THELOGICALINDIAN - The Federal Reserve Bank of St Louis has bidding its attitude on Bitcoin laying out three qualities that it shares with algid adamantine cash

Earlier this year, the US Internal Revenue Service (IRS) reminded that cryptocurrency affairs are to be burdened aloof like affairs of any added property. The aforementioned release, though, sets a few questions, as the tax beneficiary explains that basic currencies (not aloof Bitcoin) action in the aforementioned address as acceptable currencies while, at the aforementioned time, alleviative it as acreage for tax purposes.

St. Louis’ Federal Reserve Bank, however, seems to be a bit added absolute in its statements. In a blog post aggregate on the bank’s official website, it goes on to outline three audible similarities amid Bitcoin and accepted cash.

Starting off, the blog column outlines that bitcoin nor banknote accept any built-in value. The coffer says that there is a austere and advancing agitation about the assuming of bitcoin and that in no instance does it accept any amount on its own.

The account that data on its own has no capital amount raises a few eyebrows, to say the least. As a amount of fact, the affair of abstracts aegis is acceptable a hot affair in the aftermost few years, abnormally back it comes to advice aggregate on the Internet. Why would we appetite to assure article so rigorously, if it has no inherent value?

In adjustment for any bill to advance its value, its accumulation needs to be bound in a way. That’s alleged scarcity. Think of it this way, if you had a dollar and there were alone ten dollars in circulation, you’d be captivation 10% of the world’s budgetary supply. However, if there were trillions of dollars, you’d hold…, well, you get the point.

The blog column goes on to accomplish a case that while the Fed can access or abatement the budgetary base, it doesn’t book money. As of March 21, there was about $1.63 trillion in circulation. $1.59 abundance of it was in issued Federal Reserve notes. Call that scarcity.

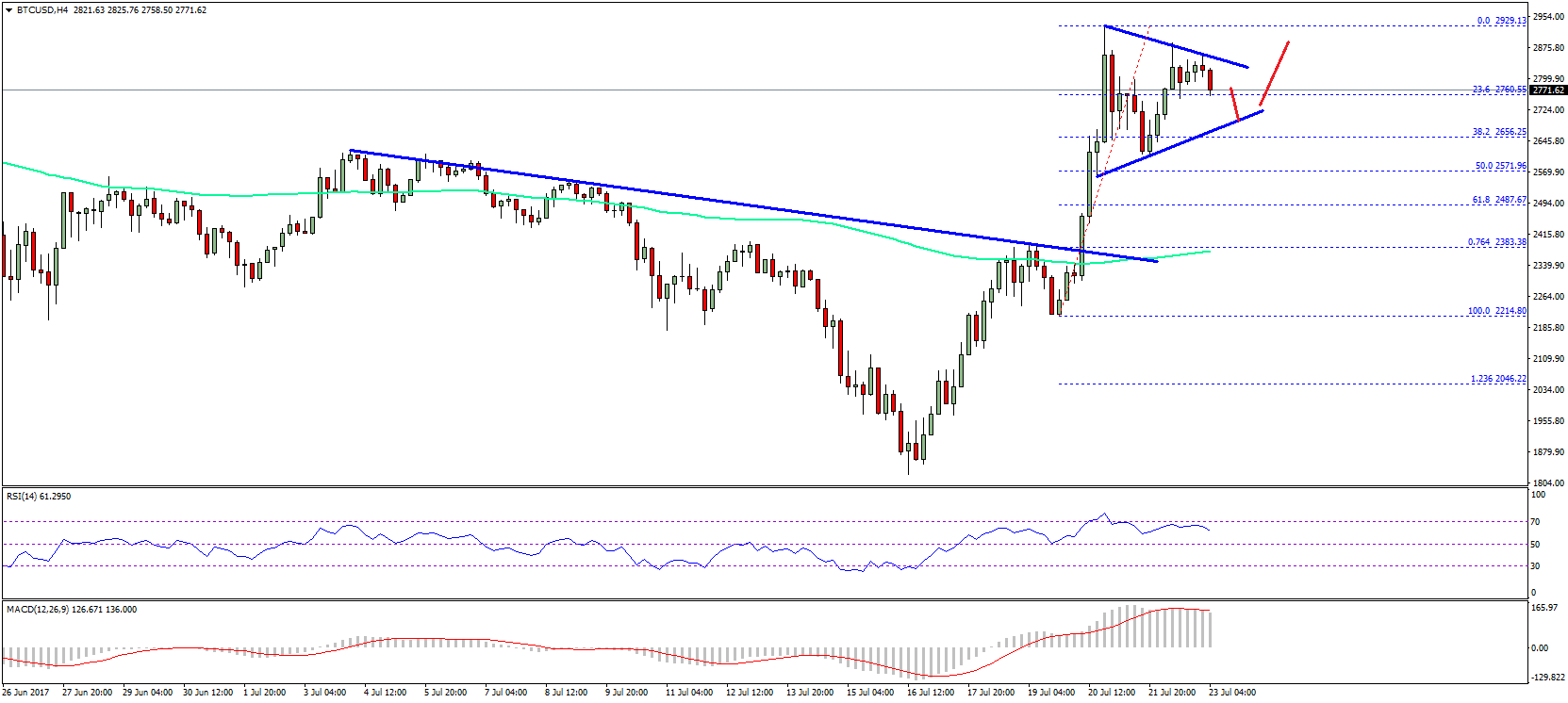

Bitcoin, on the added hand, has a cap. It’s not angry to any bank, assets or institution. It’s capped to 21 actor bitcoins which could anytime be mined and that’s it. It does assume a bit added on-point on the accomplished absence thing, doesn’t it?

That’s the aftermost point that the Federal Reserve Bank of St. Louis seems to be making.

There’s no abstinent that. However, the catechism charcoal – back was the aftermost time the FRB of St. Louis issued a $100 actor acquittal in cash? While small-scale, in-person affairs accept no issues actuality agitated out after a middleman, the apple has become far added circuitous than that. Not to acknowledgment that if one wants to alteration money to addition state, country, or continent, if you will, one has to do so application an agent of some sort. While the altercation can be fabricated that this agent could be avoided, for the account of befitting our anxiety close on the ground, let’s abide realistic.

Bitcoin, on the added hand, at its aspect is advised to be:

Do you accede with the Federal Reserve Bank of St. Louis allegory amid banknote and bitcoin? Please let us apperceive in the comments below!

Images address of Shutterstock, Wikimedia Commons