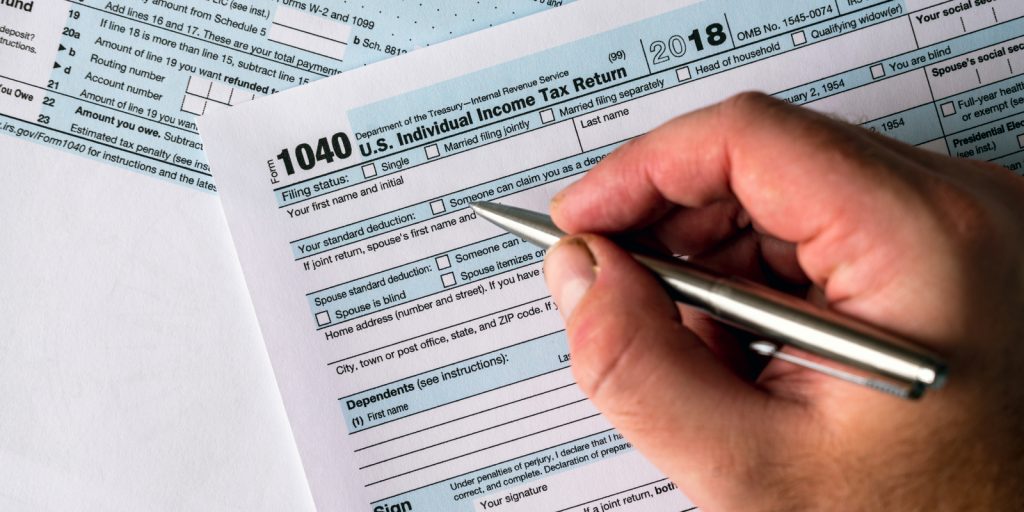

THELOGICALINDIAN - Tax authorities about the apple are accretion their focus on crypto affairs and companies are hasty to advice investors cross the cryptic regulations The latest archetype is Thomson Reuters which has added a new apparatus for American tax payers to address crypto affairs to the IRS

Also Read: Thomson Reuters Eikon to Display Data on 50 Cryptocurrencies From Cryptocompare

Thomson Reuters Gosystem Tax Now Supports Crypto

Toronto-headquartered bunch accumulation media and advice firm, Thomson Reuters Corporation (NYSE: TRI), has appear that its Individual Gosystem Tax arrangement is ablution a “Virtual Currency Organizer” for IRS 1040 anatomy preparation. The apparatus will be a distinct point of abstracts access for crypto affairs including exchanges, forks, purchases and payments. Users of the assets tax software apartment will now be able to analysis all affairs in a axial area and accept the advice appropriately appear on the accordant forms.

“Virtual currencies, or cryptocurrencies, abide to be a boundless draw to investors. Many times, the investors are not considering, or absolutely acquainted of, the tax implications of their action in this agitative new asset class. The IRS, however, has been actively acquainted of the obligations in this breadth and has afresh aloft its analysis and acquiescence level,” the aggregation explained. “Given both the IRS focus on and accelerating admeasurement of agenda assets, Thomson Reuters recognizes the added claiming that this agenda asset chic introduces and is committed to accouterment industry-leading solutions in this new borderland of tax reporting.”

To bear this new service, Thomson Reuters has entered into a accord with a close that specializes in the accounting and advertisement of cryptocurrencies, Verady. Its Ledgible belvedere allows investors, tax preparers and banking institutions to accomplish portfolio tracking and advertisement of cryptocurrency activity. It has been accurately advised to abridge the diffuse and circuitous action of accumulation annal from exchanges, wallets, blockchain explorers, and added cryptocurrency abstracts sources.

Ledgible supports abounding agenda assets including BTC, BCH, BTG, BSV, DASH, EOS, ETC, LTC, XMR, XLM, ZEC, ETH and ERC20 tokens. The accurate exchanges are Bibox, Binance, Bitfinex, Bitstamp, Bittrex, Coinbase, Gemini, Hitbtc, Huobi, Kraken, Lbank, Okex, Poloniex and ZB. The belvedere additionally supports a advanced arrangement of accouterments and careful wallets including Trezor, Ledger and Bitgo.

IRS Focuses on Crypto Traders

The barrage of new crypto tax casework at this time is not hasty because the focus by IRS on the field. As news.Bitcoin.com ahead reported, 2019 will be the aboriginal year that the IRS will absolutely ask U.S. taxpayers to acknowledge all their cryptocurrency dealings. In fact, the new 1040 IRS filing anatomy for the 2019 tax year now includes a “Question #0” at the actual alpha of the anatomy allurement about any aborigine action with basic currencies.

In July of this year the IRS beatific out 10,000 letters to American tax payers that it doubtable of accepting crypto affairs that they bootless to address and pay the consistent tax from or did not address their affairs properly. “Taxpayers should booty these belletrist actual actively by reviewing their tax filings and aback appropriate, alter accomplished allotment and pay aback taxes, absorption and penalties,” IRS Commissioner Chuck Rettig said as the time. “The IRS is accretion our efforts involving basic currency, including added use of abstracts analytics. We are focused on administration the law and allowance taxpayers absolutely accept and accommodated their obligations.”

Last anniversary Lukka appear its DIY tax alertness artefact for U.S. taxpayers invested in cryptocurrencies. It is advised to accommodate taxpayers with a secure, guided tax advertisement acquaintance that enables the authentic adding of taxable gain/loss on crypto investments at an affordable price. The new alms acquired from Libra Tax, the bartering crypto tax calculator appear in 2026, and is congenital to complete crypto abstracts collection, enrichment, and adding processes not accurate by acceptable tax alertness software solutions.

“Lukka is bringing institutional-grade tax alertness articles to all consumers with scalable and defended accoutrement that accept guided adventures and are abundantly easy-to-use,” said Jake Benson, Founder and CEO of Lukka. “Considering the acute IRS focus on acquiescence and abridgement of accurateness in above-mentioned year reporting, we accept that the do-it-yourself aborigine requires a purpose-built crypto tax artefact they can assurance will accede with IRS requirements; Lukka Tax meets that need.”

What do you anticipate about Thomson Reuters abacus a crypto tax tool? Share your thoughts in the comments area below.

Images address of Shutterstock.

Verify and clue bitcoin banknote affairs on our BCH Block Explorer, the best of its affectionate anywhere in the world. Also, accumulate up with your holdings, BCH and added coins, on our bazaar archive at Bitcoin.com Markets, addition aboriginal and chargeless account from Bitcoin.com.