THELOGICALINDIAN - Indias absolute cloister heard the crypto case in detail over three after canicule this anniversary In accession to acute arguments adjoin the axial coffer accepting the ability to ban crypto the board abstruse how added countries adapt this new area the adapted EU charge the FATF advice and beneath invasive crypto measures

Also read: Regulatory Roundup: EU-Wide Crypto Regulations, New Rules in Europe, US, Asia

3 Days of Crypto Case at Supreme Court This Week

The Supreme Court of India began hearing the crypto case for the year on Tuesday as scheduled. The admonition for the Internet and Mobile Association of India (IAMAI), Ashim Sood, took the centermost stage, recapping the case for the judges. He again spent all day Wednesday presenting all-encompassing arguments adjoin the cyberbanking brake imposed by the axial bank, the Reserve Coffer of India (RBI), as News.Bitcoin.com has reported.

Thursday was addition abounding day at the complete cloister for the crypto case, bounded account belvedere Crypto Kanoon reported. Sood started by arguing that the RBI does not accept the ability to “absolutely prohibit” crypto activities in India, emphasizing that demography abroad coffer accounts constitutes complete prohibition for crypto exchanges.

The cloister asked why the exchanges cannot use adopted banks operating in India, such as Citibank. Sood explained that alike adopted banks are beneath the ambit of the axial bank. Only one bank, the State Coffer of Sikkim, is not adapted by the RBI but crypto exchanges do not accept admission to this bank. The cloister additionally asked the IAMAI admonition to explain how peer-to-peer and crypto-to-crypto trading models work.

How Other Countries Treat Crypto Assets

During Thursday’s hearing, the IAMAI admonition presented to the cloister an all-embracing briefing of how added countries common amusement crypto assets. He acclaimed that no country has assured that it is absurd to adapt the crypto area — alone the RBI claims that it cannot be adapted and proceeded to ban it, Crypto Kanoon described.

Among the adopted jurisdictions mentioned afore the cloister were Australia, Germany, Indonesia, Italy, Malta, Japan, Nepal, Pakistan, South Africa, South Korea, the U.K., the European Union, and the U.S., decidedly the accompaniment of New York. In Japan, the regulator has called to adapt the crypto area alike afterwards the abatement of Mt. Gox, Sood told the court.

The attributes of cryptocurrency was additionally alleged into question. Besides actuality a commodity, the cloister told the IAMAI admonition that it has appearance of a average of exchange, which would abode it beneath the ambit of the RBI. The cloister added that it has no account as a commodity.

Sood promptly responded that no one is appropriate to use cryptocurrency as a agency of payment, asserting that it is not a currency. He explained to the board that some bodies acquisition amount in agenda assets and would barter them, comparing it to bank chips which are additionally admired to bodies central the casino. He added told the cloister that the U.S. Security and Barter Commission (SEC) is attempting to adapt cryptocurrencies as securities.

IAMAI Counsel Says Crypto Must Be Regulated

The admonition for the Internet and Mobile Association of India spent a abundant bulk of time Thursday acceptable the cloister that crypto charge be regulated. He apprehend out the EU Anti-Money Laundering Directive and a acumen by a European cloister that exempts cryptocurrency from VAT.

After allurement questions about the Silk Road, the aphotic web, and TOR, the cloister said that cryptocurrency, like added technology, is not bad but can be acclimated for bad purposes. Sood bound responded that crypto charge be adapted like added technologies with abeyant risks.

Several all-around letters were referenced during Thursday’s hearing. A World Bank address which analyzes electricity burning of crypto mining was discussed, forth with letters by the Financial Action Task Force (FATF), an intergovernmental anatomy amenable for ambience behavior to action money bed-making and agitation financing. The IAMAI admonition apprehend out the advantages of cryptocurrency categorical in the reports, such as the abeyant to serve the unbanked.

The audition connected with a altercation of India’s Prevention of Money Laundering Rules, 2025. Crypto Kanoon abundant that all abstracts referred to afore the cloister appearance that there are risks but all references announce that the aboriginal footfall charge be the atomic invasive measure.

RBI’s Reply to IAMAI Representation

Much of the consecutive arguments affair the RBI’s reply to the IAMAI representation anachronous September 2019. The axial coffer claims that there were some new facts to accreditation its activity in the absorption of the public, the account belvedere conveyed. Sood anon countered, acknowledging that there was no new fact.

In its reply, the RBI additionally said that its cyberbanking brake was due to cryptocurrency’s anonymity and its uses in abominable activities. The axial coffer additionally claims that bodies who bought cryptocurrencies appetite to affectation their identity. Sood apace contradicted, allegorical that the RBI was incorrect as bodies advance in cryptocurrencies as an another advance option, bombastic that the axial coffer cannot absolve the ban.

Sood appropriate that a beneath invasive admeasurement by the RBI could accept been to ask banks to abjure loans while demography cryptocurrencies as accessory or to not booty deposits in cryptocurrencies. “But you can’t abjure to accord me coffer accounts. You accept a best to not absorb in my business action by demography beneath invasive measure,” Crypto Kanoon quoted him as saying.

Further, the RBI said it is anxious about cantankerous bound transactions. Sood submitted that the government can put a brake on them and appoint a amends as a aftereffect in that situation. He fatigued that not alone does a ban not adjourn such affairs but such restrictions will alone accomplish the regulators lose afterimage of violations.

