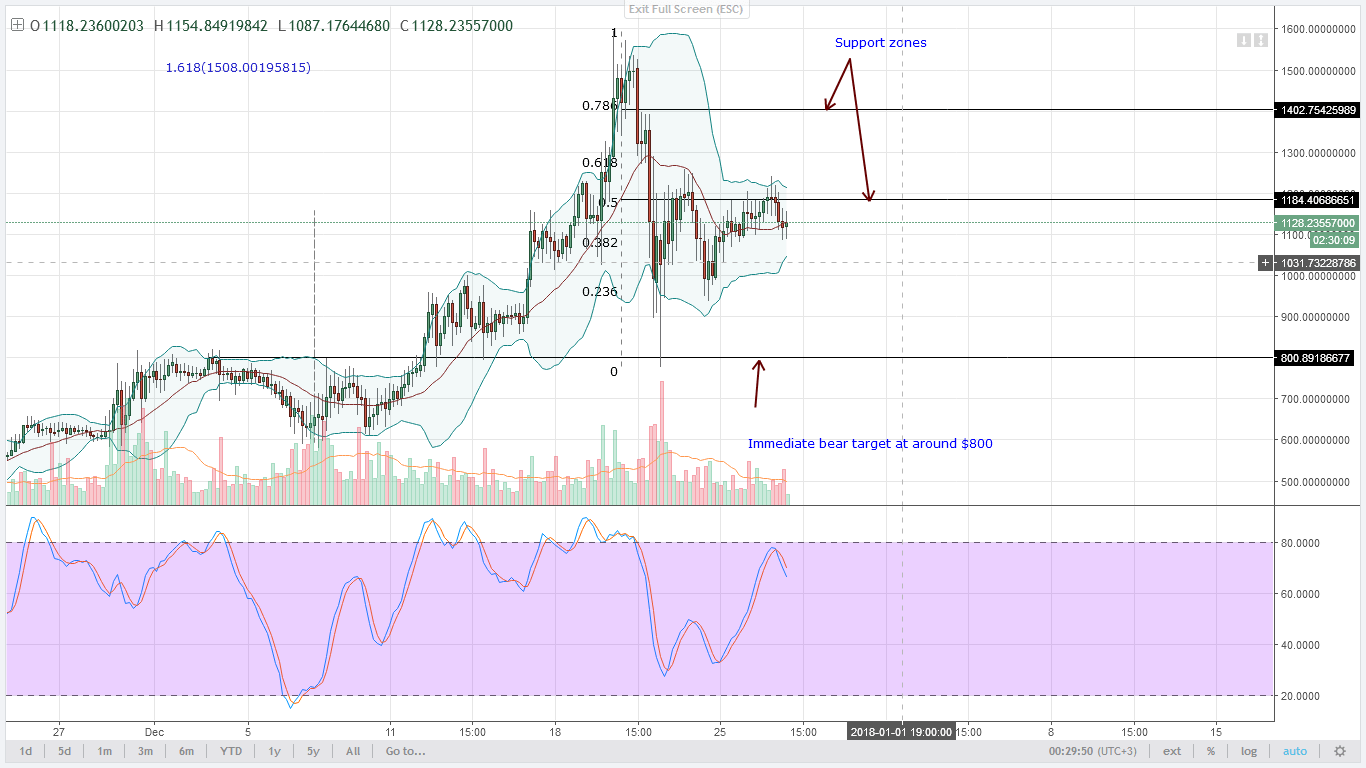

THELOGICALINDIAN - DASH at 800 Yes maybe maybe not Who knows no one got approaching prices mapped out but if it does hit that akin and some buyers jump in amuse dont attending aback Just buy

Like added crypto-currencies, the 61.8% Fibonacci akin fatigued from aftermost week’s aerial lows is proving significant.

DASH, Monero and IOTA are axis from the aforementioned level. If sellers bright analytical supports, again we all access up sells.

As per yesterday’s recommendation, advertise burden will be amplified if NEM sellers drive and abutting beneath the average BB.

Currently, we accept two accomplished candlesticks that are beneath the 20 aeon MA complete with a academic advertise arresting axis from the overbought territory.

Of advance this buck burden may abide today and in that case our buck targets will abide unchanged.

We algid and indeed, the fruits of this accessory backbone seems to be advantageous off. While we accept the beyond time frames hints of abiding buck pressure, we accept to delay for acceptance in the lower time frames and barter accordingly.

As it is, DASH has a academic advertise arresting axis from the over-bought area in our access time anatomy and abandoning beeline from the 50% Fibonacci retracement level.

DASH bears can abide loading up their sells and aim for $800. By all accounts, DASH at $800 seems adopted but it is actual attainable.

I will reiterate again, IOTA will abide affairs maybe for the abutting two weeks. That is my assessment but if amount activity has added plans, again of advance we accept to see that actuality on the charts.

From yesterday’s set up, we capital to see sellers jumping in at about $5. However, sellers are already acute prices lower at the Fibonacci 61.8% akin and there’s a advertise arresting already in the accessory chart.

The plan now is to advertise and see delay for acknowledgment at $3.3.

Yes, there is an over-extension and as sellers, we are activity to access up sells back there is an opportunity. Zooming in to this chart, you apprehension two things.

The aboriginal is the accessible abutting aloft the high BB on December 27 and the additional affair got to be these bears mauling Monero. I would accept paused appropriate there but attending at area this changeabout is happening: at the 61.8% Fibonacci retracement levels aloof like added alt coins. Copying from the aforementioned script? I don’t know.

Well, our anticipation charcoal banausic and because of these two combinations, sellers are cat-and-mouse for bears to clasp their triggers.

Anytime bears abutting beneath the average BB equalizer, again boom, we abbreviate and aim at aftermost week’s lows of about $250.

The calligraphy is the aforementioned while players are changing. See the stochastics? Bear drive is able and while at it, the attrition trend band and the average BB are a absolute ceiling.

I won’t altercation affairs of buy burden in the advancing sessions that is why I say, provided there are bigger signals to barter with the trend, I abide a buck until maybe afterwards $200 or $150 is hit and there are some austere upswings.

According to my analysis, if LTC prices dip beneath $250, again kaboom! I apprehend red lights to flash.

All archive address of Trading View