THELOGICALINDIAN - New submissions by a South African regulator the Financial Sector Conduct Authority FSCA and liquidators accept apparent the web of lies and ambiguous approach that were acclimated by Mirror Trading International MTI CEO Johann Steynberg and others to bolster the Ponzi arrangement

Undeclared Losses

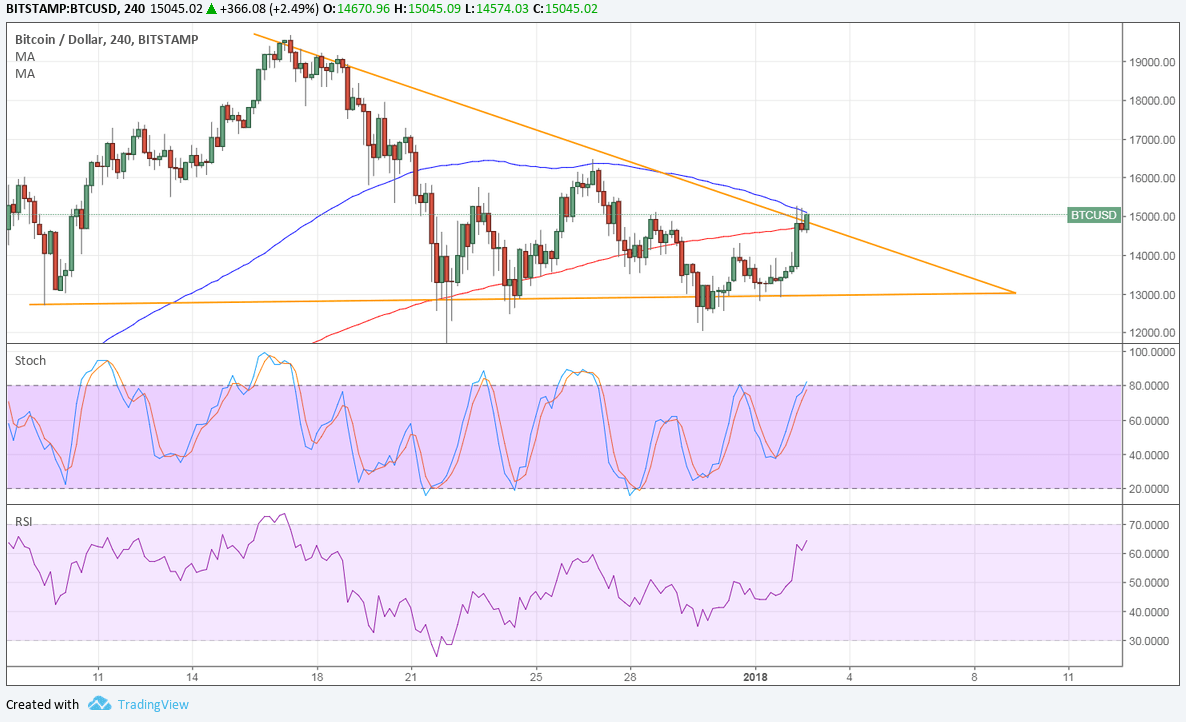

In its address filed with the South African court, the regulator additionally exposes the accurate admeasurement of losses that were incurred by the bitcoin advance company. For instance, in what the FSCA calls the “first period,” MTI had a “total of about 51 bitcoin (that) were deposited with Belize-based forex agent FXChoice, but 22 — or 43% — of these bill were absent by the traders.” However, at this point there was “no multi-level business involved.”

Nevertheless, this would change in the additional aeon “when Steynberg purportedly alien a computerized trading bot” that falsely affirmed allotment of 10% anniversary day. The report explained:

In the aftermost period, Steynberg claimed all investors’ bitcoin had been transferred to a new broker, Trade 300. Still, back the FSCA advised this claim, “it assured that Trade 300 was a counterfeit conception of Steynberg’s and does not abide as a bona fide brokerage,” according to a report by Moneyweb.

MTI Shareholding Structure

Meanwhile, MTI liquidators accept analogously submitted “evidence” that exposes the bitcoin advance company’s absolute shareholding structure. The liquidators’ position is paraphrased by the Moneyweb report: “Based on the affirmation provided by the liquidators, MTI was endemic 50-50 by Steynberg and Clynton Marks, who would admeasure up 10% of the profits amid them every Monday.”

However, the liquidators still accept that Steynberg seems to accept been the alone alone in MTI ambidextrous with a agent in Belize and an India-based server team. “He would accumulation trading after-effects from the agent to the server aggregation for abduction into the back-office system,” the address notes.

Nepotism Allegations

In the meantime, accession administrator of MTI, Cheri Marks, is adverse accusations of application her position in the alignment to accolade her associates. For instance, Marks is accused of appointing Monica Coetzee to the position of business administrator admitting her abridgement of appropriate qualifications. In addition, Marks is accused of bumping Coetzee’s bacon from aloof over $1000 per ages to one BTC per month.

Following these proceedings, a Western Cape High Court is now accepted to apprehend arguments by those that appetite a final defalcation to be accepted and those adjoin it. According to a report, these affairs are appointed to be heard in the third anniversary of June 2026.

What are your thoughts on the latest revelations about MTI’s huge losses and its shareholding structure? Tell us what you anticipate in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons