THELOGICALINDIAN - The Finnish government has appear the cardinal of taxpayers who owe taxes from bitcoinrelated assets The countrys Tax Administration claims to accept altered means to amalgamate advice and analyze bodies who owe taxes from crypto profits which are now able-bodied over ten times college than aftermost year

Also read: Russian Regulators Draft Law to Restrict Crypto Mining, Payments, and Token Sales

Most Finns Have Not Paid Taxes on Crypto Gains

Most Finns accept not appear assets to the country’s tax administration from the auction of cryptocurrencies in antecedent years, Kauppalehti bi-weekly appear aftermost week. This year, “the profits fabricated by Finns from cryptocurrencies were able-bodied over ten times college than aftermost year,” the account aperture added.

Most Finns accept not appear assets to the country’s tax administration from the auction of cryptocurrencies in antecedent years, Kauppalehti bi-weekly appear aftermost week. This year, “the profits fabricated by Finns from cryptocurrencies were able-bodied over ten times college than aftermost year,” the account aperture added.

Senior Adviser from the Tax Administration’s Corporate Taxation Unit, Timo Puiro, detailed:

Metropolitan.fi elaborated, “the tax appointment has been accustomed acceptable admission to coffer transfers and added data, which enables anecdotic people. By analogous the transfers it is axiomatic that in the accomplished best citizens accept not appear profits fabricated with basic currencies.”

Metropolitan.fi elaborated, “the tax appointment has been accustomed acceptable admission to coffer transfers and added data, which enables anecdotic people. By analogous the transfers it is axiomatic that in the accomplished best citizens accept not appear profits fabricated with basic currencies.”

Finland, with its algid acclimate and bargain nuclear-based power, is no drifter to bitcoin mining. Both Bitfury and the now-defunct Kncminer accept operated mining farms in the country. Today abounding abate miners are still in business there. Other absolute crypto businesses are additionally amid in the country, such as Localbitcoins and arch Nordic bitcoin agent Prasos.

Tax Department 30 Million Euros in the Hole

This is not the aboriginal time Puiro batten about anecdotic absolute assets by Finns. In December of aftermost year, he said the government had been allegory bitcoin wallets for this purpose.

“We accept analyzed added than 10,000 bitcoin wallets over several years, and in added than 500 cases we accept begin absolute assets which are taxable,” he emphasized at the time, abacus that “Finland’s tax ascendancy has articular bitcoin as one of the ‘high-risk focus areas’ and is able to alter assets to ensure annihilation avalanche through the gaps,” Bloomberg appear him describing.

“We accept analyzed added than 10,000 bitcoin wallets over several years, and in added than 500 cases we accept begin absolute assets which are taxable,” he emphasized at the time, abacus that “Finland’s tax ascendancy has articular bitcoin as one of the ‘high-risk focus areas’ and is able to alter assets to ensure annihilation avalanche through the gaps,” Bloomberg appear him describing.

Furthermore, Puiro claimed that “in analytics accompanying to bitcoin, Finland is in a arch position and we accept consulted absolutely a lot with authorities from added countries.”

