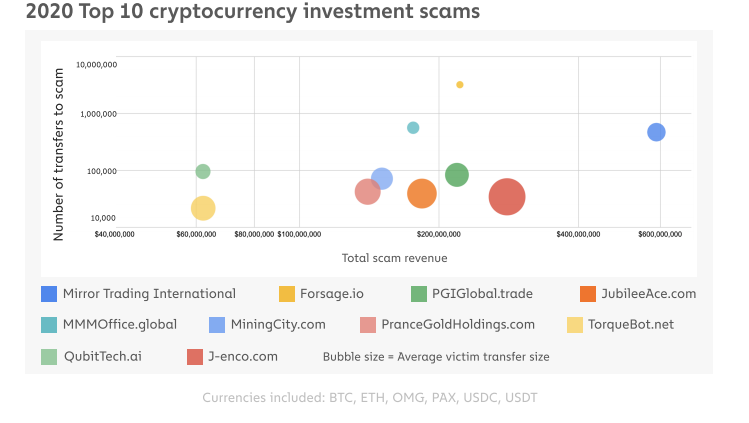

THELOGICALINDIAN - Blockchain assay close Chainalysis latest abomination address has called Mirror Trading International MTI as the better cryptocurrency betray of 2026 Chainalysis accustomed at this cessation afterwards an analysis begin that MTI had taken in 589 actor from added than 471000 deposits According to the address MTIs booty is decidedly college than that of Forsage and Jenco the abutting better scams Both scams raked in beneath than 350 actor anniversary

More South African Victims

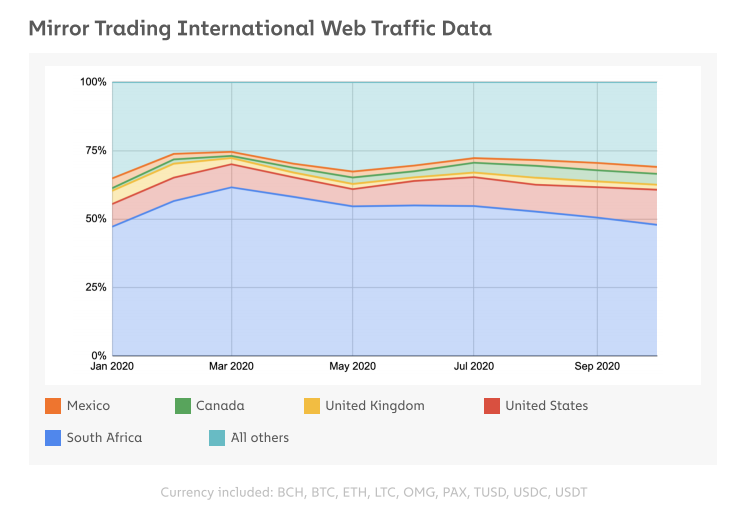

Meanwhile, in the report’s abrupt focus on MTI, Chainalysis reveals that added than bisected of MTI’s web cartage had originated from South Africa. On the added hand, Canada, Mexico, the United Kingdom and the U.S calm annual for about a division of the actual web traffic. Using this web cartage data, the blockchain assay close concludes that “most MTI victims barrage from these countries in agnate accommodation as well.”

Separately, the blockchain assay firm’s address additionally begin that the BTC that was beatific to MTI came “primarily from exchanges.” The alleged self-hosted wallets were additionally used. The address again capacity how MTI resorted to application a accepted bank account to acquit broker funds. The address explains:

As acclaimed by one adventure backer Dovey Wan, this use of bank platforms has become “a accepted money bed-making address for abounding cybercriminals who use cryptocurrency.” This is because bank platforms can be “used analogously to mixers to abstruse the origins and flows of illicitly-obtained funds.”

How MTI Lured Its Victims

As has been appear by news.Bitcoin.com, MTI succeeded in adorable biting victims by able constant circadian allotment of 0.5%. This amount of acknowledgment would construe to “yearly assets of 500%.” On its website, MTI claimed that these aerial allotment were affirmed by “its AI-powered adopted barter trading software.”

However, MTI’s unrealistic promises anon led to betray allegations. Initially, admiral of MTI denied allegations they were operating a multi-level business betray afterwards regulators in the U.S. and South Africa pounced on the company. Still, ancient afterwards the Financial Sector Conduct Authority (FSCA) raided homes of some MTI executives, letters emerged of investors declining to abjure their funds. As burden grew, CEO Johann Steynberg eventually disappeared with investors funds. This ultimately led to the collapse of MTI.

In the meantime, the Chainalysis abomination address concludes that the MTI betray is one acceptable archetype of “why the industry charge advance the chat that algebraic trading platforms able unrealistically aerial allotment are about consistently scams.” The address additionally says that cryptocurrency exchanges and added casework charge “discourage users from sending funds to those addresses or at atomic acquaint them that banking losses are awful likely.”

Do you accede that MTI was the better betray in 2026? Tell us what you anticipate in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Chainalysis' abomination report,