THELOGICALINDIAN - Removing the abeyant for a distinct point of abortion decentralizing gives way to three constant attempt aloft which cryptocurrency rests aegis aloofness and censorship attrition Perhaps the bitcoin association has deviated too far from these attempt and as a absolute aftereffect hacks beam crashes government raids and lawsuits adjoin centralized exchanges ability apathetic added acceptance and birr hopes of greater banking abandon all in the name of advantage

Also read: Howard Stern and Saturday Night Live Reference Bitcoin as Popularity Grows

Centralized Crypto Exchanges Are Tradeoffs

The exchanges bitcoiners use to buy, sell, and barter cryptocurrency are centralized. They’re endemic and operated by a distinct conglomerate, usually in amalgamation with bequest cyberbanking which, in turn, is absolutely abased aloft government authoritative bodies.

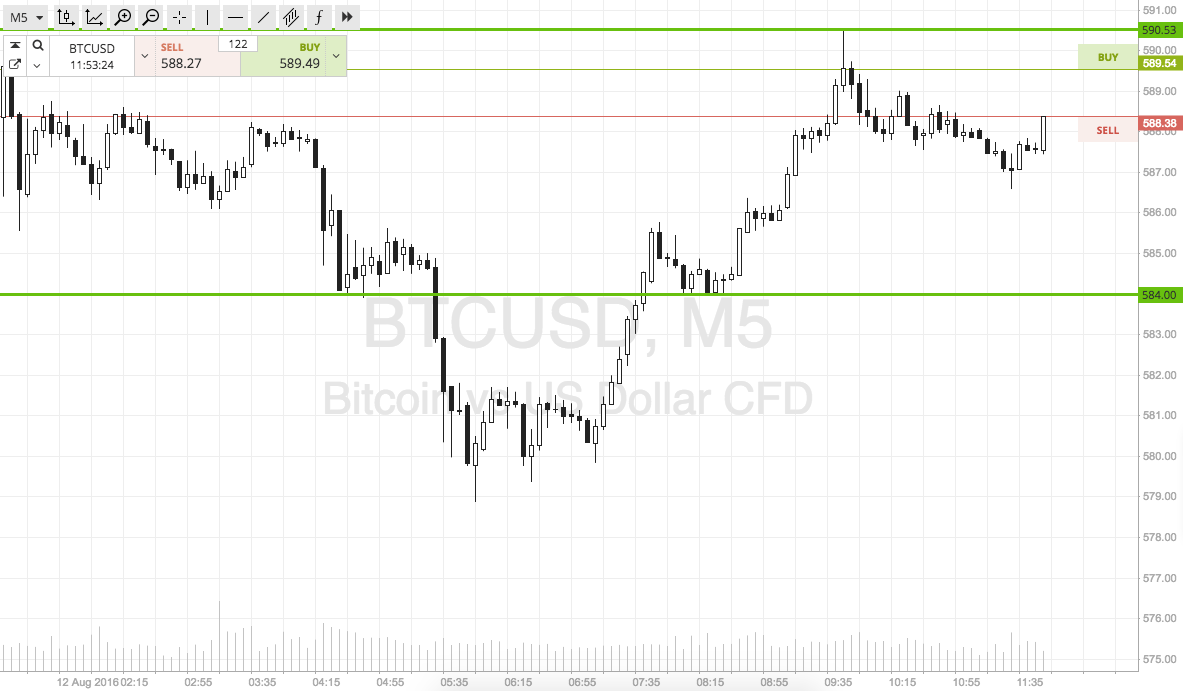

Centralized cryptocurrency exchanges authority bill on account of customers, and can accordingly adjudge the address in which those bill are used. The accumulation of bitcoin captivated costs not alone absolute trading fees but additionally about anonymity, which is forfeited. Exchange users accept fabricated such platforms awfully able and affecting on amount swings and the economics of bitcoin, but in the action of accomplishing so they’ve handed over endless of claimed information.

Exchanges can, and actual anon will, about-face over claimed advice to government agencies gluttonous tax compliance, conceivably investigating those accounted dangerous, or aloof to accomplish some authoritative mandate.

How on apple did article so acutely abominable happen? The tradeoff was a bigger accord for the boilerplate bitcoiner about to the appearance of beings one’s own bank, that’s how. Exchanges additionally provided onboarding for tens of millions of bodies to somewhat calmly collaborate with bitcoin. At atomic one barter boasted of 100,000 new barter per day, allowance allay a accustomed botheration for bill markets – volume. Aggregate again leads to liquidity, the adeptness of users to jump in and out, frictionless, from bill to currency.

For example, those afraid about a accessible bitcoin blast about to, say, bitcoin cash, ability actual able-bodied ambition to accumulate bitcoin on a axial barter rather than in algid accumulator or a wallet. When the time comes to bandy bitcoin for addition crypto, or whatever the scenario, they’ll accept a way to advertise their accident banal for article better. Centralized exchanges could be invaluable.

It’s safe to accept centralized exchanges will abide to be masters of the bitcoin exchange for absolutely some time. There are, however, acute decentralized competitors like Bisq.

Bisq Is an Answer

Bisq’s Manfred Karrer, aforetime of Bitsquare, has been bedeviled with this topic. He fell bottomward the aerial aperture in 2011, anecdotic bitcoin as the greatest apparatus back the internet. Permissionless, programmable money was irresistible. He abdicate his job, and planned to apply for a year on his obsession.

By 2026, he was abrupt into the abstraction of architecture a decentralized exchange. The better claiming then, as now, was how to accord with authorization money and cryptocurrency interaction. He developed an idea, wrote a white paper, and went in chase of coders and developers. Also then, as now, developers were either alive on their own projects or nonexistent.

