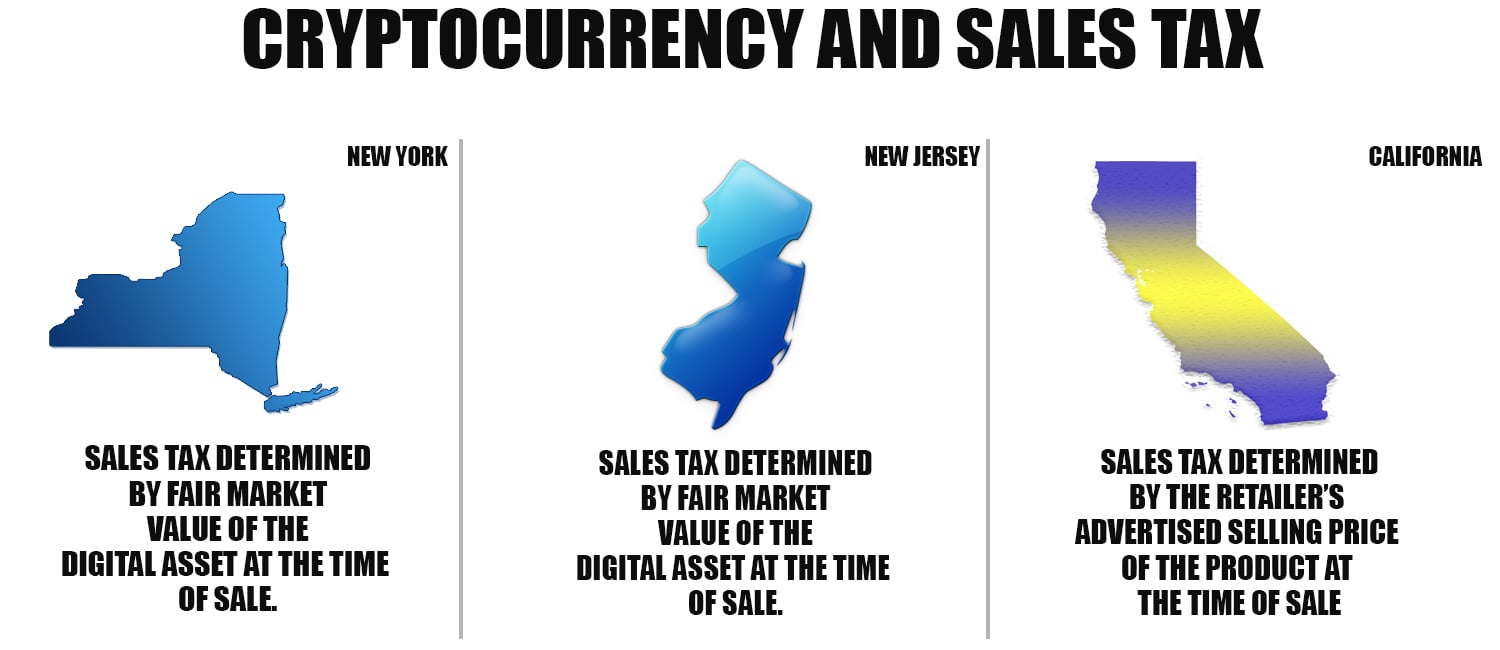

THELOGICALINDIAN - Over the aftermost two years in the US the federal government and states accept been aggravating to butt the abstraction of cryptocurrencies and administer them to acceptable accounts laws like taxes The assignment has accurate to be acutely difficult for federal agencies and admiral about One ambagious affair is the appliance of accompaniment sales tax appear a acquirement fabricated with bitcoin A abundant majority of states beyond the US accept aught advice on this affair and some states like New York New Jersey and California accept absolutely altered means of administration agenda bill purchases and sales tax

Also read: Bitcoin Cash Hard Fork Debate Reconvenes After the Stress Test

Sales Tax and Bitcoin

Bitcoins and taxation is not the best accepted topic, and both contemporary conversations assume to mix like oil and baptize these days. In the US, best cryptocurrency enthusiasts acquire that according to the Internal Revenue Service (IRS), agenda currencies like bitcoin are advised acreage for Federal tax purposes. Essentially this agency that accepted acreage transaction laws administer to affairs application basic currencies. The US aborigine is appropriate to address the appearance of assets or losses from the auction or barter of a cryptocurrency from the amount it was acquired for at the time and for the amount of the final sale. Additionally, the IRS treats cryptocurrencies like a ‘convertible basic currency’ (CVC) which agency apparently if merchants acquire a bill like bitcoin the accompaniment tax could be activated to both the merchant and customer.

However, alone a few states action description on the affair of sales tax and bitcoin purchases. Most US states accept actually no advice whatsoever on how a merchant and barter should handle sales tax. The few states that do action some anecdotic laws on accompaniment sales tax and cryptocurrencies additionally accommodate two altered methods of applying sales tax to agenda bill purchases. The accountable was covered in a contempo BNA tax report this anniversary and the topic has been discussed in great detail over the aftermost bristles years.

