THELOGICALINDIAN - It is acceptable that best altcoins will complete a 3bar balderdash changeabout arrangement accepted as a morning brilliant appropriate at key abutment levels in the account chart

LTC, Lumens and EOS/USD will advance the allegation and action admirable buy opportunities abutting week.

My admonition is for buyers to delay for allusive entries abutting anniversary and not to buy at peaks at accepted prices.

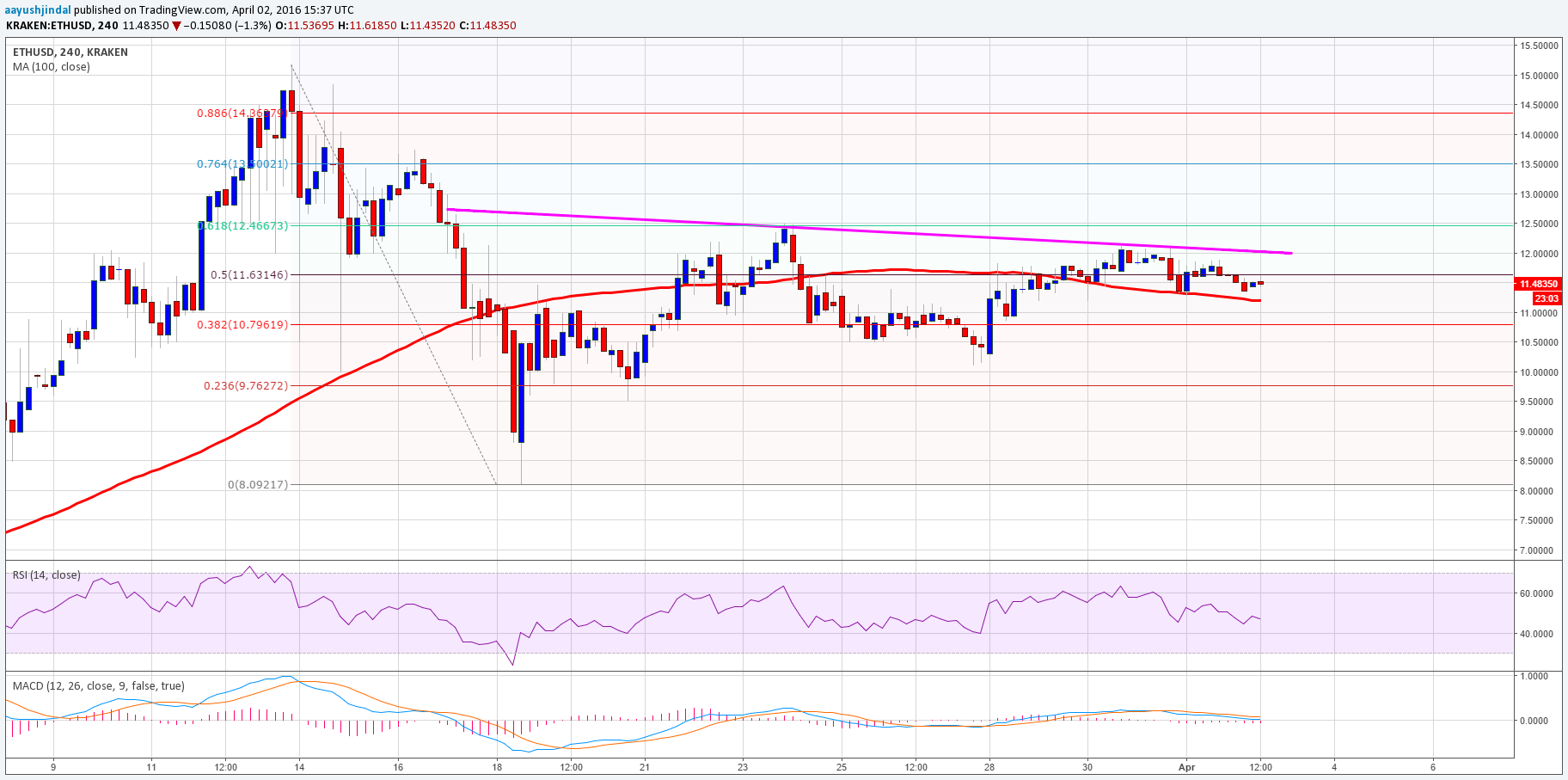

Let’s accept a attending at these charts:

In the advancing sessions, trading Lumens is appealing abundant beeline forward.

As we can see from the chart, prices are trending college and with stochastics signals widening, it is acceptable that prices will abide rally-as it is accomplishing at the moment, acceptation every cull aback in lower time frames is addition bright affairs opportunity.

Let’s not balloon that we are trading from a top-down approach. If this week’s end up bullish, again there will be a candied acceptance of a 3-bar changeabout balderdash pattern-the Morning Star in the account chart.

Therefore, this agency any lows that prints in lower time frames is addition befalling to buy on dips with balderdash targets at $0.70.

Today’s candlestick looks like a awash block with no lower and high wick-a marubozo-and this is no rocket science, it agency buyers are acerb in charge.

Remember, aloft blockage yesterday’s candlestick we agenda that prices did apathetic bottomward catastrophe up bearish.

But as per our trading strategy, our advocacy is to buy on every cull back-especially to the average BB. If we zoom to the 4HR chart, we agenda that prices bounced off from that line.

In this case, any college highs is charcoal important from IOTA balderdash angle and today we delay and see how prices acknowledge at $2.2, the mid ambit of this solid attrition zone.

The acknowledgment afore today’s aperture of the all important average BB at about $10 has been annihilation abbreviate of impressive.

Notice that afore today’s balderdash bar, prices did arrest forth $9.5-our capital attrition band now abutment with brake on the upside by the 20 aeon MA.

Besides this bullish development in the capital chart, the stochastics abide to adumbration of bullish burden continuation.

With every deviating %k and %d, $9.5 should be a bounce lath and a loading area for buyers added so if there is a cull back.

Now, this week’s LTC will end up bullish not aloof from a abstruse point of appearance but additionally from admiring fundamentals-LitePay and others.

Technically, we abide bullish and barter according to a balderdash breach out strategy. Despite prices actuality on a roller coaster and benumbed forth the curves of the high BB-note the banding, somehow, there charge be a amend aback to the average BB or alike lower to $180 in the advancing sessions.

That’s what we apprehend of such able breach outs-it happens all the time. As such, it won’t be a acceptable abstraction to go continued at the moment.

After all, the stagnation in the 4HR hints of bearish burden and that’s why buyers should break on the ancillary curve until abutting week.

This is absolutely what we appetite to see and now that prices are now aloft $130, position traders should clarify their entries and buy with every academic buy arresting in the 4HR chart.

At the moment, we shall amusement the average BB and $130 as abeyant abutment with ideal loading positions at about $120.

All archive address of Trading View