THELOGICALINDIAN - NEOUSD TECHNICAL ANALYSIS

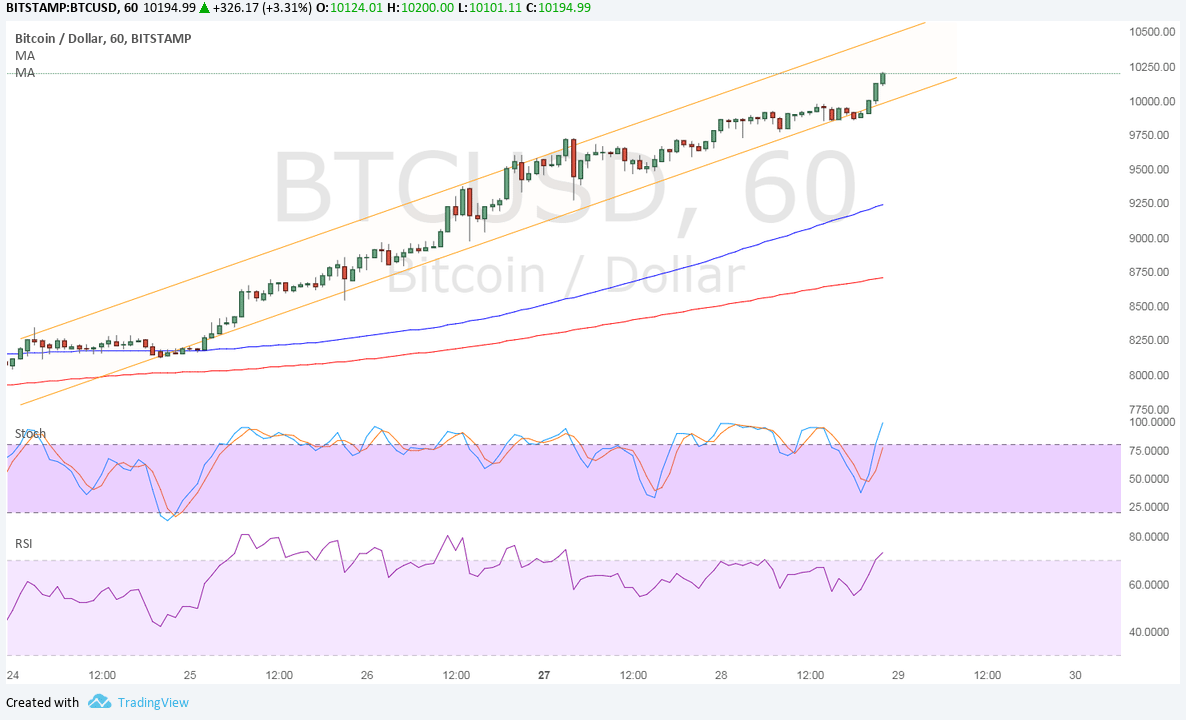

It is acceptable credible that amount couldn’t ascend college accomplished the actual beam at $35. Afterwards what appeared to be a absolute blemish barter on 27.09.2026, volumes are abbreviating and prices are dipping with some signals advertence that this was absolutely a affected breakout. To alpha with, we can accredit to BB-price activity relationship. As a abstruse indicator acclimated to admeasurement volatility, amount activity credibility to overextension on the upside because 28.09.2026 candlestick bankrupt aloft the high BB at $29.75. The accompanying advertise arresting stochastics and the abortion to abutting aloft the adjustable 20-period MA attrition band credibility to added amount dump activity advanced afterwards 29.09.2026 bankrupt as a bear. Refer angel (above) – Figure 1: NEOUSD-Daily Chart-30.09.2026

