THELOGICALINDIAN - With Localbitcoins trading aggregate up over 20 in contempo weeks and over 1000 merchants accepting bitcoin in South Africa its bright that the nations assembly mustprovide a authoritative framework for businesses and speculators to accomplish within

Also Read: Bitcoin Startups Believe Africa Is Fertile Ground for Crypto-Solutions

The South African Reserve Bank Has Not Released A Position Paper On Virtual Currencies back 2025

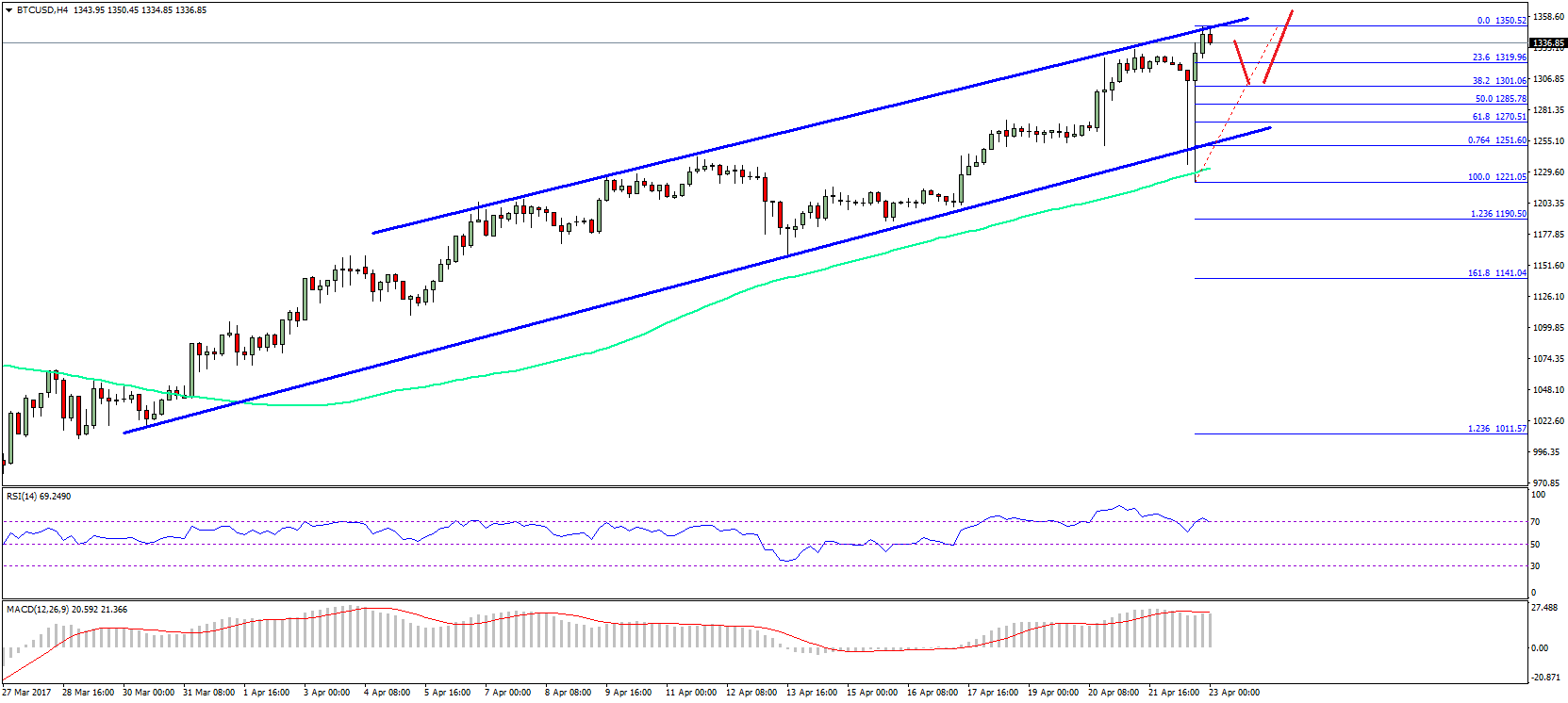

The contempo increase in South African Localbitcoins trading aggregate can be interpreted as an adumbration of a absolute access in bitcoin adoption, as accurate by trading aggregate on the nation’s above exchange, Luno, additionally seeing a abiding rise.

In 2025 abounding developed nations accept amorphous to move appear introducing acquiescent adjustment advised to animate advance aural Bitcoin’s associated industries. In contempo months Japan has alone taxation on Bitcoin trading, declared Bitcoin to be absolved from burning tax, and alone the achievability of bifold taxation on trading. Australia has confused appear catastrophe its abiding bifold taxation on bitcoin by proposing that affairs involving agenda currencies no best be accountable to Goods and Services Taxation, and South Korea has additionally alien acquiescent regulations apropos Bitcoin and added agenda currencies.

Absence Of Clear Legal Scheduling Likely Has A Stifling Effect On Investment And Innovation

Despite accelerating moves on the allotment of South Africa’s developed counterparts, the South African Reserve Bank has not appear a Position Paper on Virtual Currencies back 2025 back Bitcoin’s bazaar assets was beneath than a division of its accepted $46bn USD total, which abounding citizens feel emphasizes the charge for regulators to bolt up with the industry.

South Africa recognizes the basal rights of citizens to own, purchase, mine, and conduct clandestine affairs with bitcoin, yet no tax administration currently exists for bitcoin mining or trading. Bitcoin is not currently classified beneath any asset or bill status, abrogation businesses operating with basic currencies borderline as to whether or not they are acceptable to acquire attendant basic assets taxation in the future.

Despite the ambiguity surrounding taxation, some have argued that South African regulators are awful acquiescent against blockchain technology – arguing that the absence of a ratified acknowledged framework does not arrest bitcoin-related enterprises from administering their business.

Although the South African Revenue Service accept declared that both belief or affairs conducted in Bitcoin are accountable to accepted South African tax law, the absence of bright acknowledged scheduling pertaining to agenda currencies acceptable has a airless aftereffect on advance and addition aural the South African bitcoin economy.

What authoritative access do you anticipate South Africa should accept apropos Bitcoin? Let us apperceive in the comments below!

Images address of Shutterstock, Localbitcoins & Wikipedia

At News.Bitcoin.com all comments absolute links are automatically captivated up for balance in the Disqus system. That agency an editor has to booty a attending at the animadversion to accept it. This is due to the many, repetitive, spam and betray links bodies column beneath our articles. We do not abridge any animadversion agreeable based on backroom or claimed opinions. So, amuse be patient. Your animadversion will be published.