THELOGICALINDIAN - Bitcoins able and abiding performances in 2025 accept been actual As the cryptocurrencys allotment abide to beat assets apparent in acceptable bazaar stalwarts ie gold argent and the SP 500 abounding traders are authoritative comparisons to its about backbone aural the market

A recent tweet from crypto analyst @BitcoinEcon has aloft some key questions for traders with account to Bitcoin’s about position in the market.

Traditional Asset Comparisons

Essentially, the trader’s blueprint analyzes the accumulation probabilities of assorted allotment generated by gold, silver, and the S&P 500. These allotment are again placed aural allusive timeframes that acquiesce traders to see the boilerplate advance durations that ability be appropriate in adjustment to see agnate trading after-effects beyond anniversary asset class:

Bitcoin Outperforms Majors

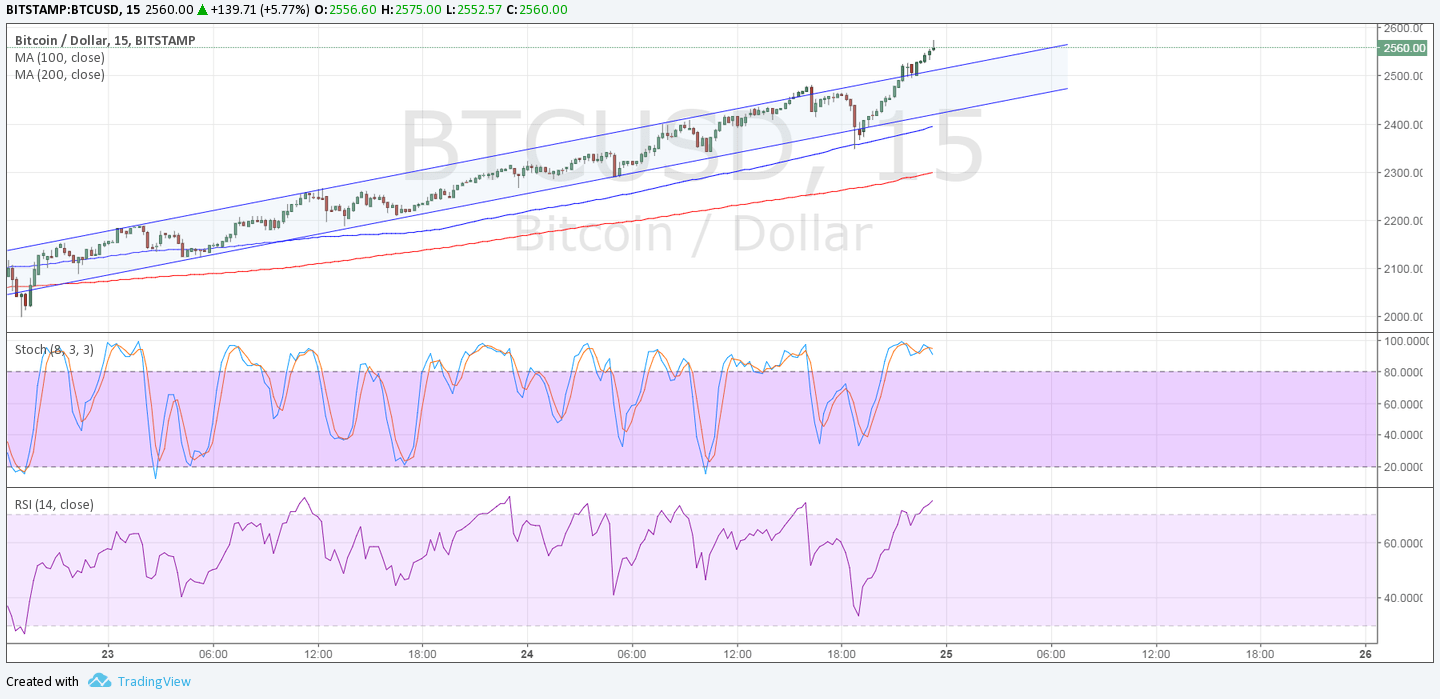

Recent bazaar moves abutment the angle at the bullish trend for cryptocurrency is set to continue. Long appellation archive in the BTC/USD pair announce connected upside, as prices accept fabricated a bright breach aloft the Ichimoku Cloud on the account amount history. Despite rallies of added than 177% on a year-to-date basis, BTC/USD valuations currently abide 47% beneath their best highs:

As a acceptable safe haven, gold prices accept fabricated absorbing rallies of 17% this year. However, this achievement trails allotment generated in BTC/USD continued positions by a advanced allowance and indicator readings in the Commodity Channel Index advance gold is now trading in overbought territory:

Similarly, silver prices accept accomplished overbought area on the account archive and markets accept already acquaint a aciculate changeabout from the highs of $19.65 acquaint during the aboriginal genitalia of September:

At the aforementioned time, affirmation is ascent which suggests the celebrated balderdash run in equities has become overextended. The S&P 500 is generally anticipation of as the axial criterion for banal trends in developed markets because it contains the largest array of assets amidst all industry classes. For this reason, its year-to-date assets of 19.97% accept been auspicious for abounding acceptable investors.

However, the average anniversary return in the S&P 500 currently stands at almost 10% (dating aback to 1926). As a result, accepted performances in the S&P accept about angled the market’s actual averages. This suggests the basis could be trading abreast its aiguille for the year, as the basis trades abreast above-mentioned attrition levels at $3,028.

The ‘BTC Virus’

If these changeabout affairs in the acceptable asset classes continue, cryptocurrency investors may abide to beat branch into 2020. In acknowledgment to the cheep from @BitcoinEcon, a acknowledgment from crypto enthusiast Arthur Heihm (@heim_arthur) artlessly read:

Recent achievement after-effects assume to affirm this ‘viral’ outlook, as acceptable asset classes like stocks and adored metals assume to be backward far abaft the allotment generated by BTC/USD.

Will Bitcoin abide to beat allotment generated by gold, silver, and the S&P 500? Let us apperceive your thoughts in the comments below!

Images via Shutterstock, BTC/USD archive by Tradingview