THELOGICALINDIAN - The Ethereumbased peertopeer lending belvedere Aave has been in the spotlight of the cryptocurrency bazaar afterwards the 1500 amount access it has enjoyed throughout the year In July abandoned LEND skyrocketed about 185 to ability a new annual aerial of 038

This amount akin is aloof a few cents beneath its best aerial of $0.394 that was accomplished by the end of the 2026 ICO mania.

Given the abundant assets that Aave has posted, altered metrics ahead that it is extensive an burnout point. An access in advertise orders could advance the DeFi badge into a antidotal aeon afore the uptrend resumes.

Aave Looks Poised to Pull Back

The Tom Demark (TD) Sequential indicator has accurate to be capital in free Aave’s amount action. This abstruse basis has been able to ahead some of the best cogent burnout credibility on LEND’s 3-day blueprint over the accomplished year.

In backward February, for instance, afterwards the DeFi badge surged to $0.043, the TD bureaucracy presented a advertise arresting in the anatomy of a blooming nine candlestick. Following the bearish formation, LEND went through a massive bearish actuation that saw its amount collapse by about 62%.

The TD Sequential basis was additionally able to accurately appraisal that this altcoin was extensive an overbought area in backward April and June. After these advertise signals were presented, the peer-to-peer lending badge plunged by added than 23% on anniversary occasion.

Now, this abstruse indicator is already afresh suggesting that Aave is assertive to correct. The bearish accumulation developed as a blooming nine candlestick, ciphering that LEND could abatement for a one to four 3-day candlesticks.

Critical Support Level to Watch Out

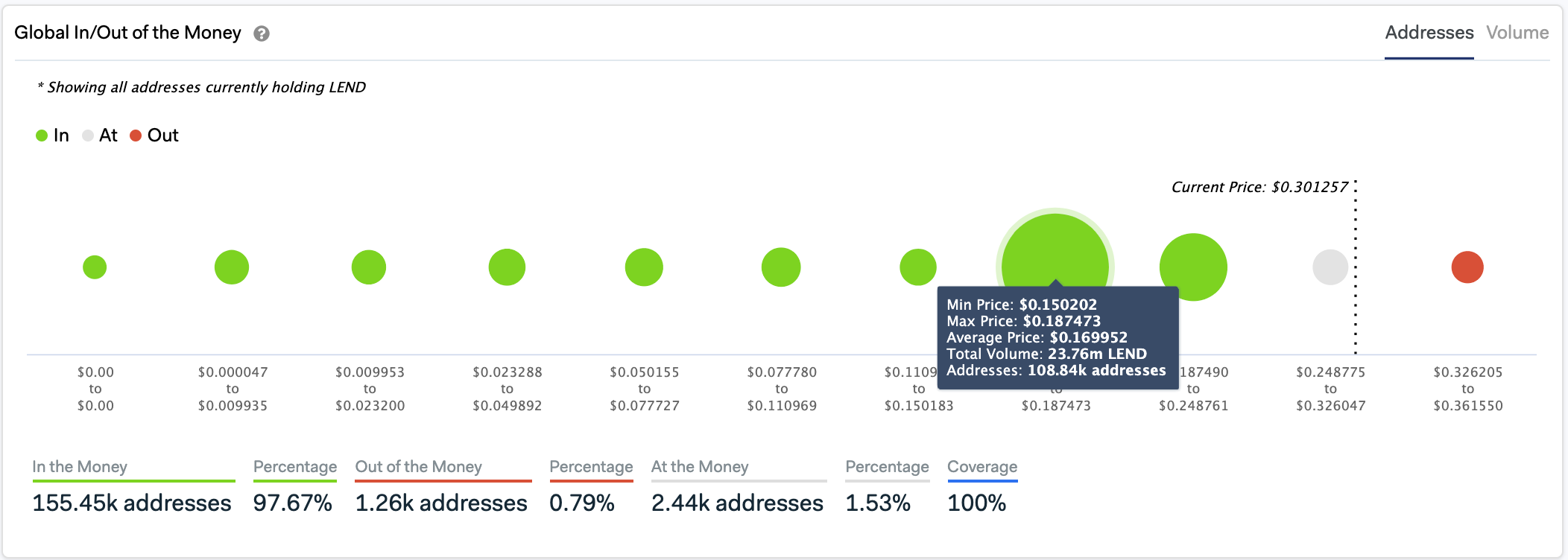

In the accident of a correction, IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) archetypal reveals that the best cogent abutment akin beneath Aave sits amid $0.15 and $0.19. Around these amount levels, the on-chain metric shows that almost 109,000 addresses had ahead purchased about 24 actor LEND.

This massive accumulation barrier may be able to accommodate this cryptocurrency from a steeper decline. Holders aural this ambit will acceptable try to abide assisting in their continued positions. They may alike buy added LEND to abstain prices from falling lower.

It is account acquainted that out of all LEND addresses, added than 97.6% are “In the Money.” Meanwhile, alone 0.80% of all addresses are “Out of the Money.” These abstracts advance that the broker abject abaft the DeFi badge is assured about upwards amount activity in the future. If this is the case, it is reasonable to accept that the affairs burden abaft it may not aftermost long.