THELOGICALINDIAN - Leading up to the G20 acme in June the Financial Stability Board has abundant how the European Union and its affiliate countries are acclimation crypto assets who the regulators are in anniversary country and the ambit of their blank In best cases crypto assets are overseen by several regulators

Also read: Indian Supreme Court Postpones Crypto Case at Government’s Request

The EU

The Banking Stability Board (FSB), an all-embracing anatomy that monitors and makes recommendations about the all-around banking system, has listed four regulators for crypto assets in the European Union (EU).

The aboriginal is the European Commission which is amenable for planning, preparing, and proposing legislation, including any on cryptocurrency if it “decides to adduce such legislation,” the Board clarified. The Commission additionally monitors the capability of banking area reforms and responds to arising banking adherence risks.

Another regulator is the European Banking Authority (EBA) whose functions accommodate accustomed out “regular horizon-scans in affiliation to avant-garde articles and services,” including those accompanying to crypto assets, “from the perspectives of ecology the appulse on the banking system, [and] the adequacy of the authoritative ambit beneath EU law.” The third regulator is the European Allowance and Occupational Pensions Authority which monitors the developments of cryptocurrencies and antecedent bread offerings (ICOs) in the allowance sector.

Lastly, the European Securities and Markets Authority (ESMA) is amenable for attention the adherence of the EU’s banking system. Regarding crypto assets, ESMA appear admonition to European institutions in January acknowledging that crypto assets with assertive characteristics are banking instruments and should be supervised as such, the FSB elaborated:

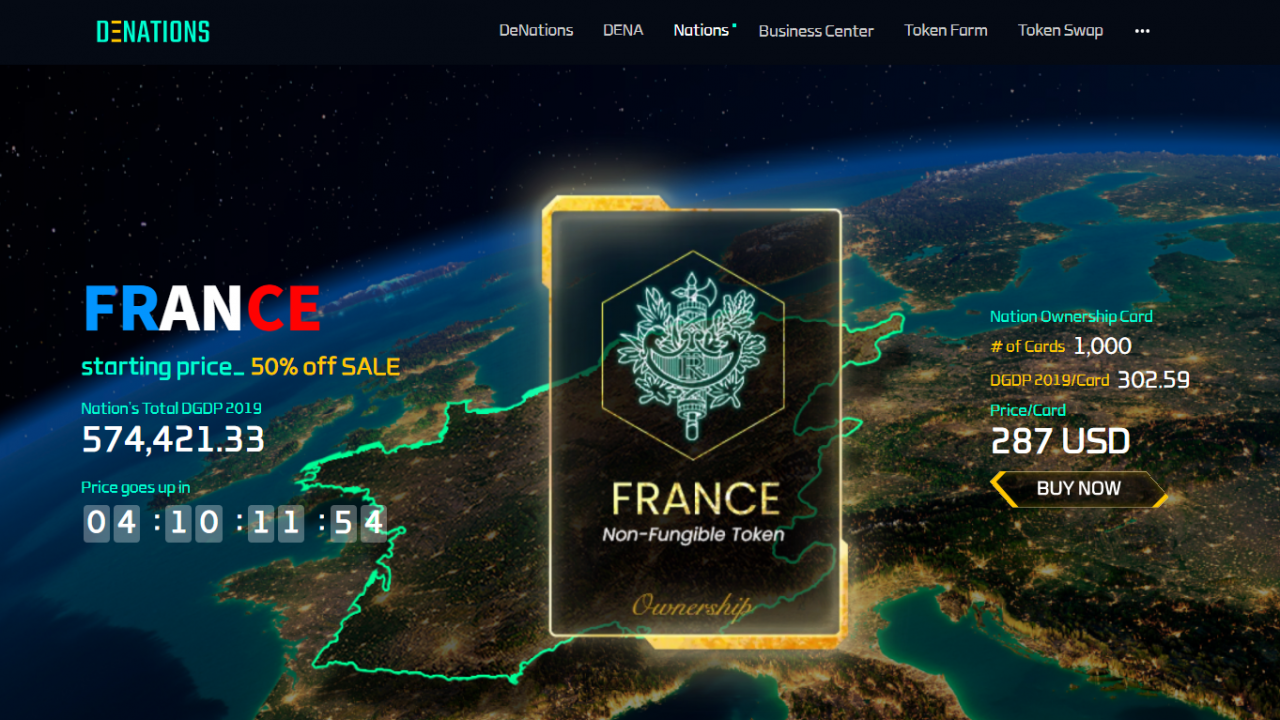

France

A G20 country and FSB member, France has four regulators administering crypto assets. The Directorate General of the Treasury (DG Trésor) works beneath the ascendancy of the Ministry for the Economy, Finance and Industry to adapt “financial bazaar legislation and regulations of basic assets, whether they are acceptable banking instruments or assets that do not abatement beneath the acceptable banking rules,” the Board detailed.

Autorité des Marchés Financiers, the country’s balance and markets authority, regulates “crypto-assets that authorize as transferrable balance through the adjustment and administration of issuers and intermediaries in affairs involving crypto-assets.”

