THELOGICALINDIAN - Just afresh during Microstrategys Bitcoin for Corporations accident Stone Ridge Asset Management and New York Digital Investment Group NYDIG architect Ross Stevens explained that he sees a bank of money entering the bitcoin amplitude A anniversary afterwards after that account NYDIG has appear that the aggregation has filed for a bitcoin exchangetraded armamentarium ETF and is acquisitive for authoritative approval

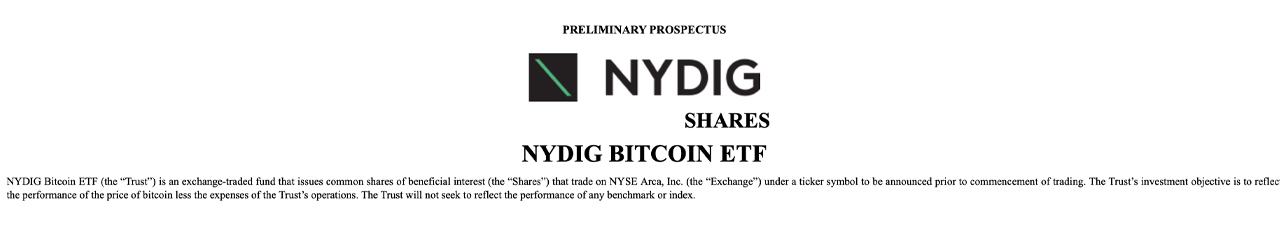

NYDIG Files for a Bitcoin Exchange-Traded Fund With Hopes to Trade on NYSE Arca

Last week, back Ross Stevens told the Microstrategy CEO and bitcoin bull, Michael Saylor that he believes a lot of money was advancing into bitcoin he apparently had a appealing acceptable inclination. Not too continued afterward, Stevens’ close NYDIG a accessory of Stone Ridge Asset Management appear the aggregation is aiming to barrage an exchange-traded armamentarium (ETF). The account follows the contempo Purpose Bitcoin ETF approval, which will barter on the Toronto Stock Exchange.

NYDIG additionally avalanche abaft the bitcoin-based ETF filings registered by the firms Valkyrie Digital Assets and Vaneck. The “NYDIG Bitcoin ETF” filing was filed with the U.S. Securities and Exchange Commission on February 16, 2021. The allotment is a Form S-1 statement, which aims to administer accepted shares barter on NYSE Arca.

“The [NYDIG Bitcoin Trust’s] advance cold is to reflect the achievement of the amount of bitcoin beneath the costs of the Trust’s operations. The Trust will not seek to reflect the achievement of any criterion or index,” the allotment filing notes.

“In gluttonous to accomplish its advance objective, the Trust will authority bitcoin,” the filing continues. “The Trust will amount its assets circadian in accordance with About Accepted Accounting Principles, which about amount bitcoin by advertence to alike affairs in the arch alive bazaar for bitcoin.”

There are about ten companies cutting for a bitcoin ETF in the U.S., according to Jeff Kilburg, architect and CEO of KKM Financial and a accomplice at Valkyrie. Kilburg thinks that 2021 will be the year the SEC approves a U.S.-based exchange-traded armamentarium that leverages the arch agenda asset.

Kilburg jokingly said that it was agnate to consistently allurement addition to get married.

“It’s a agnate access to the way I strategically asked my wife to ally me. Around the 15th or 20th time I asked, she assuredly said yes,” Kilburg told CNBC.

NYDIG Names Morgan Stanley as the Authorized Participant

NYDIG’s SEC filing for a bitcoin exchange-traded armamentarium accordingly was registered the day BTC jumped to a new best high. BTC briefly affected an boilerplate amount of about $50,603 during the aboriginal morning trading sessions (EST) on Tuesday.

NYDIG’s filing additionally addendum that the close will be alive with Morgan Stanley as an initially accustomed participant. Of course, the NYDIG Bitcoin ETF filing additionally has a accomplished folio (pg. 9) committed to answer the “risks” complex with a bitcoin-based advance vehicle.

“Investment in the assurance involves cogent risks and may not be acceptable for shareholders that are not in a position to acquire risks accompanying to bitcoin,” the allotment admonishing says. “The shares are abstract securities. their acquirement involves a aerial amount of risk, and you could lose your absolute investment. you should accede all accident factors afore advance in the trust.”

What do you anticipate about the latest bitcoin ETF filing by New York Digital Investment Group (NYDIG)?

Image Credits: Shutterstock, Pixabay, Wiki Commons, sec.gov/Archives/