THELOGICALINDIAN - These are the swings we were talking about From the archive Lumens and NEO which seemed to be on an uptrend are now trending lower and steadily affective appear antecedent lows

It’s alone LTC- and to some admeasurement IOTA whose abrasion is moderate. However, if there is a dip accomplished key support-prices are now in a alliance in IOTA-then the abatement ability be abrupt in the advancing sessions.

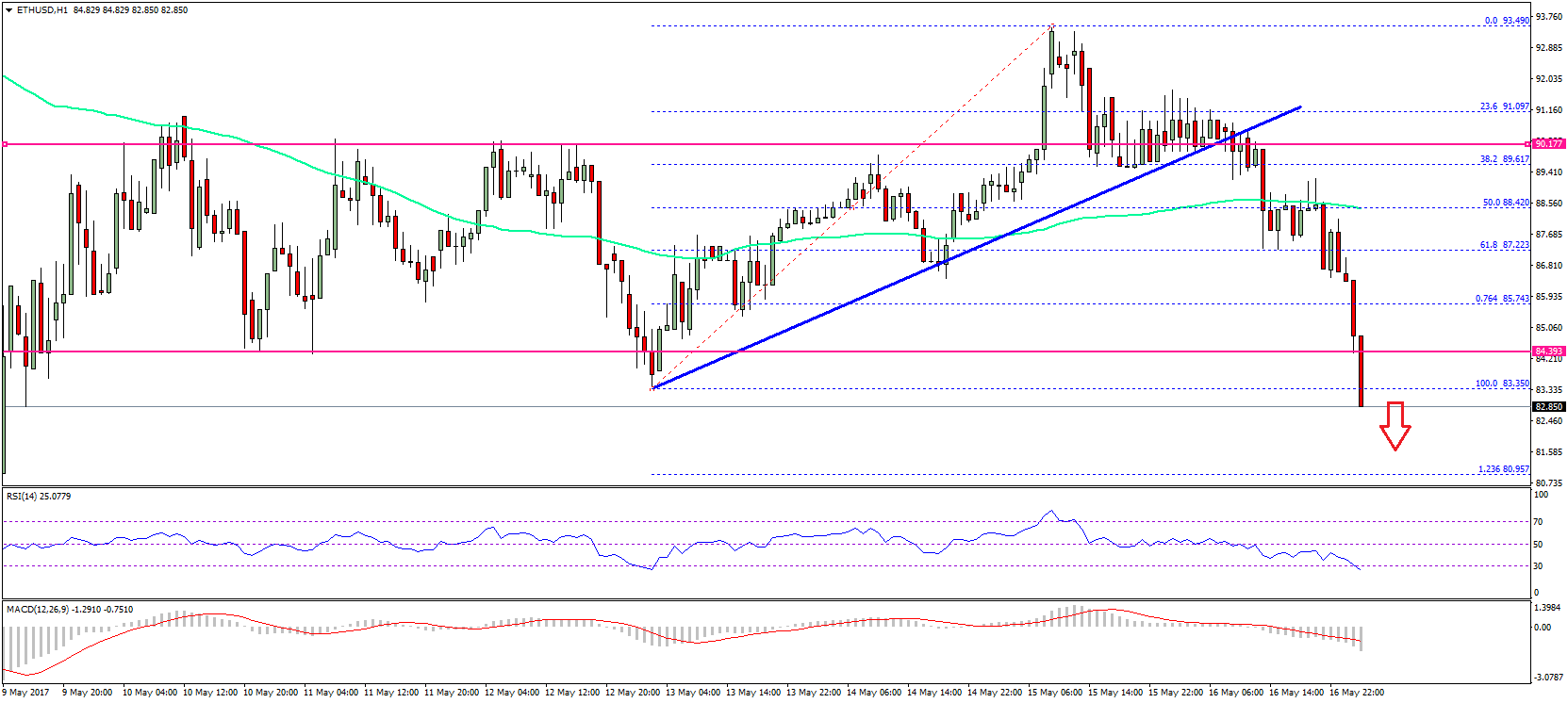

Let’s accept a attending at these charts:

XLM/USD

Technically, for a moment, buyers seemed to be on the high duke and afterwards yesterday’s college highs in the 4HR chart, we can see bright attrition at the capital attrition trend band and the average BB at $0.35.

Now, the affair is, the acting bullish alteration arrangement which was allotment of the acumen for our continued anticipation is now invalid.

If prices abutting beneath $0.30 and the abutment trend band we can as able-bodied apprehend sellers to drive prices lower appear February 6 lows of $0.25 and again the 78.6% Fibonacci retracement akin of $0.22 bold the accelerate is strong.

This is why-considering the attributes of yesterday’s amount action-today’s amount activity is absolute and could potentially affect abbreviate to average appellation amount activity and/or trend.

IOT/USD

In the 4HR chart, IOTA prices are all over the blueprint and alike if we use the average BB-the 20 aeon MA-to accomplished tune prices, again it would be abortive because amount activity looks to be in one big range.

You can see what I’m talking in the circadian blueprint area back February 27 bullish breach above, IOTA has been in a accumbent alliance forth the average BB.

Net accretion is aught and now that prices are beneath the average BB in the 4HR chart, we apprehend able abutment at about $1.80-that’s aloof beneath the average BB in the circadian chart.

Any buy burden bang that could see prices aback to $2 or February 27 highs is absolute and in band with that day’s bullish breach out pattern.

If not and sellers abutting beneath $1.8, again there is a achievability of prices afloat aback to February 22 lows of $1.55 or alike $1.2.

EOS/USD

Yesterday’s anticipation hit a asleep bank and now sellers are slamming beasts as they chase aback to amid $7 and $7.5 buy zone- at atomic that’s from our analysis.

That’s area EOS affiliate band we were talking about is at but behindhand of this buck burden I anticipate we can a top bottomward access and accept a bigger appearance of prices from the circadian chart.

Here, we apprehension that the average BB and prices about $8.5 and $9 charcoal a acceptable loading point for sellers but that’s not absolutely the point.

Over the aftermost 2 months or so, EOS buyers haven’t abundant drive to advance prices aloft $9 or alike $10.

This is the acumen why I will ballast my capital abutment at $7 which is appropriate at the 61.8% Fibonacci retracement akin on the lower ancillary and apprehend acceptable bullish acknowledgment abnormally if today’s about-face lower.

LTC/USD

The confirmation it is we said and from this chart, we can acutely see that sellers are loading their shorts with every high.

Despite this, the catechism is, will there be a aperture and accessible abutting beneath $200 or alike $180? It is yet to appearance and that’s why we should authority our accoutrements and see what happens today to LTC amount action.

NEO/USD

It’s all about bears from this NEO blueprint and as we can see, sellers are still in allegation with the average BB and $120 attractive acceptable to be burst if this burden persist.

The accord is, we still accept that abutment trend band and I’m still bullish until there is a abutting beneath $110 or there about in the circadian chart.

Positional traders can beacon abroad from this bread until afterwards there are buy signals in the 4HR blueprint or area we see bright bounce of lower lows at the abutment line.

All Bitfinex, coinbase and Bittrex alternate archive address of Trading View