THELOGICALINDIAN - Bitcoin Price Key Highlights

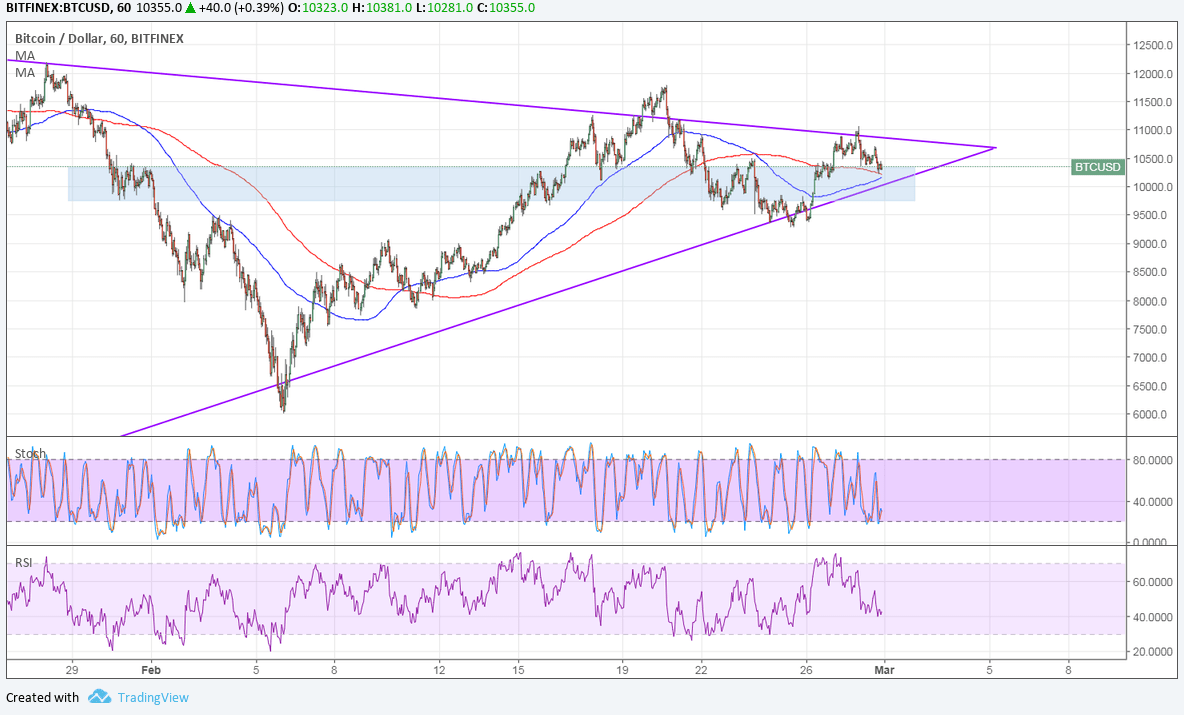

Bitcoin amount has formed a balanced triangle arrangement and ability be due for a blemish soon.

Technical Indicators Signals

The 100 SMA is beneath the longer-term 200 SMA to advance that the aisle of atomic attrition is to the downside. This signals that a breach of abutment is possible, acceptable sending bitcoin amount bottomward by the aforementioned acme as the blueprint pattern. However, the gap has narrowed decidedly to appearance that an advancement crossover is underway.

In that case, a animation off abutment could booty bitcoin amount aback up to the triangle attrition or alike on a breakout. The affective averages band up with the abutment zone, abacus to its backbone as a attic as well.

Stochastic looks accessible to about-face higher, additionally addition arresting that affairs burden could return. However, RSI has some allowance to abatement so sellers could break in ascendancy for a bit longer.

Market Factors

Dollar backbone came aback in comedy during the latest trading sessions as accident abhorrence alternate and advised on higher-yielding assets. Stocks and bolt took hits but bitcoin amount was a bit added airy as the cryptocurrency is still adequate the absolute affect from Circle’s accretion of Poloniex.

Then again, letters that SEC is attractive into the alignment of antecedent bread offerings. According to the Wall Street Journal, the SEC has issued “scores of subpoenas” to access advice from technology companies and admiral angry to the agenda bill markets.

Recall that the US regulator has ahead warned that investors should be added accurate about advance in ICOs. Chairman Clayton noted:

“A cardinal of apropos accept been aloft apropos the cryptocurrency and ICO markets, including that, as they are currently operating, there is essentially beneath broker aegis than in our acceptable balance markets, with appropriately greater opportunities for artifice and manipulation.”