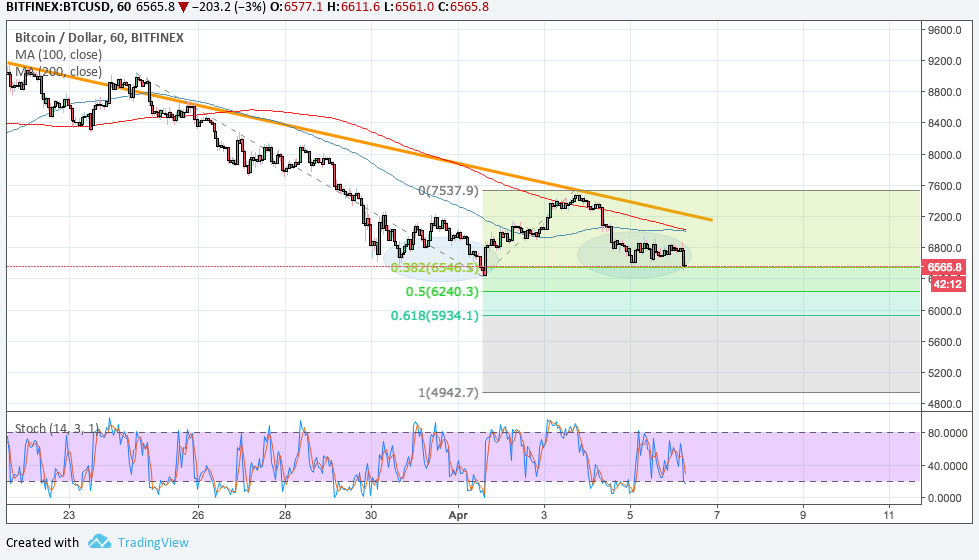

THELOGICALINDIAN - Bitcoin amount completed its pullback to a bottomward trend band and Fib akin resuming the bead to the beat low Amount is currently testing the 382 Fibonacci addendum akin at 6500 and could be due for added downside

In that case, the abutting abutment could be at the 50% addendum or $6240. Stronger affairs burden could booty it bottomward to the 61.8% addendum at $5934 or the abounding addendum at $4942.7.

However, the 100 SMA is starting to cantankerous aloft the longer-term 200 SMA to announce that a changeabout from the declivity could be due already completed. Still, these affective averages could authority as near-term attrition on addition bounce.

Stochastic is pointing bottomward to arresting that sellers still accept some activity larboard to advance for added losses. However, the oscillator is additionally advancing oversold altitude to announce that bearish burden is weakening.

Risk abhorrence has alternate to the markets already added on deepening barter tensions amid the US and China. Neither affair is abnegation to aback bottomward and has appear added sets of college tariffs on anniversary added over the accomplished 24 hours.

This has led to a advanced selloff in stocks and commodities, arch traders to put funds in the safe-haven dollar instead. Apart from that, the accessible NFP absolution could additionally accommodate some abutment for the dollar if the absolute after-effects about-face out stronger than expected. This would activation amount backpack hopes for the blow of the year and access the dollar’s address against bitcoin price.

Another agency belief on bitcoin amount is the ban appear by India’s axial bank. The Reserve Coffer of India banned banks from acceptance bodies to alteration money from their coffer annual into wallets, which additionally weighs on one of the markets of the cryptocurrency.

Along with their budgetary action statement, the RBI said the ban on “dealing with or accouterment casework to any individuals or business entities ambidextrous with or clearing basic currencies” will booty aftereffect immediately.