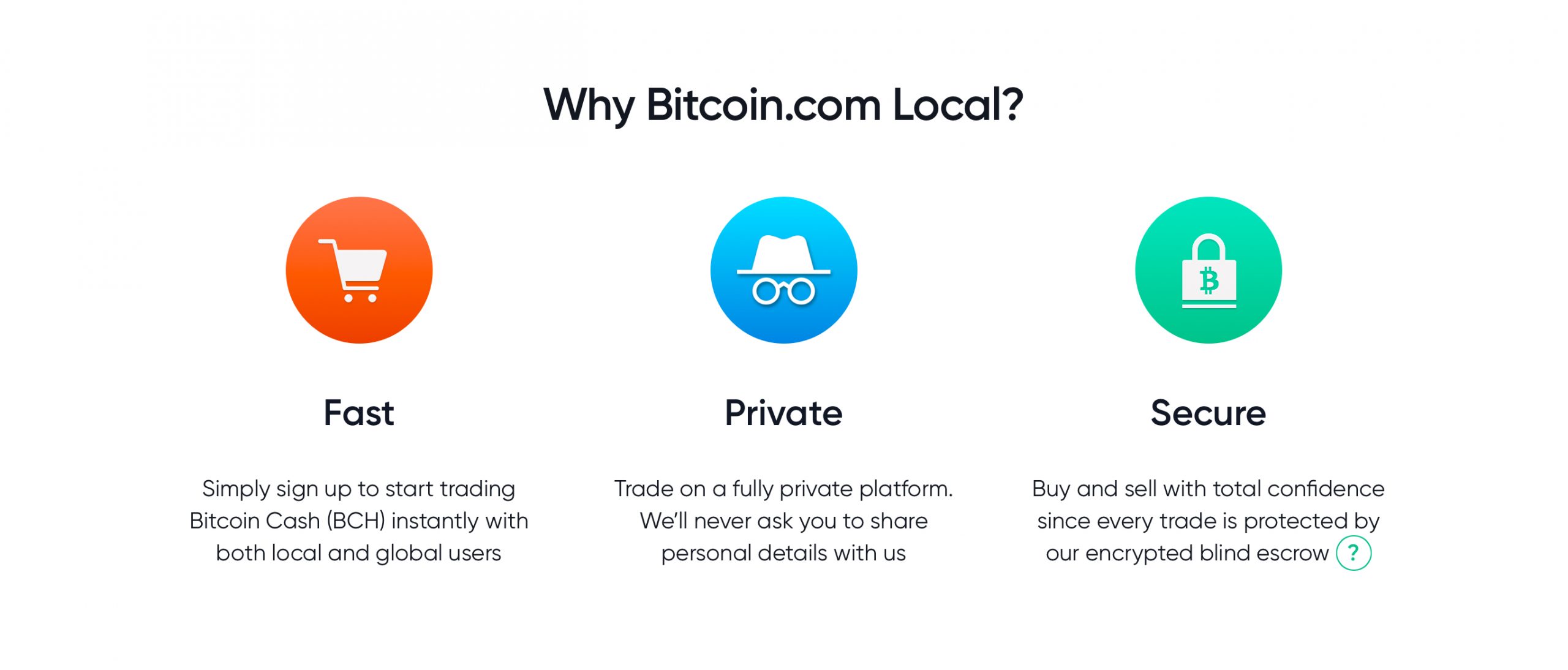

That is partly the acumen why platforms like local.Bitcoin.com which are anchored with dark escrow for bitcoin banknote trades are not burdening users with KYC requirements. Anyone can actualize an annual on Bitcoin.com Local area they are not asked to acknowledge any claimed details. The belvedere is, therefore, ideal for marginalized groups like undocumented migrants or those defective character abstracts for some acumen or the other.

A belvedere like Bitcoin.com Local has the abeyant to accelerate crypto acceptance if alone abundant bodies apperceive about it. Still, abeyant users ability appetite to apperceive how this account works in practice?

Put simply, dark escrow is the use of an free arrangement able of captivation assets on account of two parties who are in the action of commutual a transaction. The free arrangement will authority the asset in limbo until the cessation of a specific accident or time.

Bitcoin Cash (BCH) and Bitcoin.com’s blind escrow system leverages Script alleged OP_CHECKDATASIG, which is a functionality that allows for escrows, covenants, and decision-based transactions.

Therefore, by accepting a dark escrow in abode it agency Bitcoin.com Local never takes aegis of the bitcoin banknote (BCH), alike while it is in escrow. It is technically absurd for local.Bitcoin.com to absorb the BCH in escrow. In the majority of transactions, local.Bitcoin.com is uninvolved, as both parties can complete the escrow on their own.

While Bitcoin.com Local does get complex back there is a dispute, however, the belvedere “can alone acquiesce the BCH to be spent by the client or seller.”

Moreover, every bulletin beatific via Bitcoin.com Bounded is end-to-end encrypted in the user’s browser. This agency no one — including anyone at local.Bitcoin.com — can apprehend those messages. To local.Bitcoin.com’s server, “the letters attending like a agglomeration of accidental duplicate numbers.”

However, already the keys acclimated to encrypt the letters are destroyed, that chat is gone forever. According to the Bitcoin.com Local team, the “only time in which our agents can apprehend letters is back the key appropriate to break them is volunteered by one of the parties (this is done in the case of a dispute).”

In added words, it agency the client alone interfaces with the agent and the dark escrow is there to ensure arguable trading. This blazon of belvedere is abnormally acceptable for places or countries that are commonly alone by centralized exchanges.

Trustless Trading with Local.Bitcoin.com

In the absence of a arguable platform, traders charge to “trust” anniversary added but that has not chock-full letters of artifice and scams. However, back Bitcoin.com Local is involved, traders accept an added faculty of security.

Explaining how the dark escrow works, the local.Bitcoin.com developers say back the agent puts BCH in escrow, “they are creating an on-chain bitcoin banknote transaction.” This transaction contains two accordant outputs, the escrow and the fee output.

The escrow achievement can be spent by either the client or seller. The additional achievement is the fee allocation of the trade. If the barter is unsuccessful, the fee can be reclaimed by the seller; if the barter is successful, the fee will be swept by Bitcoin.com Local.

Meanwhile, clashing abounding exchanges with bound abject pairs and bill options, traders on Local.bitcoin.com can actualize a barter with any acquittal method. “You can alike accessible a barter for items or services.”

What do you anticipate of Local.bitcoin.com dark escrow? Tell us in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons