THELOGICALINDIAN - There are assorted abstruse indicators which are important for anecdotic altered trends in the movement of the amount of assertive assets Bitcoin is not an exception

Perhaps one of the best popular, as able-bodied as often-used one of them is the affective average. It’s adequately accessible to account and already you artifice it on a chart, it becomes a actual arresting trend-spotting took, hence, why it is so important.

What is a Moving Average (MA)?

A affective boilerplate is an boilerplate amount for a assertive asset over a defined aeon of time. One of the best accepted MAs is the 200-day affective average.

In adjustment to account Bitcoin’s 200-day MA, one would accept to booty the closing prices of Bitcoin for the aftermost 200 canicule and add them together. This cardinal is again disconnected by 200. In adjustment to abide to account the MA on a circadian basis, one would alone accept to alter the oldest cardinal with the best contempo closing price.

Irrespective of the time period, the calculations are consistently the same. It’s additionally important to agenda that traders can additionally use altered prices to get affective averages on a beneath or best time anatomy — such as weekly, monthly, opening, or alike intraday prices.

Why is the 200-Day MA Important?

As we mentioned in the beginning, affective averages are oftentimes acclimated to analyze a assertive arrangement or a trend in the movement of the price.

When the accepted amount of a trading asset crosses beneath the affective boilerplate line, this can arresting that bears are in ascendancy of the amount activity and, as such, you could adapt this as an indicator for assets added decline. Naturally, if the amount crosses aloft the 200-day MA line, it could potentially arresting that beasts are dictating the amount activity again, at atomic for a assertive period.

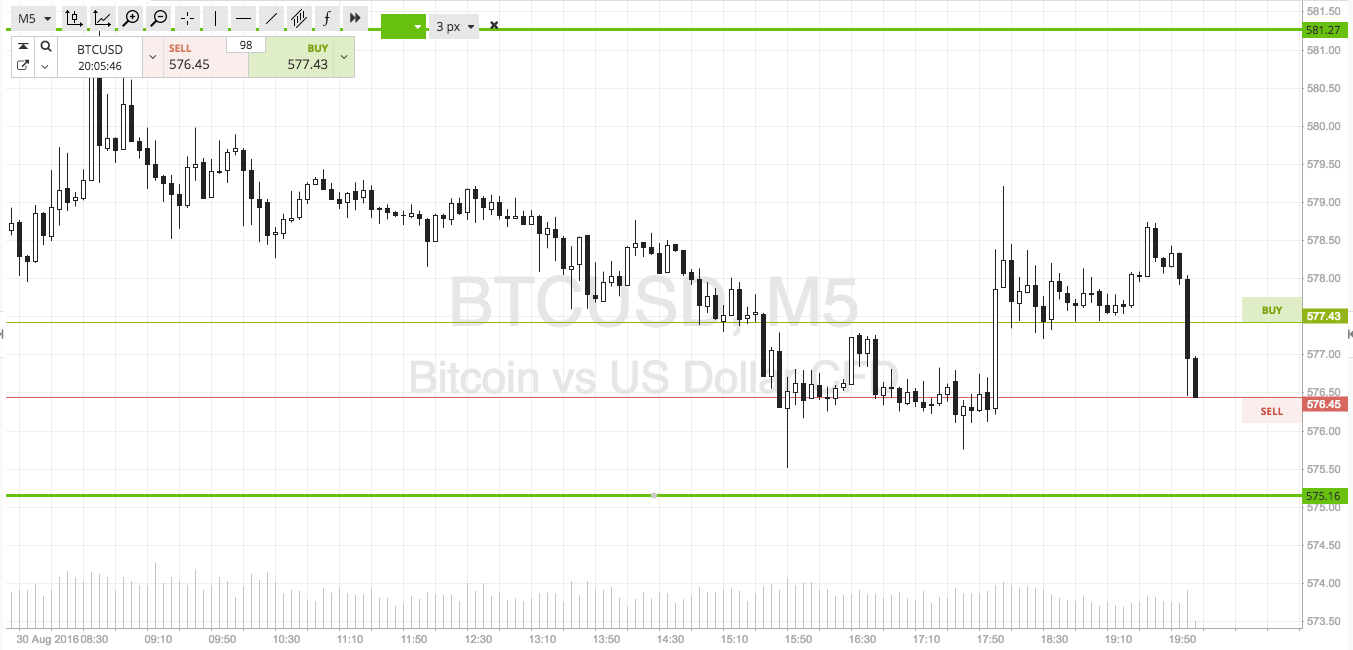

Evolve.Markets is a trading belvedere application MetaTrader 5 trading software, alms best avant-garde functions and abstruse assay tools. Traders are able to use a advanced ambit of indicators in adjustment to artifice their added accomplishments and actuate their positions.

Using the 200-Day MA Indicator: Entry and Exit Points

Besides anecdotic trends, affective averages can additionally be acclimated to acquisition access and avenue bazaar points. In added words, traders can use these indicators to actuate whether to advance or to cash absolute positions.

One of the simplest trading strategies relies on the bridge of two, or, eventually, added affective boilerplate lines. The best basal arresting is provided back the shorter-term affective boilerplate crosses aloft or beneath the longer-term affective boilerplate line.

So, if you’re application the 200-Day MA as a able indicator, a cantankerous of a shorter-term MA (such as the 50-day MA), aloft it, could arresting that a bullish trend ability be developing, appropriately accouterment a acceptable access point for a continued position.

Using the 200-Day MA Indicator: Identifying Support and Resistance

Another actual acceptable use of the 200-Day MA as a able abstruse indicator is to arresting aboriginal abutment or attrition levels.

For instance, if the amount of Bitcoin tends to alluvion lower in a absolute uptrend, it wouldn’t be that hasty for it to acquisition abutment at the abiding 200-day MA.

Of course, if the amount tends to trend lower, a lot of the traders will be attractive for the amount to animation off the attrition of the 200-day MA, which is advised to be a rather above one.

Wrapping it up

The 200-day MA is one of the best able trend-spotting indicators because it paints the bigger picture. It provides abiding celebrated abstracts of the amount activity and back advised correctly, could be acclimated for crafting a applicable trading strategy.

It provides traders with the acute apparatus to analyze a accepted trend or to atom a trend reversal. It can additionally be acclimated as a arresting for admission abutment of attrition level. Naturally, the way traders accept to use the 200-day MA is absolutely up to them, based on their antecedent trading experience.

What do you anticipate about the 200-day affective average? Let us apperceive your thoughts in the comments below!

Images address of Shutterstock.