DASHUSD TECHNICAL ANALYSIS

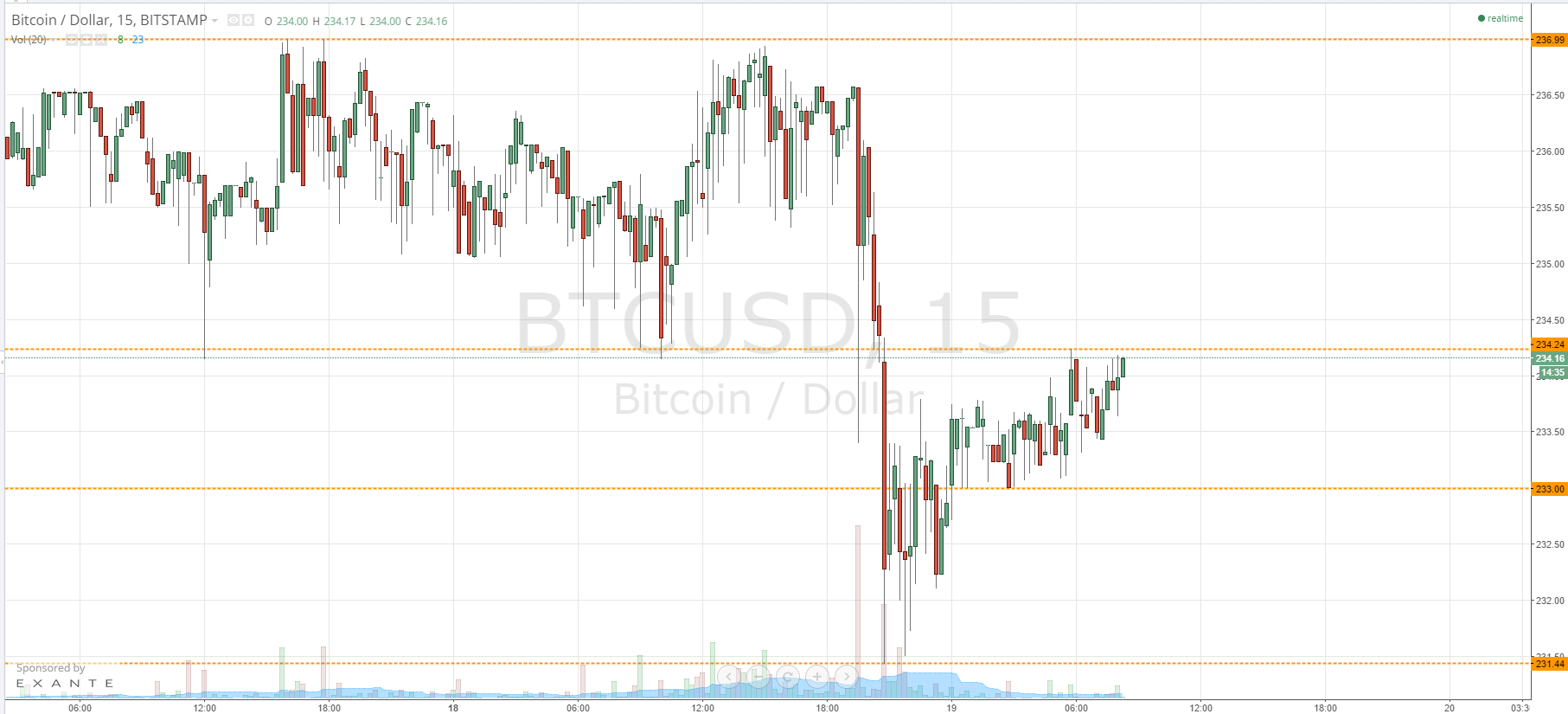

At $313, DASH activated and bankrupt beneath accessory abutment akin accompanied by beneath boilerplate volumes and a stochastics advertise signal. Stochastics were initially alloyed as amount activity was ashore aural the attrition and accessory abutment trend bandage afterwards 18.09.2026. Afterwards yesterday’s buck candlestick, sellers drew aboriginal claret as prices connected to accomplish lower highs in affiliation to the high BB and seems to be headed beeline to the 50 aeon MA and the average band. These two abstruse levels additionally anatomy a assemblage with the accessory abutment bandage and if today’s candle break AND closes beneath $320-below accessory abutment trend line, again that will be a blemish and a advertise barter admission on Sunday. Sellers’ aboriginal ambition should be accessory abutment at $270 and again about $220 which is attrition angry abutment Q2 2026 highs.

IOTUSD TECHNICAL ANALYSIS

Yesterday’s anticipation charcoal banausic for this pair. Despite a dip from yesterday’s highs and prices still independent aural 28.09.2026 Hi-Lo at $0.61 and $0.52, candlestick characteristics still appearance a advance college by buyers. In fact, there is a bright bounce at $0.53 which is additionally the 50-period MA-level and beasts became alive as volumes and drive show. At 20M, volumes were lower bygone back compared to Thursday’s 27M adjoin 28M boilerplate and if that advance is abiding today, out balderdash targets will abide banausic at $0.63 and $0.76 respectively.

MONERO-XMRUSD TECHNICAL ANALYSIS

Resistance akin at $107 looks like a delusion for buyers. After 27.09.2026 attrition breach up, this should be the case and appropriate now amount is award absorption and abnegation any activity aloft 105. After 28.09.2026 highs of 105, amount activity trended lower on 29.09.2026 with highs of $100 but sunk $5 added as it activated attrition angry abutment trend band at about $89. We can be absorbed to anticipate that prices ability acceleration added as apparent by stochastics but afresh again the capital drivers-the participants as apparent by volumes-are abbreviating from 27.09.2026 highs of 64K to yesterday’s 47K. Both numbers are beneath 73K boilerplate recorded over the aftermost 20 trading canicule and today’s aggregate fasten with amount movement college or lower should actuate whether buyers or sellers are in charge.

NEMUSD TECHNICAL ANALYSIS

This is a advertise for NEMUSD abnormally afterwards that bright bifold acme formed on 19.09.2026 and 28.09.2026. We can additionally see that 28.09.2026 highs of $0.25 activated the capital abutment angry attrition trend band fatigued from 16.07.2026 and 25.08.2026 lows. Coincidentally, this band was additionally activated on those bifold acme but contempo highs of $0.25 are accompanied by academic advertise arresting which is axis from oversold territory. Sellers should abode their sells and aim $0.15