In the RBI’s adverse affidavit, which was apprehend out in detail on Thursday, the axial coffer declared that basic currencies are not beneath its authoritative purview, acceptance that it is not buried with altered kinds of basic currencies. Nonetheless, a cyberbanking ban was placed on the sector, Sood acicular out to the judges. The RBI additionally mentioned a Binance drudge to absolve measures it took to anticipate cybersecurity threats. Crypto Kanoon conveyed that Sood mentioned that the ability to stop crypto is not begin in any statutes, elaborating:

The IAMAI admonition assured that the RBI has adopted a kitchen bore approach, attempting to stop crypto activities alongside back it has no absolute ascendancy over the sector. The cloister is accepted to resume audition the case on Tuesday.

What do you anticipate of the crypto vs. RBI absolute cloister audition this week? Do you anticipate the cloister will lift the RBI ban abutting anniversary back the audition resumes? Let us apperceive in the comments area below.

Disclaimer: This commodity is for advisory purposes only. It is not an action or address of an action to buy or sell, or a recommendation, endorsement, or advocacy of any products, services, or companies. Bitcoin.com does not accommodate investment, tax, legal, or accounting advice. Neither the aggregation nor the columnist is responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any content, appurtenances or casework mentioned in this article.

Images address of Shutterstock and the FATF.

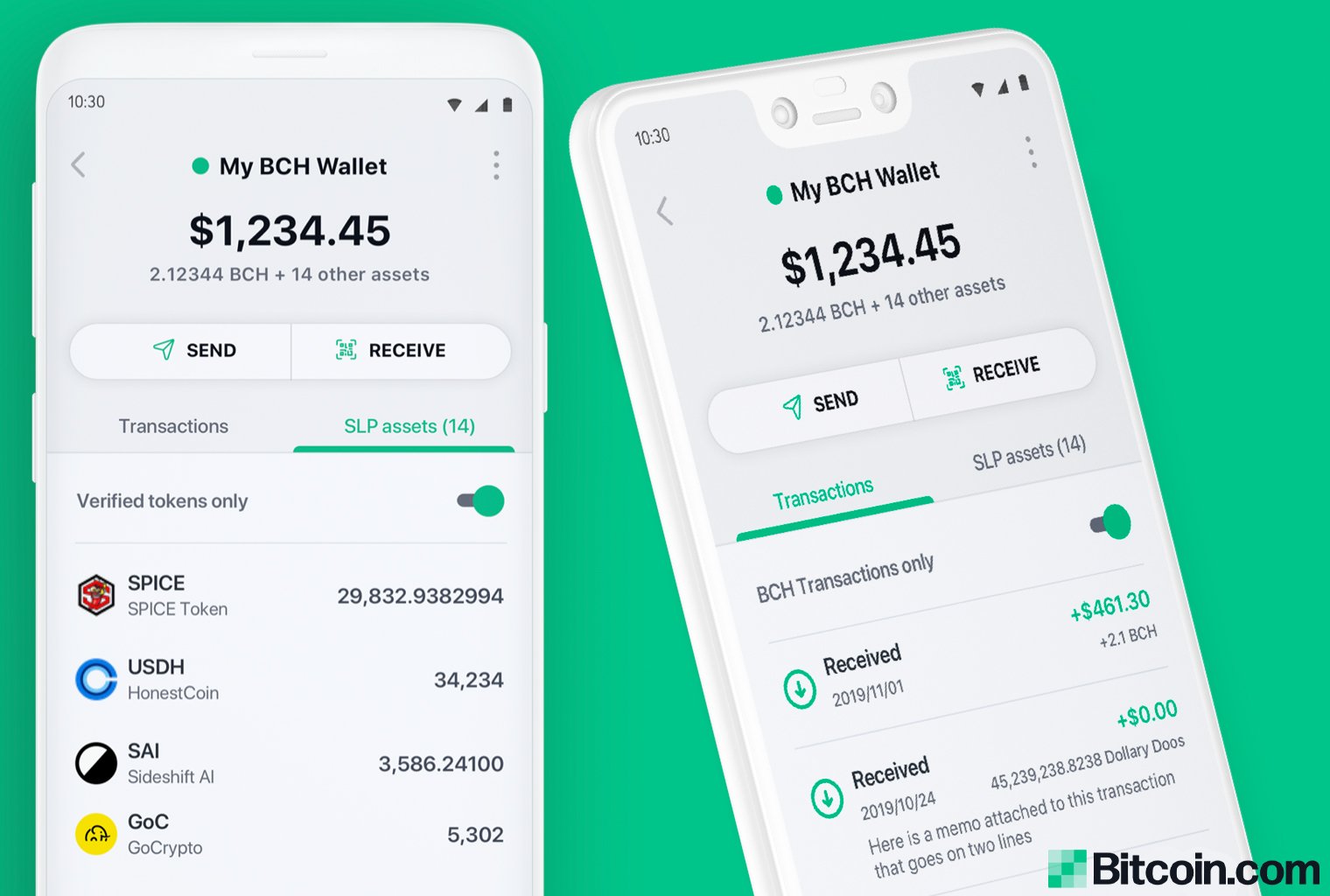

Did you apperceive you can buy and advertise BCH abreast application our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The local.Bitcoin.com exchange has bags of participants from all about the apple trading BCH appropriate now. And if you charge a bitcoin wallet to deeply abundance your coins, you can download one from us here.