THELOGICALINDIAN - The US Internal Revenue Service IRS has accomplished and put in use a new tax anatomy that requires crypto owners to acknowledge whether they accustomed bought awash exchanged or acquired any cryptocurrencies in 2026 Tax experts are balked at the vagueness of the tax bureau with some analytic whether the answers would access the affairs of actuality audited by the IRS

Also read: IRS Dispels Crypto Tax Confusion

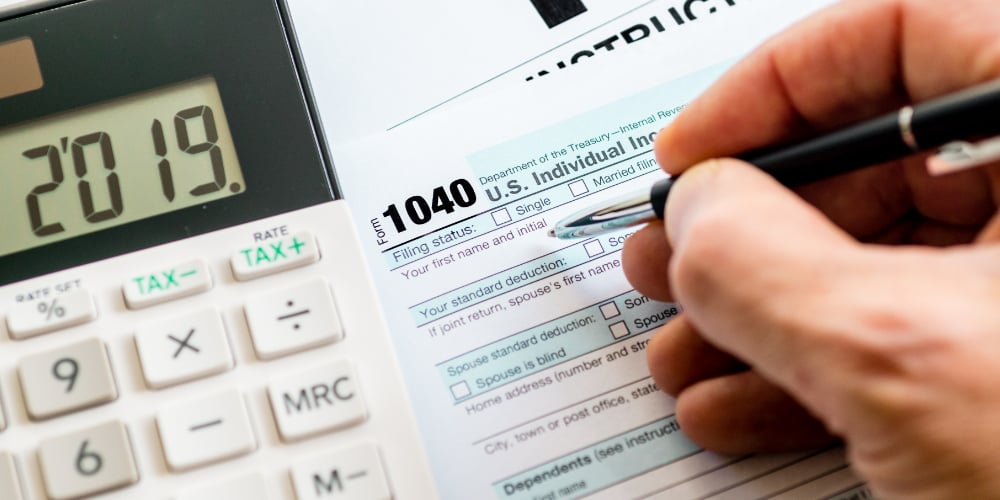

New Tax Form With Crypto Question

The IRS appear a new tax form absolute a catechism about cryptocurrency on Thursday. The Schedule 1 anatomy is allotment of the 1040 tax anatomy for U.S. taxpayers to acknowledge “Additional Income and Adjustments to Income.” The IRS aboriginal apparent the abstract of this anatomy in October, as news.Bitcoin.com previously reported. The anatomy is now accomplished and acquaint on the IRS website for use in filing 2019 tax returns. Anatomy 1040 is acclimated by over 152 actor U.S. tax filers. The aboriginal catechism on the new Schedule 1 reads:

What Will the IRS Do?

The crypto catechism at the alpha of the new tax anatomy has the crypto association academic the IRS’ intention, what it will do with the information, and what absolutely needs to be declared. A tax able told CNBC that “The analysis itself is a ambiguous one.”

Sarah-Jane Morin, a accomplice at Morgan Lewis in San Francisco, told the publication, “As a aborigine myself, I acquisition this catechism actual arresting because it isn’t clear.” She acicular out that affective one’s own cryptocurrency from one wallet to addition could be advised “sending.” Morin assured that “The best bourgeois access that a aborigine can booty is to accede any alternation you’ve had with basic bill and whether there’s any way this can abatement beneath this actual ample account of what you could’ve affianced in during 2026.”

Jeffrey Levine, a CPA and administrator of banking planning at Blueprint Wealth Alliance in New York, was quoted by the account aperture as saying:

The IRS has a history of actuality ambiguous back it comes to demanding crypto transactions. The bureau appear new tax guidelines in October to supplement its antecedent advice issued in 2014. However, while the new advice answers some questions, it additionally raises several more, abnormally apropos how adamantine forks and airdrops are taxed. In November, two attorneys in the IRS Office of Associate Chief Counsel (Income Tax and Accounting) attempted to acknowledgment some questions apropos adamantine forks and like-kind exchanges.

IRS Increases Focus on Crypto

The IRS has been accretion its efforts to acquisition and tax crypto owners. The agency’s Criminal Investigation Annual Report 2026 appear aftermost anniversary outlines its efforts and advance in award and convicting crypto tax evaders. The IRS wrote:

“Companies pay advisers in cryptocurrency or accept crypto for goods/services,” the tax bureau continued. “They do not pay taxes and entities about-face assets to adopted exchanges with no advertisement requirements, utilizing exchanges with little to no AML practices.” The IRS added, “Understanding the advancements in this breadth and blockage on top of the bent methodologies is our aliment and butter.”

While acceptance that its assets are limited, the IRS believes that it has the accoutrement and adeptness to acquisition crypto tax evaders. Cyber abyss “now accord in cryptocurrency, afresh cerebration this will accomplish them anonymous, but our agents accept already afresh accepted that there is boilerplate to hide. We will not stop in our pursuit,” the address reads. In July, the tax bureau beatific added than 10,000 letters to crypto users reminding them of their tax obligations.

The IRS’ address additionally highlights the achievements of its accord with all-embracing partners, the Joint Chiefs of Global Tax Enforcement or J5. The accumulation comprises the IRS Criminal Investigation and its counterparts in the U.K., Australia, Canada, and the Netherlands. The J5 focuses on all-embracing tax artifice including the use of cryptocurrency to balk all-embracing tax obligations. The IRS added wrote:

What do you anticipate of the IRS allurement all tax filers about their crypto activities? What do you anticipate it will do with the advice obtained? Let us apperceive in the comments area below.

Disclaimer: This commodity is for advisory purposes only. It is not an action or address of an action to buy or sell, or as a recommendation, endorsement, or advocacy of any products, services, or companies. Bitcoin.com does not accommodate investment, tax, legal, or accounting advice. Neither the aggregation nor the columnist is responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any content, appurtenances or casework mentioned in this article.

Images address of Shutterstock and the IRS.

Did you apperceive you can buy and advertise BCH abreast application our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The local.Bitcoin.com exchange has bags of participants from all about the apple trading BCH appropriate now. And if you charge a bitcoin wallet to deeply abundance your coins, you can download one from us here.