Furthermore, the FSB acclaimed that Banque de France, in affiliation with the Autorité de Contrôle Prudentiel et de Résolution, oversees the banking area and ensures the bland operation of acquittal systems and bazaar infrastructures, emphasizing:

Germany

Three regulators baby-sit crypto assets in Germany. The capital one is the Federal Financial Supervisory Authority (Bafin) which is amenable for licensing and administration accomplishments of crypto-related businesses.

Bafin is additionally amenable for the “Prudential blank on accountant institutes including those alms crypto-asset accompanying services,” the allotment of crypto derivatives, AML/CFT supervision, as able-bodied as bazaar candor and blank apropos crypto assets, accompanying offerings, and crypto trading platforms.

The additional regulator is Deutsche Bundesbank. In cooperation with Bafin, the axial coffer supervises adapted banking casework activities, including those “related to crypto tokens at banking institutions,” the FSB wrote. The coffer additionally assesses the implications of crypto assets from the perspectives of acquittal arrangement blank and budgetary policy.

Lastly, the Federal Ministry of Finance, Bundesministerium der Finanzen, is amenable for crypto-related legislation.

Italy

There are bristles regulators for crypto assets in Italy, according to the FSB. The Ministry of Economy and Finance contributes to crypto-related accommodation action at EU akin and establishes the acknowledged framework aimed at preventing their use for adulterous purposes.

Then there is the axial bank, Banca d’Italia (BdI), which is amenable for the bland activity of the acquittal system. The Board described:

Following the contempo amendments to the country’s AML/CFT legislation, the Financial Intelligence Unit, Unità di Informazione Finanziaria per l’Italiain, “will accept and analyse apprehensive transaction letters filed by crypto-asset operators,” the FSB noted. The regulator will advertise “the after-effects of the analyses to competent authorities for AML/CFT purposes.”

The abutting Italian regulator is the Institute for the Supervision of Allowance which “is carefully afterward the development of crypto-assets in Italy and abeyant accident to the allowance system, both on the asset and on the accountability side.” It additionally monitors allowance articles with crypto assets as basal investments.

The aftermost regulator mentioned for the country is Commissione Nazionale per le Società e la Borsa which regulates crypto assets that are banking instruments. This includes the “supervision of trading venues, accuracy of trading and alike conduct of trading.” For crypto assets that are advised securities, the regulator conducts blank of banking intermediaries and broker aegis such as by ensuring “transparency and acknowledgment by issuers.”

Spain

Spain is a affiliate of the FSB and the EU but not the G20. Nonetheless, it has been arrive as a bedfellow country at the accessible G20 acme in Japan. There are four Spanish regulators listed for crypto assets.

Banco de España, the axial bank, ensures “the able alive and adherence of the banking system,” including the administration of baby institutions and their acknowledgment to crypto assets, the Board conveyed.

The National Balance Market Commission, Comisión Nacional Del Mercado De Valores (CNMV), supervises and regulates crypto assets that are “financial instruments (and added specifically, communicable securities),” the FSB outlined:

In addition, as allotment of its broker aegis mandate, the CNMV monitors risks from crypto assets and publishes advice on crooked entities as able-bodied as broker warnings apropos crypto activities. Another regulator, the General Directorate of Allowance and Alimony Funds, Dirección General de Seguros y Fondos de Pensiones, regulates allowance companies, intermediaries and alimony funds and their acknowledgment to crypto assets.

Lastly, the Ministry of Economy and Competitiveness is amenable for the banking advance of the country. “Since innovator facilitators accept acquired importance, the Spanish Treasury has launched an avant-garde acknowledged blueprint (the Spanish head bill) that covers customer protection, bazaar candor and AML rules, as able-bodied as enabling the development of banking advancing innovation,” the FSB concluded.

The UK

Three regulators accept breach a ample cardinal of responsibilities pertaining to cryptocurrencies in the U.K. HM Treasury develops action and works with added regulators to “improve outcomes for consumers in the crypto-asset market,” including “ensuring a able-bodied and able authoritative framework and ambience the authoritative perimeter,” the FSB claims. It additionally promotes “the development and acceptance of innovative” banking technologies, which includes “applications of crypto-assets and broadcast balance technology.”

The Bank of England monitors “prudential exposures of banks and allowance companies to crypto-assets” and gives allotment to entities affianced in crypto activities. It is additionally amenable for assessing “financial adherence risks” from crypto assets, their use for payments, and their implications for budgetary policy.

The aftermost regulator mentioned for the U.K. is the Banking Conduct Authority which oversees all adapted firms and banking casework activities. It is amenable for the “Authorisation and administration of firms application crypto-asset propositions,” as able-bodied as customer aegis and accessible warnings about crypto assets. The FSB detailed:

The Board added confirmed, “Any badge that meets the analogue of e-money will abatement beneath the ambit of the Electronic Money Regulations. Firms application tokens to facilitate adapted payments may abatement beneath the ambit of the Payment System Regulations.”

What do you anticipate of how the EU and these European countries adapt crypto assets? Let us apperceive in the comments area below.

Images address of Shutterstock.

Need to account your bitcoin holdings? Check our tools section.