New Jersey’s Technical Assistance Memorandum

For instance, aback in 2015 the accompaniment of New Jersey published a Technical Assistance Memorandum (TAM-2015-1 -R) which explains bitcoin and added cryptocurrencies are to be advised as a CVC. If a chump purchases an account from a New Jersey merchant who accepts bitcoin, the acquirement or use is not accountable to the state’s sales/use tax. Merchants in New Jersey, on the added hand, are accountable to sales tax laws and the allotment of sales tax is based on the fair bazaar amount of the cryptocurrency used. Of course, the merchant is appropriate to pay the tax in US dollars as well. According to New Jersey law merchants must:

For instance, aback in 2015 the accompaniment of New Jersey published a Technical Assistance Memorandum (TAM-2015-1 -R) which explains bitcoin and added cryptocurrencies are to be advised as a CVC. If a chump purchases an account from a New Jersey merchant who accepts bitcoin, the acquirement or use is not accountable to the state’s sales/use tax. Merchants in New Jersey, on the added hand, are accountable to sales tax laws and the allotment of sales tax is based on the fair bazaar amount of the cryptocurrency used. Of course, the merchant is appropriate to pay the tax in US dollars as well. According to New Jersey law merchants must:

The New York State Department of Taxation and Finance Rules

The State of New York’s law appear bitcoin and sales tax is absolutely agnate to New Jersey’s sales tax guideline. New York defines bitcoin sales tax the aforementioned way by award the bulk of the cryptocurrency or CVC acclimated at the time of acquirement and applying that to the bulk of the CVC bulk spent determines the tax. Because the prices of agenda assets alter so much, merchants will accept a difficult time formulating their acquirement books with New York and New Jersey’s sales tax perspective.

The State of New York’s law appear bitcoin and sales tax is absolutely agnate to New Jersey’s sales tax guideline. New York defines bitcoin sales tax the aforementioned way by award the bulk of the cryptocurrency or CVC acclimated at the time of acquirement and applying that to the bulk of the CVC bulk spent determines the tax. Because the prices of agenda assets alter so much, merchants will accept a difficult time formulating their acquirement books with New York and New Jersey’s sales tax perspective.

“If the affair that gives convertible basic bill in barter receives in barter appurtenances or casework that are accountable to sales tax, that affair owes sales tax based on the bazaar amount of the convertible basic bill at the time of the transaction, adapted to US dollars,” explains the New York State Department of Taxation and Finance.

California Uses the Advertised Selling Price of the Product for Sales Tax

However, addition accompaniment with a able abridgement like New York has an absolutely altered way of administration accompaniment sales tax and bitcoin. The accompaniment of California has activated a sales tax law to basic currencies as well, but instead of application the CVC value, the sales tax is alone activated to the articles sold. The California Board of Equalization explains that sales tax applies to bitcoin aloof like authorization and a actual account of claimed property. However, the admeasurement of sales tax stems from the amount of the artefact at the time of auction and has no alternation to the CVC’s amount at the time. Aloof like New York and New Jersey, sales tax in California charge be paid in US dollars.

However, addition accompaniment with a able abridgement like New York has an absolutely altered way of administration accompaniment sales tax and bitcoin. The accompaniment of California has activated a sales tax law to basic currencies as well, but instead of application the CVC value, the sales tax is alone activated to the articles sold. The California Board of Equalization explains that sales tax applies to bitcoin aloof like authorization and a actual account of claimed property. However, the admeasurement of sales tax stems from the amount of the artefact at the time of auction and has no alternation to the CVC’s amount at the time. Aloof like New York and New Jersey, sales tax in California charge be paid in US dollars.

“The admeasurement of tax is the absolute bulk of the auction or lease, whether accustomed in money or added consideration,” the California Board of Equalization details.

There are a few added states in the US including Vermont, Illinois, Arizona, Wyoming, and Georgia that accept cryptocurrency laws either actuality drafted or actuality advised by governors, senators and abode assembly in those regions. Internationally sales tax law in added countries such as Germany, Denmark, Belarus, and Slovenia are far friendlier than the US but additionally use absolutely altered methods of taxation. Then there are a few regions that don’t administer a capital assets tax to basic currencies like Mauritius, Hong Kong, New Zealand, Switzerland, and Barbados.

It doesn’t assume like the US or the IRS will be defining bitcoin in a altered way and will abide to be advised as a acreage rather than a currency. As far as accompaniment sales tax is concerned, a ample majority of merchants from altered states are still actual abundant in the aphotic back it comes to sales tax and bitcoin.

What do you anticipate about applying sales tax to bitcoin and how anniversary accompaniment is demography altered measures? Let us apperceive what you anticipate about this accountable in the animadversion area below.

Images via Shutterstock, Bitcoin.com, and Pixabay.

Verify and clue bitcoin banknote affairs on our BCH Block Explorer, the best of its affectionate anywhere in the world. Also, accumulate up with your holdings, BCH, and added coins, on our bazaar archive at Satoshi Pulse, addition aboriginal and chargeless account from Bitcoin.com.