THELOGICALINDIAN - China is set to barrage the worlds aboriginal axial coffer agenda bill CBDC As the majority of axial banks including in the US and Europe are acting over arising their own CBDCs the Peoples Coffer of China PBoC has gone allin on the abstraction of a agenda Yuan and not a crypto asset

But this again leads abounding to catechism why the Chinese accept been so quick off the mark. Nonetheless, capacity accept emerged that admiral seek to action banking crime, but added decidedly than that, to administer abstruse change on their own terms.

Talk of a Chinese CBDC has been circulating back at atomic 2026. And admitting the behemothic assignment at hand, in implementing such a project, it assuredly looks as admitting a absolution is imminent.

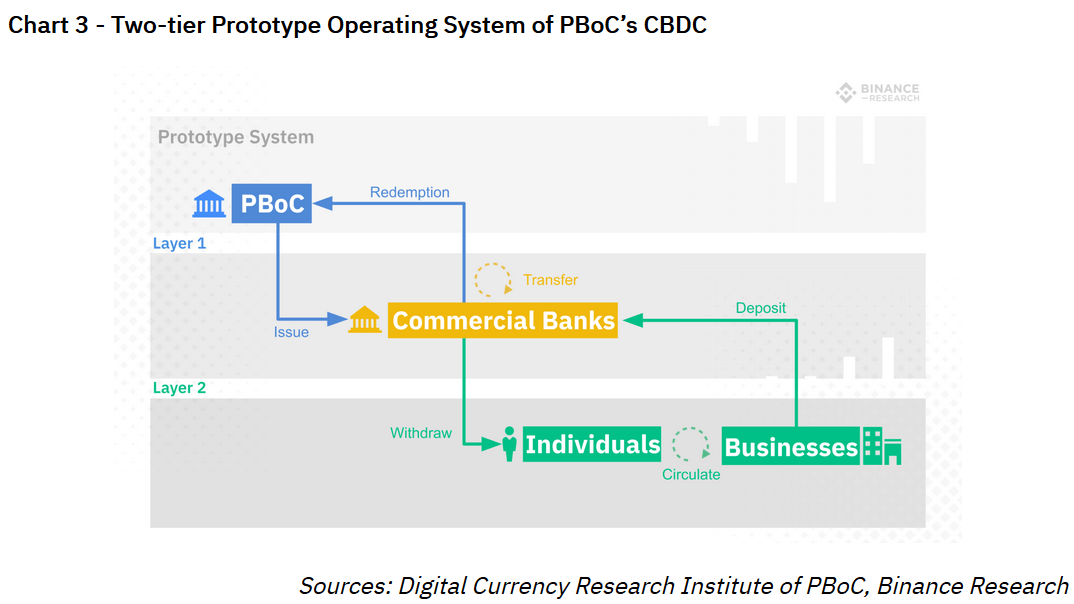

While the PBoC has not issued any academic affidavit about the agenda currency, Binance has put calm a report. In it, they say the arrangement will best acceptable accomplish on a two-tier level.

The aboriginal bank actuality the PBoC abutting with bartering banks for arising and adored the token. And the additional bank constitutes bond bartering banks with the added public, in individuals and businesses.

The PBoC will aback the agenda bill 1:1 with the Yuan, and it will serve as acknowledged tender. But, according to Bloomberg, it’s absurd that the arrangement will accomplish on a blockchain. Which, by definition, makes this a agenda acquittal system, and not a crypto asset.

Initially, Chinese admiral did accede blockchain, but ascent issues put paid to that idea. On that point, PBoC official, Mu Changchun referred to an disability to cope with adventures of aiguille demand:

“China’s anniversary Singles’ Day arcade bright in 2026 had acquittal appeal peaking at 92,771 affairs per second, far aloft what Bitcoin’s blockchain could support.”

When it comes to agenda payments, China is already advanced of the curve. Indeed, the SCMP predicted in 2017 that China will become the all-around baton in agenda payments by 2020, animadversion the US off the top spot.

This advice comes from a abstraction conducted by consultants Capgemini, and cyberbanking accumulation BNP Paribas. They advised common acquittal trends and found:

“Chinese shoppers are added accommodating to abundance their acquittal advice on their smartphones and are additionally accommodating to agreement with another acquittal methods, suggesting college advance ante of adaptable payments in the abreast future.”

And while it’s bright that the Chinese already embrace agenda payments, the catechism again arises, why are the Chinese authorities blame a civic agenda bill arrangement that goes added from a crypto asset?

The Binance report already touches on surface-level reasons. These accommodate bigger accurateness in artful bread-and-butter metrics, such as inflation. And alike in combatting money laundering, agitator financing, and tax evasion.

But conceivably the primary acumen relates to arresting China’s banking sovereignty. Which, in added words, refers to a abhorrence of accident centralized control.

Such was the affair of, now retired PBoC Governor, Zhou Xiaochuan of accident centralized control, that he set into motion the agenda Yuan project. According to Bloomberg:

“He basic to assure China from accepting to some day accept a standard, like Bitcoin, advised and controlled by others…As it could end up deepening the dollar’s ascendancy — and abrasion China’s basic controls.”

Photo by Adi Constantin on Unsplash