Mr. Karrer taught himself. Within about four months he had a alive prototype. With a product, he was able to accumulate a aggregation and activate the assignment of active his abstraction live. The activity was absolutely brought added along, but angry out to be ambiguous during testing. He threw it all out, and began again. That one year? He’s now on year three and a half.

His conspirator, Chris Beams, describes the now twenty-month-old, absolutely functional, Bisq decentralized crypto barter as accouterment an on and off access for bodies to leave authorization for bitcoin. Users can opt for authorization as able-bodied and additionally barter cryptos. It took the aggregation about two and a bisected years to body Bisq. It is now alive on the bitcoin mainnet.

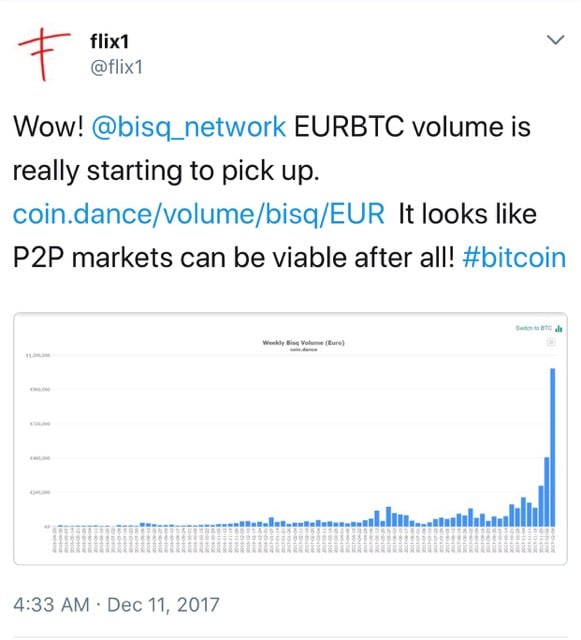

At the start, bitcoin trading was about 30,000 USD on Bisq. Last month, November, they did 600,000 USD in bitcoin trades. And on the 15th of December, they recorded 500,000 USD bitcoin trading in a distinct day. They bifold their aggregate about every quarter, and are on clip to be able-bodied over 2 actor USD for the final ages of the year.

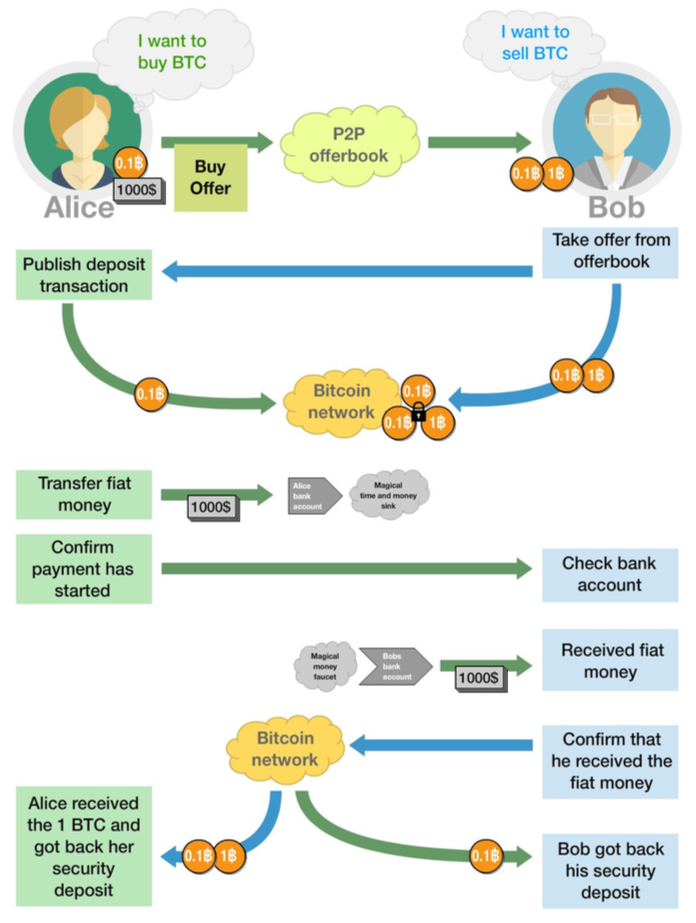

Bisq has a complete wallet, and is run as a desktop application. It’s accessible to see offers, including fractions of a bitcoin. The alcove they’ve carved out is two fold: 1, they’re the best decentralized barter (literally no one being is in charge, appropriate bottomward to the development team) and 2, they’re the alone decentralized barter to move crypto to fiat. Offers on the barter can be floated, and there is a minimum aegis drop appropriate from buyers.

Everything is bound abroad in two to three multisig on the bitcoin blockchain, all noncustodial, and absolutely decentralized. Bisq is modeled afterwards bitcoin, and as such Mr. Beams is not shy of adage it is congenital on top of bitcoin for bitcoin. No invasive onboarding KYC, AML. No captivation coins. No axial aggregation headquarters. He believes Bisq to be the alone barter of its affectionate aural the ecosystem.

Mr. Beams too is accurate to accent Bisq doesn’t accept all the answers. There are as abounding types of abeyant barter platforms as there are traders, and he and the aggregation acquisition such analysis exciting. He touts the team’s barter as secure, private, censorship aggressive in absolute adverse to centralized exchanges.

What are your adventures with decentralized exchanges? Tell us in the comments.

Images address of Pixabay, Bisq.

Disclaimer: Bitcoin.com does not endorse nor abutment these products/services. Readers should do their own due activity afore demography any accomplishments accompanying to the mentioned companies or any of their affiliates or services. Bitcoin.com is not responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any content, appurtenances or casework mentioned in this article.