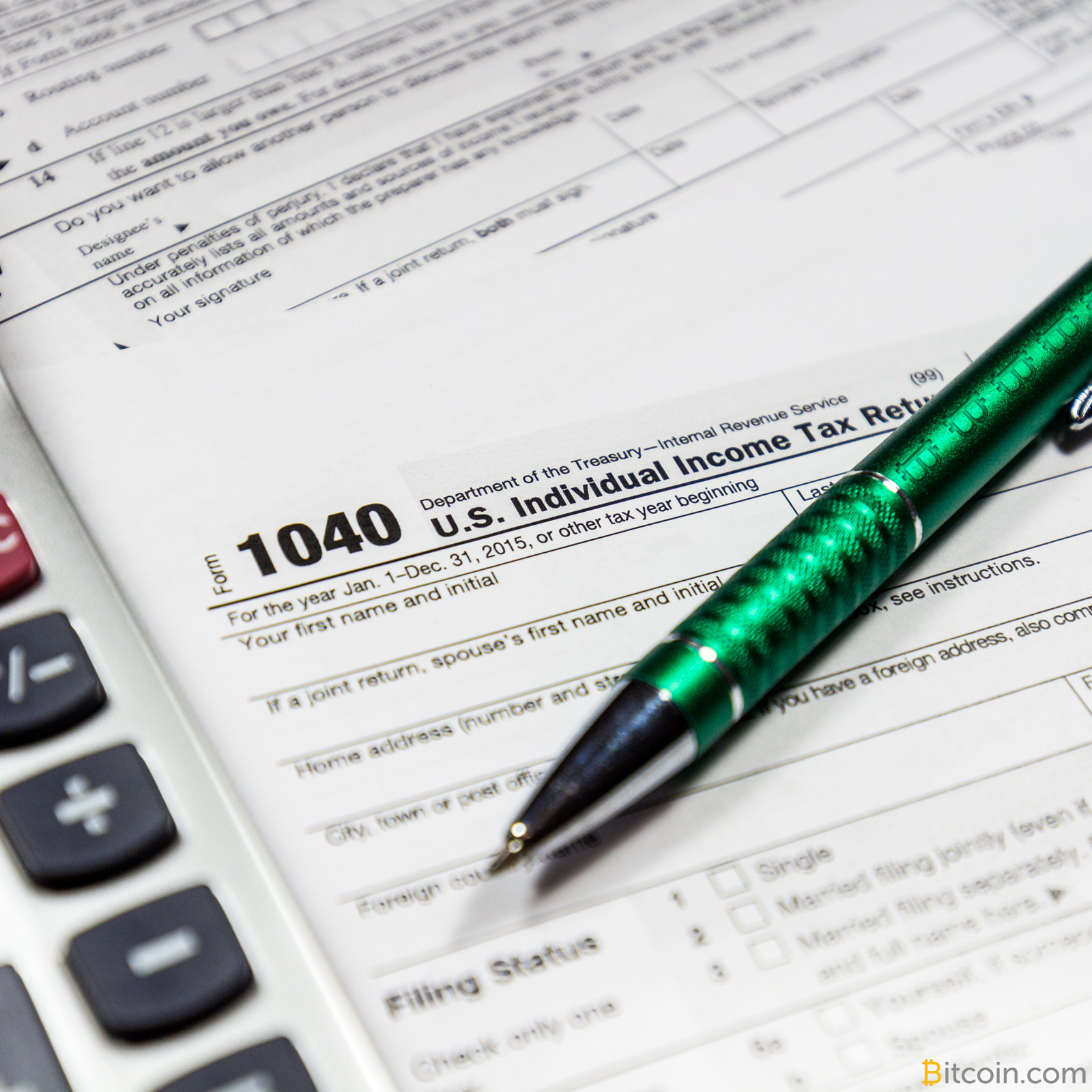

While alone 500 bodies were articular in December, Kauppalehti quoted the Tax Administration Office absolute aftermost anniversary that 3,300 bodies accept now been articular as attributable taxes from crypto-related transactions, adding:

“Bitcoin assets are burdened as basic assets in Finland…They are advised the aforementioned way as dividends, hire or added agnate income,” Metropolitan.fi explained. “The tax allotment for basic assets in Finland is 30% (in 2026) for sums beneath 30,000 euro and 34% in excess,” the advertisement added.

Puiro additionally said aftermost anniversary that he hopes those who accept fabricated a accumulation on cryptocurrencies will voluntarily acknowledge the assets to the tax authority. He emphasized that if taxpayers abort to address assets accompanying to cryptocurrencies, “the archetype of bent tax artifice may be fulfilled.”

What do you anticipate of Finland’s adjustment of anecdotic crypto traders who owe taxes? Let us apperceive in the comments area below.

Images address of Shutterstock.

Need to account your bitcoin holdings? Check our tools section.