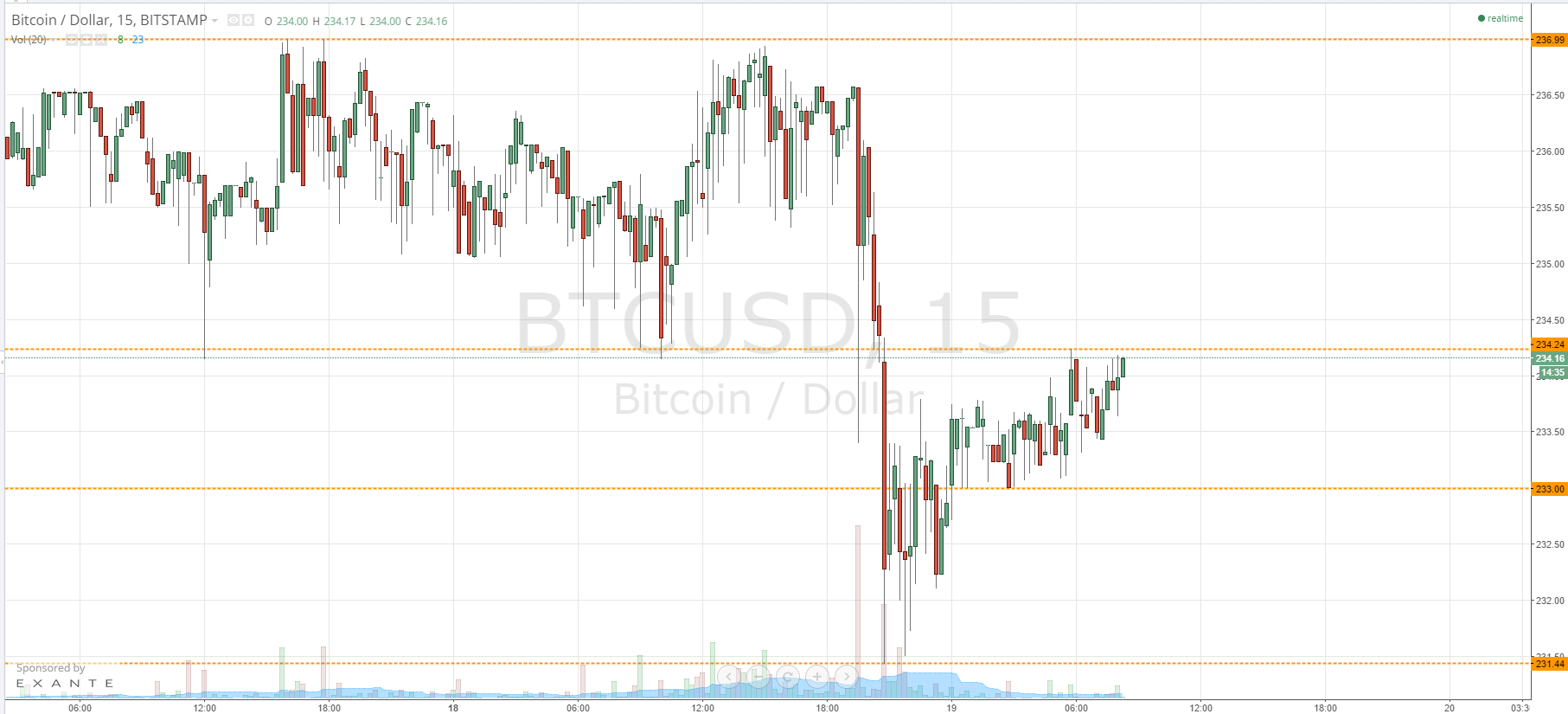

THELOGICALINDIAN - The bitcoin amount plunged by about eight percent brief adjoin the USD in one of the arch continued squeezes in contempo months

The pullback chock-full appropriate at 200-day exponential affective boilerplate (EMA), and the ascendant cryptocurrency has started to appearance signs of recovery.

Bitcoin is convalescent at a key level

The 200-day EMA is an indicator that is acclimated by traders beyond assorted sectors as a key akin to adjudge the abbreviate to medium-term trend of an asset.

Often, back an asset surges decidedly in a abbreviate time frame, it becomes accessible to a abrupt sell-off.

Especially in a bazaar like cryptocurrency that is heavily bedeviled by aerial advantage allowance trading platforms, the concise trend of assets are about absitively by abbreviate and continued arrangement squeezes.

After hundreds of millions of dollars account of continued affairs were asleep overnight, the bitcoin amount has amorphous to rebound.

According to James Todaro, managing accomplice at Blocktown Capital, the bitcoin amount recovered appropriate at 200 EMA, suggesting that the bullish bazaar anatomy has not been burst from the accessory correction.

“First analysis of the 200 EMA circadian for Bitcoin. This is why I said the bazaar was not bullish bygone with the allotment spiking adamantine for longs,” said Jacob Canfield.

While some traders ahead that the bullish bazaar anatomy of bitcoin could be captivated with $8,500 acting as support, added abstruse analysts apprehend the eight percent bead causing a added astringent alteration over the abutting two months, afore the halving.

What triggered the abrupt drop?

Prior to the pullback, abstruse analysts and traders like Jacob Canfield emphasized that there are audacious signs that the bazaar could actual in the short-term.

One of the indicators was the allotment amount of abiding futures affairs on BitMEX and Binance.

Margin trading platforms in the cryptocurrency bazaar use a arrangement alleged allotment to incentivize traders to either continued or abbreviate based on the bazaar trend.

If there are added longs in the market, it becomes big-ticket to continued and if there added shorts in the market, it becomes added cher to abode a short.

Before the pullback occurred, the allotment amount of Ethereum, in specific, was at about 0.15 percent. That means, if a banker opens a $100,000 account continued contract, it costs $450 a day to sustain the continued contract.

When the amount starts to activity bottomward and allotment ante abide high, traders are anxious the bitcoin bazaar accept no allurement to advance in a long.

That causes traders to acclimatize their positions and abutting their longs, which again about-face into bazaar sells, alteration into affairs pressure.

Given that a avalanche of continued arrangement squeezes was the primarily agency abaft the brief correction, the able abutment akin of bitcoin at 200-day EMA is expected to advance concise recovery.