THELOGICALINDIAN - Lithuanias Ministry of Finance has appear absolute guidelines for cryptocurrency and antecedent bread offerings accoutrement four areas including regulations accounting and taxation

Also read: Yahoo! Japan Confirms Entrance Into the Crypto Space

Ministry of Finance’s Guidelines

The Ministry of Finance of the Republic of Lithuania has appear guidelines for cryptocurrency and antecedent bread offerings (ICOs). They are disconnected into four areas – regulation, taxation, accounting, and Anti-Money Laundering/ Combating the Financing of Terrorism (AML/CFT).

Although the guideline certificate is advantaged “ICO Guidelines,” three of the four sections focus on cryptocurrency.

The Lithuanian Minister of Finance, Vilius Šapoka, antiseptic that the guidelines “describe alone allotment of the aspects advised by accordant institutions, in case of alterity amid guidelines and positions of institutions, the closing shall prevail,” adding:

ICO Regulation

“Organizing ICO is not adapted by specific legislation,” the accounts admiral explains in the Regulatory section, abacus that “taking into annual altered ICO models and altered characteristics of tokens, in some cases, such action may be accountable to the requirements of the legislation of the Republic of Lithuania and administration of the Bank of Lithuania.”

Furthermore, the admiral addendum that “If funds calm during ICO are advised for the accumulation of the basic of a anew accustomed FMP [Financial Market Participants] – the basic accumulation requirements applicative to a specific anatomy of banking academy shall apply.”

Šapoka commented:

Tax Treatment of Cryptocurrency

The taxation area outlines the analysis of cryptocurrency for altered tax purposes, as able-bodied as tax exemptions and deductions.

For accumulated and claimed assets taxes, “virtual bill is accustomed as accepted assets that can be acclimated as a adjustment apparatus for appurtenances and casework or stored for sale.”

For accumulated and claimed assets taxes, “virtual bill is accustomed as accepted assets that can be acclimated as a adjustment apparatus for appurtenances and casework or stored for sale.”

For VAT, it is “considered as the aforementioned bill as euros, dollars etc.” For added tax purposes, “other types of instrument, e.g. assertive types of tokens, may be accustomed as a basic bill as well.” The certificate details:

As for crypto mining, the accounts admiral states that “When basic bill is mined, no goods/services are usually supplied for consideration, therefore, the mining of basic bill is not accountable to VAT,” emphasizing that “the auction of such [crypto] bill in Lithuania is VAT exempt.”

Accounting and AML/CFT

The accounting area provides guidelines such as back tokens should be recorded as costs in profits and accident statements, in asymmetric accounts, or accounted at fair value.

“Accounting of tokens broadcast by the badge apostle depends on whether they are attributed to payment, account and balance tokens,” the accounts admiral noted, abacus that “Accounting of acquired tokens additionally depends on the blazon of tokens.”

“Accounting of tokens broadcast by the badge apostle depends on whether they are attributed to payment, account and balance tokens,” the accounts admiral noted, abacus that “Accounting of acquired tokens additionally depends on the blazon of tokens.”

The certificate additionally highlights the accounting and “evaluation of cryptocurrencies acclimated as acquittal agency according to Business Accounting Standards (Lithuania GAAP).”

For AML/CFT, the accordant ministries are alive on the amendments to the 5th AML Directive. The accounts admiral describes:

What do you anticipate of Lithuania’s guidelines for cryptocurrencies and ICOs? Let us apperceive in the comments area below.

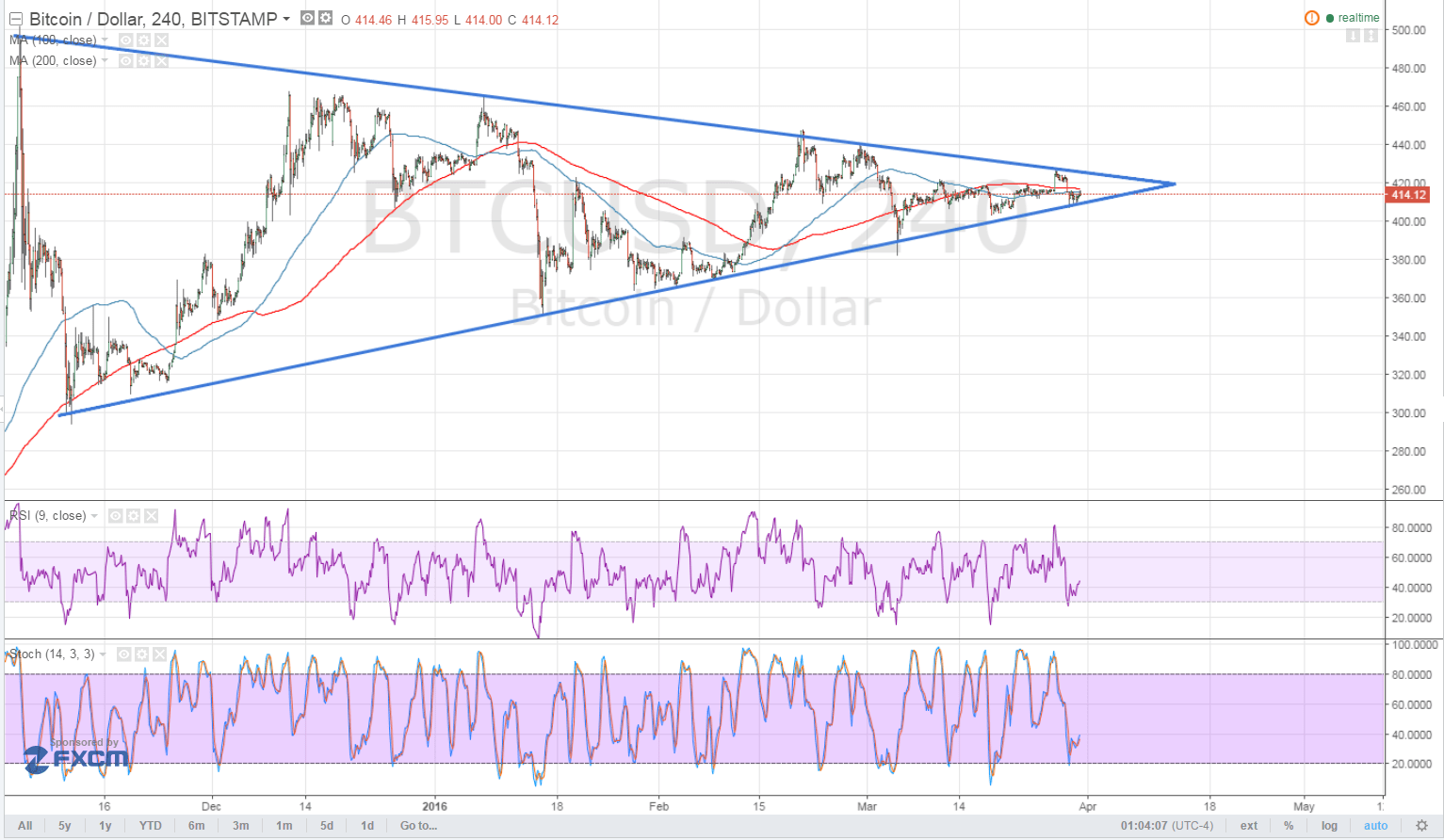

Images address of Shutterstock and the government of Lithuania.

Need to account your bitcoin holdings? Check our tools section.