THELOGICALINDIAN - Binance Coin BNB the eighthlargest cryptocurrency by bazaar assets opened on Tuesday in a acutely abrogating breadth as a cord of poor fundamentals afraid investors away

BNB plunged by 5.78 percent, or $0.77, to barter at $12.65. The latest downside move came as a allotment of an continued bearish alteration apparent beyond the absolute cryptocurrency market. Like BNB, top bill including Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP), too suffered intraday losses.

On the whole, the cryptocurrency bazaar had asleep approx $16bn off its assets from Monday until 1523 UTC today.

BNB Fundamentals Turn More Bearish

The accelerated abatement in the BNB amount additionally came two weeks afore the administration of the European Union’s Anti-Money Laundering Directive (5AMLD).

In retrospective, 5AMLD requires Europe-based cryptocurrency exchanges to annals with the bounded authorities. It additionally orders them to accomplish KYC checks on all their users.

Binance, which is based in Malta, do not appoint austere KYC on users abandoning beneath than 2 BTC. That leaves the barter with two options: Either it can appoint new regulations on its hundreds of bags of traders, or it can adjudge to stop alms casework to European audience altogether.

I anticipate the alone way for Binance to accumulate the accepted altitude would be to alpha geo-blocking all EU users. Wouldn’t be afraid if they advertise article agnate to back they appear that they’d stop confined U.S. customers

— Larry Cermak (@lawmaster) December 17, 2019

Historically, geo-blocking users accept not helped BNB, a de-factor accolade badge at Binance. Back in June, back Binance had appear that it would stop alms trading casework to the United States citizens, the amount of BNB had taken a toll.

The badge admitting accustomed a year-to-date aerial of $43.15 but has back asleep a ample allocation of its profits. As of 1523, it was alteration easily at a 70 percent bottom price.

The 5AMLD charge has prompted abate cryptocurrency businesses, including Bottle Pay, which had aloft $2mn beforehand this year, to shut down. Irrespective of what Binance does, it would lose a huge block of traders that appetite to avoid KYC checks.

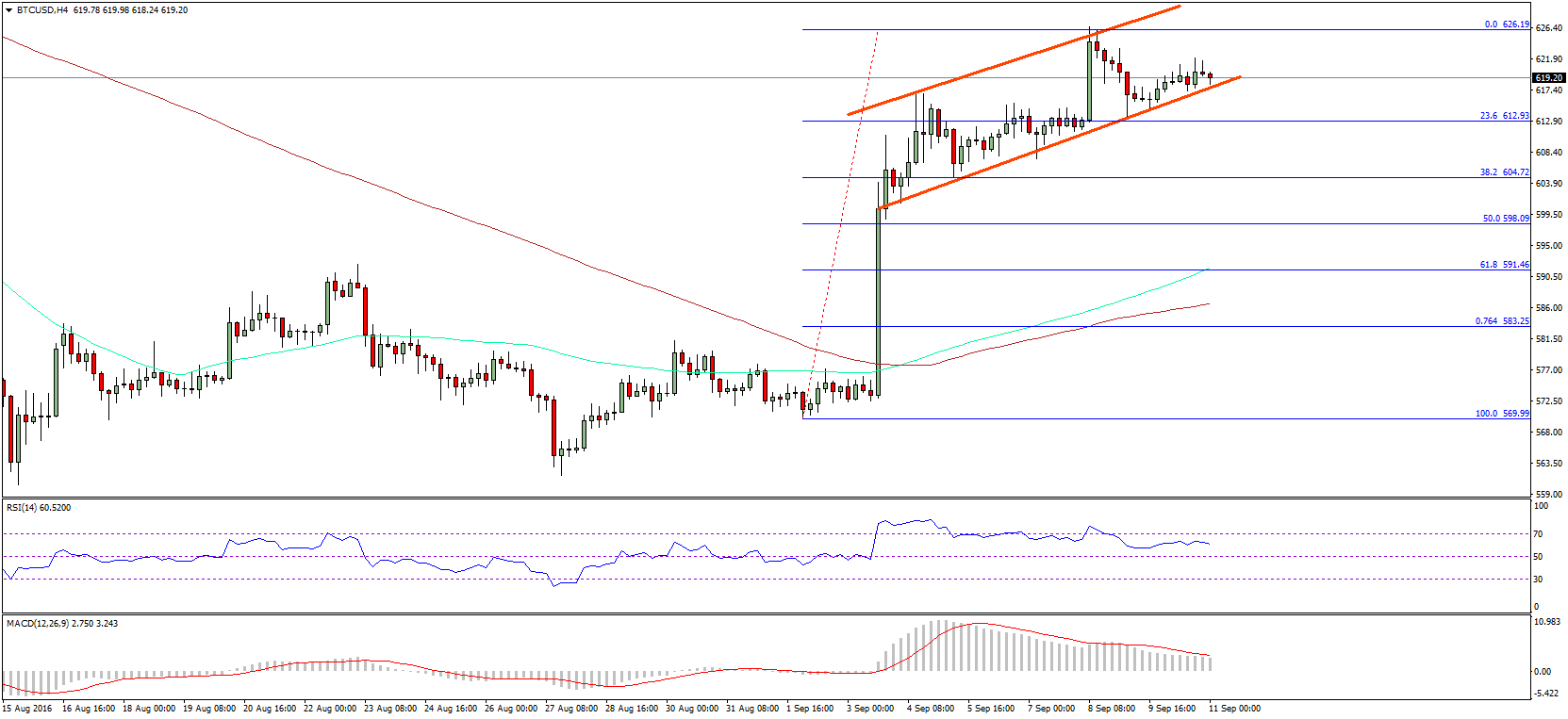

A Breakdown for the cryptocurrency

The latest attack has brought Binance Coin afterpiece to testing its 78.6 percent Fibonacci akin of $12.455 as support. So it appears, it is one of the aftermost levels continuing afore BNB and a all-inclusive breakdown.

The prevailing bearish affect could see traders eyeing targets beneath the $12.45 support. Ideally, a breach beneath the said akin could accept them accessible abbreviate positions appear $8.96, an acting downside target. A added breakdown, meanwhile, could accept traders extend their shorts appear $4.086.

Conversely, a pullback from $12.45 could accessible an adorable acting continued befalling appear the 50-daily MA in orange.